Avita Medical Teases Third Quarter Results

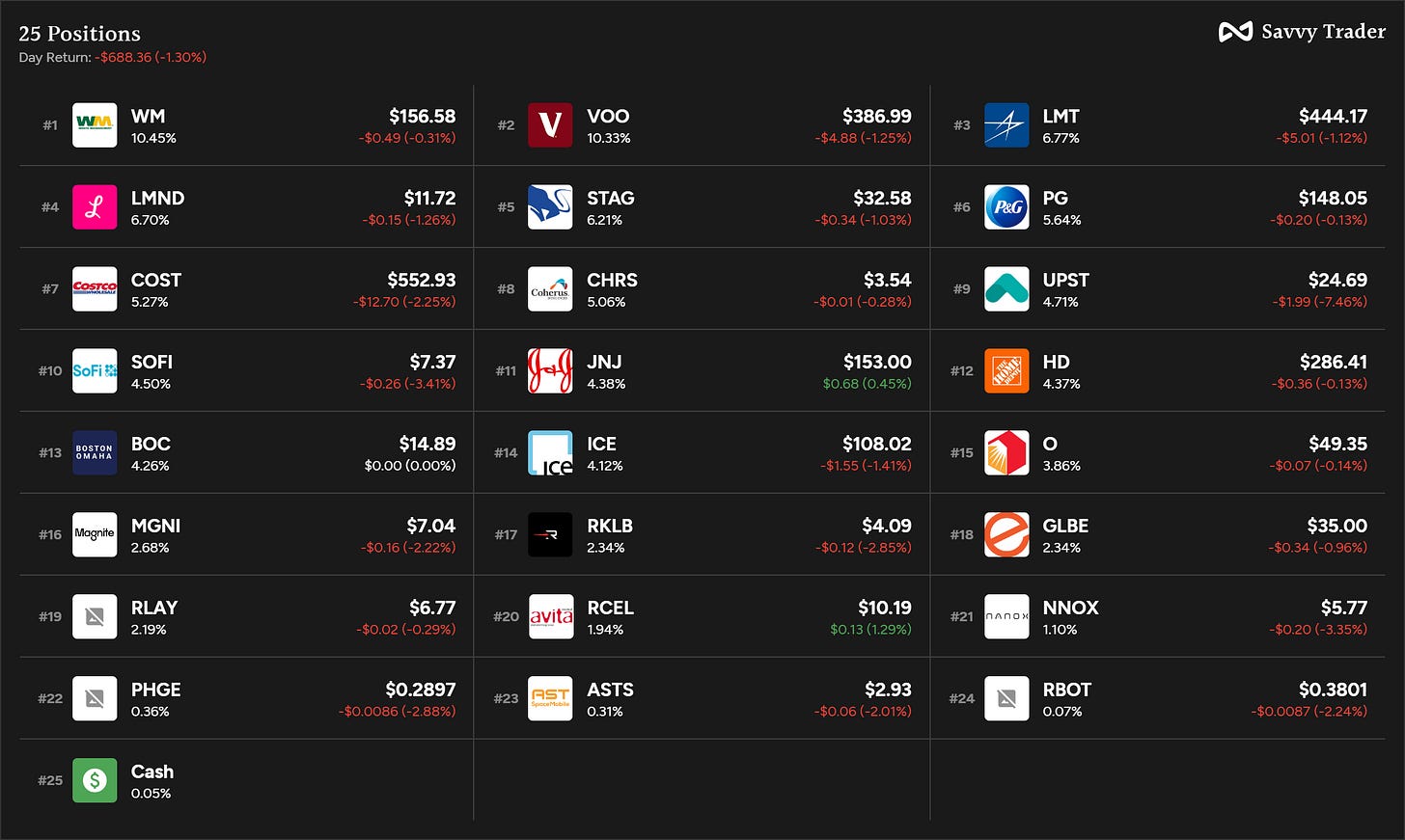

Taking a Look at Avita Medical's (NYSE: RCEL) Preliminary Results & Financing Agreement, Weekly Activity, & Portfolio Update.

As earnings season commences, several companies under my coverage have unveiled their financial results (reference archive). Notably, Avita Medical (RCEL) recently shared a glimpse of their financial standing through a preliminary performance announcement, accompanied by an intriguing financing agreement. Let's dive deeper into the details of this development and explore the reasons for investor optimism.

It’s Time for Execution

RCEL disclosed impressive third quarter 2023 financial highlights this past week. On top of an impressive preliminary performance, the company has bolstered its financial position by entering into a $90M debt financing agreement with OrbiMed, a reputed healthcare investment firm.

Financial Highlights & Growth Trajectory:

The third quarter saw a 50% spike in preliminary commercial revenue, which stood at $13.5M, compared to $9M during the same timeframe in 2022.

The company enjoys a robust gross margin of approximately 84.5% for the quarter.

Undeterred in its growth projection, RCEL has maintained its full-year 2023 commercial revenue guidance, which is anticipated to fall between $51-$53M.

OrbiMed Financing & Its Strategic Significance:

At the outset of the Credit Agreement with OrbiMed, RCEL drew $40M.

An additional $50M is earmarked for release in two phases, contingent upon the company meeting specific revenue benchmarks.

The Credit Agreement extends until October 2028.

To solidify this partnership, RCEL issued OrbiMed a warrant allowing the purchase of 409,661 shares at approximately $10.9847/share.

In the midst of a transformative phase, RCEL did show solid numbers with a remarkable 50% surge in Q3 2023's preliminary commercial revenue. The company's steady gross margin of 84.5% further cements its strong fiscal position. Enhancing this trajectory, RCEL's $90M debt financing agreement with the healthcare investment firm, OrbiMed, is a game-changer. This strategic partnership not only amplifies the company's growth capabilities but also fortifies its financial flexibility. With continued emphasis on innovations in regenerative medicine and a clear roadmap towards profitability by 2025, RCEL continues to stand out. It’s also important to note that, shareholder will not be diluted this non-dilutive.

My Take

In the ever-evolving landscape of biotech, companies are often faced with critical strategic decisions. For RCEL, the path has seen its share of challenges. The issuance of the FDA's complete response letter for ReCell Go, coupled with a subsequent decline in stock price, arguably eliminated the potential for a public offering of common stock. While some may view this as a missed opportunity, it's essential to recognize it as a hurdle rather than a setback.

Historical data reveals we're navigating through one of the toughest periods for biotech in the last two to three decades. In such a volatile environment, expecting flawless maneuvers from management teams might be an overstretch. It's worth noting that perfection isn't the benchmark, especially in these unpredictable and challenging times.

While the earlier management at RCEL faced its trials, the new leadership appears to be in a favorable position, showcasing improved strategic execution. After all, it's the execution that stands out but it needs to continue. RCEL's recent strides, despite challenges, underpin this very sentiment. While maintaining an objective lens is crucial, the company's current trajectory signals cautious optimism. My conviction remains high with the business and I believe any other sharp declines from these levels presents a long-term opportunity.

Weekly Activity (October 16th-20th)

Nothing this week.