2 High-Risk, High-Reward Stocks

Checking in on Upstart (UPST) & Nano-X Imaging (NNOX).

Recently, I've dedicated significant attention to covering two companies: Upstart (UPST) and Nano-X Imaging (NNOX). However, I've since removed UPST from my coverage, a decision I explained in previous articles. Given UPST's current run-up, it feels timely to dive deeper into the reasons behind my shaken conviction in the company.

In a separate development, Nano-X Imaging held their Investor Day on December 4th. The event, while somewhat anti-climactic, offered several takeaways worth discussing. In the following, I’ll share my perspectives on the presentation and what it means for NNOX moving forward.

Do the Risks Outweigh the Potential Rewards?

1. Upstart (UPST)

Upstart (UPST) is notably one of the most heavily shorted stocks in the public market, and not without reason. The shorts primarily focus on the company's vulnerability to our current high-interest-rate environment, a concern that holds merit. This has shown in the stock price. However, the market is now showing signs of a potential plateau or even a decrease in interest rates, which has favorably impacted UPST's stock price in the short term, pushing it above $35/share.

Despite this, UPST is not without significant risks. The primary concern remains the interest rate environment. Yet, another critical issue, which ultimately led to my decision to exit my position, is what I believe to be flaws in their AI-based software. Other risks like loan financing on their balance sheet, cash reserves, autonomous lending, and trust in management are also notable but secondary to these two key concerns.

My decision to no longer hold shares in UPST is grounded in several factors. Despite the company's resources to withstand a high interest rate environment for a reasonable period, which I believe they are capable of navigating, my primary concern lies with their AI software. This is central to UPST's business model, and any flaws here are significant (which I’ll get to). Additionally, my trust in the management has waned, following three specific incidents: firstly, the misleading information about loans on the balance sheet; secondly, the removal of revenue illustrations from their Q2 2023 earnings; and thirdly, the use of June 2023 default rates in their Q3 2023 earnings report (why?). These factors, combined with my concerns about the software, have pointed me to the exits.

Analyzing the risks associated with high interest rates is a primary concern for the bears/shorts when it comes to UPST. While bullish investors, including myself, recognize that interest rates may decrease sooner than expected, there remains the looming question: What if rates stay high for an extended period, or what if the Federal Reserve opts to increase them further? Such a scenario would undoubtedly put a strain on UPST's business, potentially leading to more financial distress, dilution issues, and the need for additional financing – although UPST has demonstrated its ability to secure funding in the past. This risk is a critical point of consideration for bullish investors.

Turning to what I perceive as an even greater risk than fluctuating interest rates: the potential flaw in UPST’s software. UPST aims to revolutionize lending by making it more efficient, less cumbersome, and superior to traditional FICO models. The company is progressing towards its goal of autonomous lending, as evidenced in recent quarters. However, the effectiveness of their AI cloud-based software comes into question. Here's why I am concerned: Pagaya Technologies (PGY), UPST’s direct competitor, has been outperforming remarkably for three consecutive quarters in what is described as a challenging lending environment due to high interest rates. PGY is not just meeting but significantly exceeding expectations, setting record revenues, and securing more partnerships. Meanwhile, UPST struggles to meet its own targets, with repeated downward revisions in revenue guidance.

While the lending market is not a 'winner-takes-all' scenario, and I am not advocating solely for PGY, UPST supporters must consider these contrasting performances. Initially, I wasn't overly concerned when PGY outperformed in the first or second quarter, but their continued success contrasted with UPST’s struggles is certainly a cause for concern and worthy of attention.

It might seem like I’m a permabear on UPST, but in reality, my stance is quite the opposite. For those bullish on the company, I hold a genuine belief that UPST has the potential to reverse its current trajectory and the reward could be massive for shareholders. Should UPST manage to realign its operations and execute effectively, especially in a scenario where interest rates decrease to more favorable levels in a reasonable timeframe, the company could see a significant turnaround. This transformation might require a change in leadership, but it is certainly within the realm of possibility.

2. Nano-X Imaging (NNOX)

Before diving into Nano-X Imaging (NNOX), I want to express my confusion regarding the scheduling of their earnings call and Investor Day presentation, which were held less than a week apart. This timing strategy is puzzling, particularly since NNOX management had repeatedly indicated that the Investor Day would provide greater clarity on several matters. However, the presentation turned out to be somewhat underwhelming. During the company's earnings review, which wasn't entirely negative but still showed no revenue from Nanox.ARC, shareholders were expecting to gain deeper insights into the commercialization plans for their primary medical systems. There was an anticipation of a detailed, clear-cut strategy, potentially with target dates for commercialization. Yet, disappointingly, such specifics were not provided, leaving significant questions unanswered.

The urgency of the situation with NNOX is underscored by the fact that the company only has about four quarters' worth of cash left before it burns through its reserves. This context makes the lack of clarity and detail in their recent presentations particularly frustrating.

NNOX's primary mission is to fulfill the unmet need for medical imaging in parts of the world where such facilities are scarce or almost non-existent. Their strategy involves initially targeting these underserved areas and then expanding into developing regions. What's unique about their approach is the plan to distribute these imaging systems free of charge, while adopting a "pay per scan" model for revenue generation. This innovative model is designed to make medical imaging more accessible while also creating a sustainable business model for the company.

