3 Quality REITs For The Long-Term Investor

Taking a Look at 3 of My Current Favorite REITs & Weekly Activity

This Weeks Newsletter is Powered by Savvy Trader!

I’ve transitioned to Savvy Trader’s platform for more transparency and real-time tracking of my portfolio. Attached below is the link to my portfolio on Savvy Trader:

https://savvytrader.com/SteveWagsInvest/stevewagsinvest

If this has issues connecting, search for “Steve Wagner | Invest” as your 2nd option. Doing this, you should be able to find my portfolio. This is 100% FREE and will start putting more time into that platform.

What Exactly are REITs?

This week I want to take the time to talk about one of my favorite kind of investments and that’s real estate (which also happens to be my current profession, specializing as a commercial real estate investment advisor). Those that follow my portfolio closely know I have a handful of REITs in my portfolio, with a couple on my watchlist. So, let’s jump into it!

Real estate investing is a strategy that has been used for centuries as a way to build wealth; however, not everyone has the time, expertise, or resources to buy properties directly. This is where Real Estate Investment Trusts (REITs) come into play… REITs offer a way for individual investors to benefit from owning real estate, and get paid, without the need of becoming a landlord/developer. REITs are companies that own, operate, or finance income-producing real estate. Modeled after mutual funds, REITs allow both small and large investors to invest in portfolios of real estate assets the same way they invest in other industries, through the purchase of an individual company’s stock or via a mutual fund/exchange-traded fund (ETF).

The concept of “REITs” was first established in the United States in 1960 as a way for small investors to access diversified portfolios of large-scale, income-producing real estate. Today, REITs have grown globally and provide investors with a means of investing in virtually every segment of the real estate market including apartments, hospitals, hotels, infrastructure, office buildings, shopping malls, and even warehouses (one of my favorites). They provide individuals the opportunity to invest in portfolios of large-scale properties the same way they invest in other industries, through the purchase of individual company stock.

Also, REITs must distribute at least 90% of their taxable income as dividends to shareholders annually. This requirement often results in higher average dividend yields, making REITs an attractive option for income-focused investors. In most cases, REITs pay their dividends on a quarterly basis; however, some actually pay their dividends on a monthly basis (two of my favorite REITS do).

3 REITs to Bless Your Portfolio With

Realty Income (O)

Realty Income is one of the largest retail REITs in the world, coming in at a market cap value of around $40B (as of June 30th). They are also a leading S&P 500 company. Realty Income has been acquiring and managing freestanding commercial retail properties that generate rental revenue under long-term, net lease agreements.

Many bears/critics that don’t have experience in real estate, will go along with the narrative that floating around that commercial real estate is in a “bubble” which is essentially misplaced. Especially when we are talking about the 3 REITs I’m listing, in this case it’s Realty Income, their strength lies in its diversified portfolio and rigorous vetting process.

Orange indicates investment grade clients that are companies or their subsidiaries with a credit rating, as of the balance sheet date, of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch).

Their top 20 clients are either investment grade or sub-investment grade tenants (majority investment grade tenants, which is the highest quality tenant) that are based off recession-resistance, not to mention how diversified this spectrum of clientele is. This is what I mean by diversification and vetting process, because this is how you filter out the good from the bad REITs.

The company currently owns and operates 12,400 properties that are leased to over 1,250 different clients who operate in more than 84 separate industries throughout all 50 states, as well as Puerto Rico, the United Kingdom, Spain and Italy. This broad diversification mitigates the risk as mentioned above, ensuring that the company's fortunes are not tied to the success of a single tenant, industry, or geographical location.

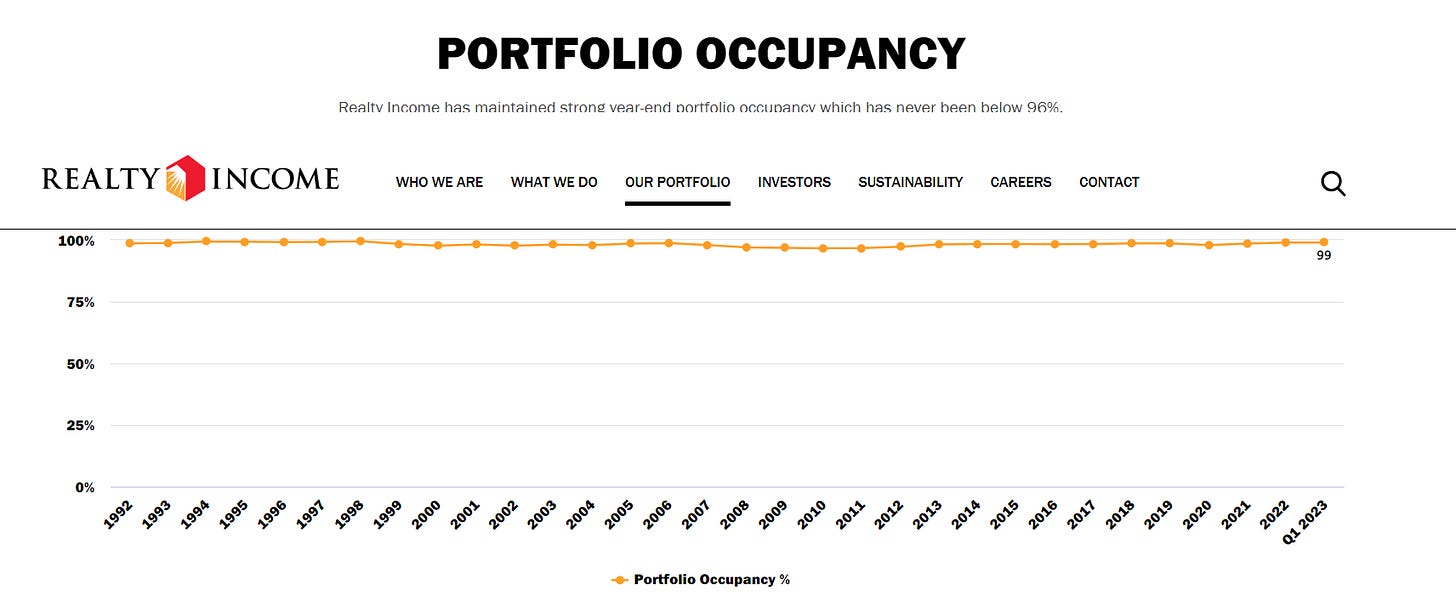

Moreover, it’s important to note that Realty Income rarely has any turnover, which has been like this for over 30 years (impressive). This is one of my favorite REITs for many of the reasons highlighted above. On top of this, they pay a monthly dividend that has been increased for 28 consecutive years, making them a Dividend Aristocrat. This is a REIT I’m going to focus on building up to a top 10 position in my portfolio, I’ve been doing this at a much slower than I anticipated pace due to better opportunities in the market but it’s still my goal.

STAG Industrial (STAG)

Keep reading with a 7-day free trial

Subscribe to Pierce Capital Research to keep reading this post and get 7 days of free access to the full post archives.