Costco Hits Record-Highs After Earnings

Taking a Look at Costco's (COST) Earnings, Weekly Activity, & Portfolio Update.

The past week has been nothing short of a whirlwind for the financial markets. It began at a measured pace, but the landscape shifted dramatically following the Federal Reserve's latest comments on interest rate hikes. The Fed's unexpectedly positive and optimistic tone sparked a significant reaction from Mr. Market, resulting in a rally. Amidst these broader market fluctuations, Costco (COST) stood out by reporting its Q1 2024 earnings results, coupled with a special announcement for its shareholders (which I’ll get to below). This development has certainly caught the attention of investors and market analysts alike. So, let's take a closer look at COST's performance this quarter and their special announcement to shareholders.

The Winner that Keeps on Winning

COST released their Q1 2024 earnings, and the results were pleasantly surprising, exceeding my initial expectations. The company successfully outperformed forecasts in both revenue and earnings for the quarter.

Key Financial Highlights:

Net Sales:

Q1 2024 net sales: $56.72B.

Increase of 6.1% from Q1 2023's $53.44B.

Sales benefit from fiscal calendar shift due to fifty-third week in fiscal 2023.

Net Income:

Q1 2024 net income: $1.589M ($3.58 per diluted share).

Compared to Q1 2023 net income: $1.364M ($3.07 per diluted share).

Current year includes a tax benefit of $44M ($0.10 per diluted share) from stock-based compensation.

Previous year included a charge of $93M pre-tax ($0.15 per diluted share) mainly for charter shipping downsizing, and a tax benefit of $53M ($0.12 per diluted share) from stock-based compensation.

Cash Reserves:

As of November 26th, 2023 the company had cash and cash equivalents of $17B.

Operational Footprint:

871 total warehouses:

600 in the United States and Puerto Rico.

108 in Canada.

40 in Mexico.

33 in Japan.

29 in the United Kingdom.

18 in Korea.

15 in Australia.

14 in Taiwan.

5 in China.

4 in Spain.

2 in France.

1 each in Iceland, New Zealand, and Sweden.

Special Announcement:

COST's Board of Directors declared a special cash dividend for the company's common stock. This dividend, set at $15 per share, is scheduled to be paid out on January 12, 2024, to shareholders who are on record as of the close of business on December 28, 2023. The total amount set aside for this dividend payment is $6.7B, marking a substantial return to shareholders.

My Take:

Overall, COST's recent financial performance and strategic decisions suggest a company that is not only navigating current market challenges successfully but also positioning itself for sustained growth and profitability. Investors have every reason to be pleased with COST’s recent performance. Contrary to the expectations of many analysts, shareholders (including myself), and Wall Street observers for a slower quarter, COST has excelled, showing growth in key metrics, particularly membership fees and revenue. This growth is complemented by an aggressive expansion of their global footprint, signaling promising prospects for future growth.

Financially, the company is in a robust position, with a strong balance sheet boasting over $17B in cash and a reduction in dilution. The recent announcement of a special dividend, the second I've received from COST, came as a pleasant surprise to many in the investment community and reaffirms my satisfaction with the company’s performance.

In my detailed article about COST, which you can find in my archive, I elaborate on my investment thesis. COST's business model is centered around being a "one-stop shop," aiming to provide consumers with everything they need under one roof. This strategy is not only convenient for customers but also cost-effective, thanks to the savings offered by their bulk shopping model. Members can fulfill a wide range of needs at their warehouses, from groceries and automotive services to optical and pharmaceutical needs, not to mention their famous food court and iconic $1.50 hotdog combo. For shareholders, Costco's stellar execution has been reflected in the company's stock reaching all-time highs.

