Company Updates & Weekly Activity (May 1st-5th)

Trending Market News, Company Updates, & Weekly Activity

Earnings Extravanganza, Banking Crisis, & Interest Rates

We are in the bulk of earnings season, with many of the largest publicly traded businesses reporting their Q1 2023 results; also, one of the bigger weeks for me personally, with 3 of my top 10 largest positions having reported their results (May 1st-5th).

All you have to do now, is throw in higher interest rates and more banks collapsing, then you will get an extremely unpredictable and volatile week ending in red (-0.77%). This may not seem like it’s not too bad of a week… you’re right, it could have been much worse. If it wasn’t for Apple’s (AAPL) strong earnings on Thursday and a reassuring/optimistic jobs report with unemployment coming in at record lows, we would have been closing at a potential -3% week. Fortunately, the market rallied on this combination Friday.

So, let’s go over what happened this week… The FED came out on Tuesday, before their official meeting on Wednesday, anticipating another rate hike of .25 BPS. With this anticipation, they would also consider a “pause” on interest rates. However, before/during this time, $25B First Republic Bank (“FRC” well… what was $25B) officially collapsed. This was the second largest bank in U.S. history to ever collapse, it caused chaos to the entire market and started to even drag “healthy” banks down along with it. This brought FRC to a halt on exchanges, and eventually led to a bidding war between PNC Financial (PNC) and JPMorgan Chase (JPM) on the acquisition of FRC, since federal regulators seized assets then bided it out. JPM eventually acquired FRC to end the banking crisis (Or is it still just the beginning?).

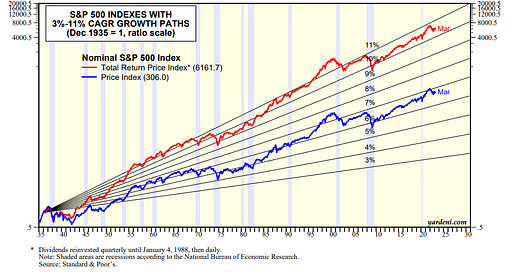

Wednesday comes around and the FED announced a .25% BPS rate hike, as expected. The FEDs #1 job is to control inflation right now, and people have a hard time understanding this. The FED considers what additional rate hikes could do to vulnerable banks that overextended themselves, but it’s not their job to stop banks from collapsing. Their job is to suppress/control inflation, because this is by FAR more devastating to an economy over the long-term than banks continuing to collapse leading to a recession (my thoughts on a recession later). Although this may cause severe pain in the short-term, it’s not as devastating as inflation is… inflation undermines the strength of our economy and is permanent, we are seeing those affects happen in real-time with our status as the reserve currency. To get back to what I was saying, the FED hiked interest rates and this went on to expose more vulnerable banks (along with FRC news carrying).

Some of the notable banks that showed their vulnerabilities are as followed:

Pacific Western Bank (PACW) -70%

HomeStreet (HMST) -50%

First Horizon (FHN) -50%

Metropolitan Bank (MCB) -40%

First Foundation (FFWM) -35%

Western Alliance (WAL) -35%

When the FED announced their hike, investors started to panic to see smaller regional banks get pummeled for their potential vulnerabilities. This was after the FED said the “economy is strong”, Jamie Dimon CEO of JPM said “this is not 2008”, and the White House saying, “the banking crisis is over”. So many investors are skeptical on these comments, especially when its coming from the driver seat to the U.S. economy.

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.