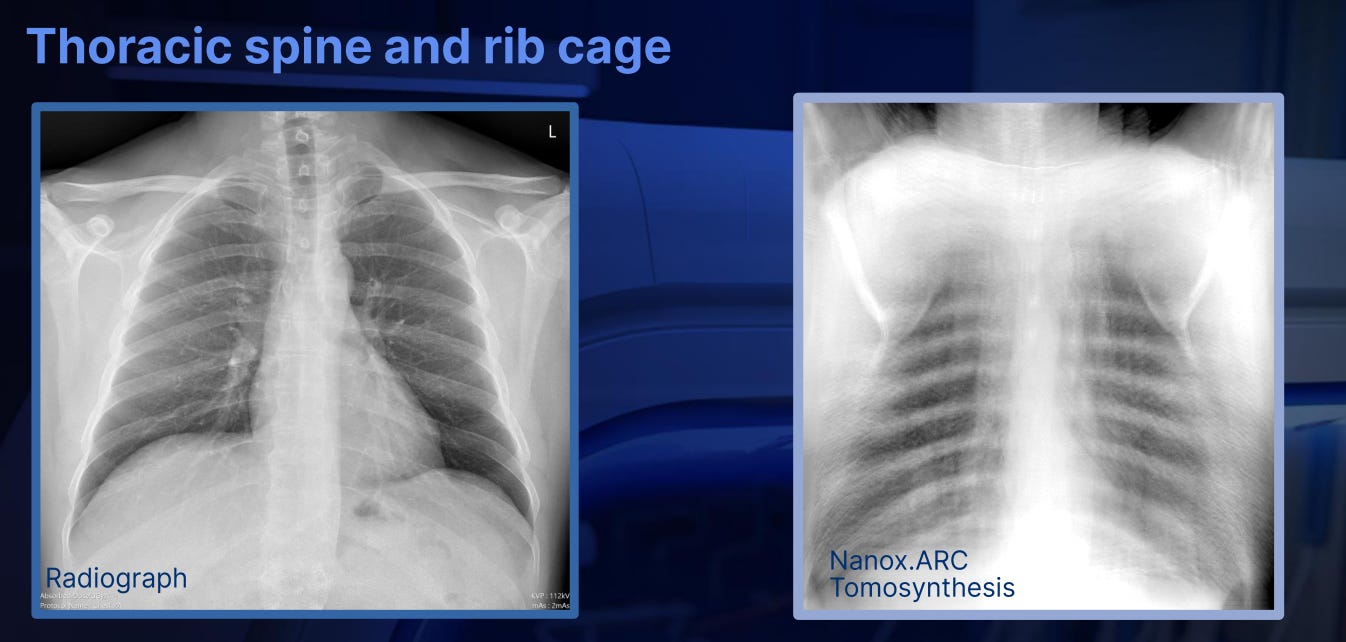

Regarding the "U.S. Business Model" detailed above, NNOX has outlined that there will be a minimum number of daily scans, priced at $30 each. While the workings of this model were somewhat anticipated, it was beneficial for the company to reiterate and clarify this aspect during the presentation. However, a significant concern emerged during the Investor Day that hadn't been apparent until this latest presentation. In what appeared to be a questionable decision, the management opted to present a side-by-side comparison of traditional x-rays (Radiograph) and the Nanox.ARC (Tomosynthesis), accompanied by commentary that seemed less than satisfactory. This aspect of the presentation raised new concerns about the company's approach and communication strategy, essentially leading to a 10%+ selloff. Here is how it went…

The ankle is not bad. Actually better than Radiograph.

Poor commentary in this slide.

The images showcased during the Investor Day for NNOX were somewhat humorous, as many of them did not seem to surpass traditional methods in terms of quality. However, the ankle image did appear to offer a clearer representation, in my opinion. Before drafting this, I consulted with two medical professionals – a radiologist and a pediatric orthopedist. Both expressed skepticism about the ability to make accurate diagnoses of bone fractures using these images. This feedback, combined with the anti-climactic nature of the presentation and the lack of a definitive commercialization strategy, significantly concerned me.

I want to clarify that I am not bearish on NNOX. Currently, my investment in NNOX fluctuates around 1% of my portfolio, reflecting my caution given the inherent risks associated with this business. It's vital for bullish investors to consider both the potential and challenges of their investments; such a balanced view is key to becoming a well-rounded investor. With NNOX, several factors need to align in the next year to avoid this becoming another failed investment. Concerns include the low cash reserve, the absence of a clear commercialization plan, no revenue yet from Nanox.ARC (which is central to the company’s thesis), and uncertainties around the "pay per scan" model.

However, if NNOX starts effectively implementing their strategy by early next year, begins deploying their systems, and generates revenue, there's a good chance the company could get back on track. Should everything go according to plan, NNOX has the potential to be one of those 'I wish I had invested more' success stories. Similar to UPST, patience is key for investors in NNOX, along with a close watch on how the management team executes their plans.