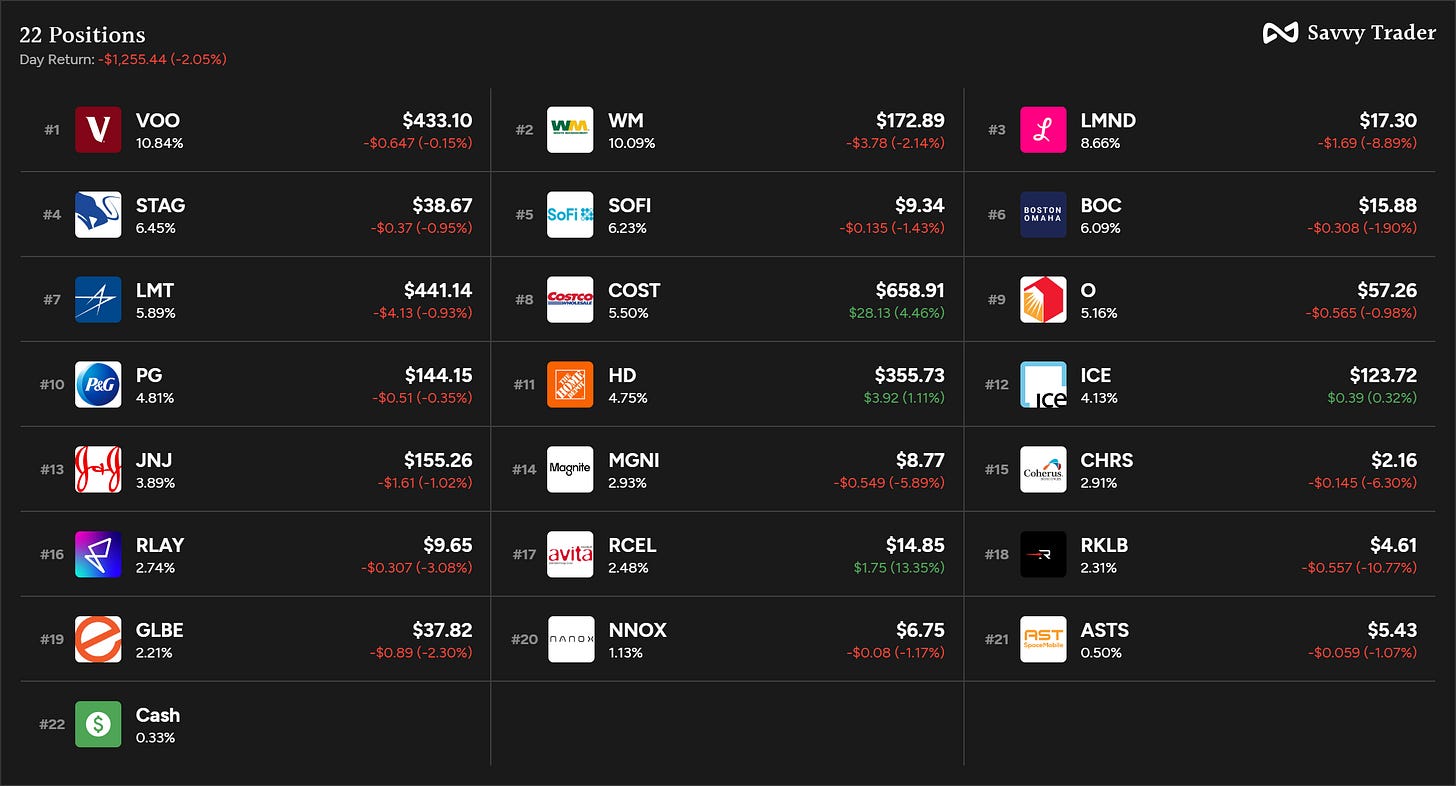

While there are inherent risks from competitors, I believe that COST is in a league of its own at the moment. Personally, COST will continue to be a top 10 position in my portfolio. My conviction in the company remains strong, and I'm excited to see what the future holds for the company.

Weekly Activity (December 11th-15th)

Nothing this week.