Earnings Reports (Jan 22nd-26th)

Taking a Look at Earnings Reports for Procter & Gamble (PG), Lockheed Martin (LMT), and Johnson & Johnson (JNJ).

This week's earnings releases have been particularly strong, highlighted by great performances from cornerstone holdings such as Procter & Gamble (PG), Lockheed Martin (LMT), and Johnson & Johnson (JNJ). In light of this, over the next several weeks to months, I plan to realign my attention towards the earnings outcomes for companies within my portfolio. Now, let's dive deeper into these businesses.

1. Procter & Gamble (PG)

PG reported its second-quarter earnings for fiscal year 2024. The results showcased a complex yet promising picture, with net sales and organic sales witnessing an uptick, but diluted EPS experiencing a downturn, primarily due to an impairment related to the Gillette brand (acquisition made many years ago).

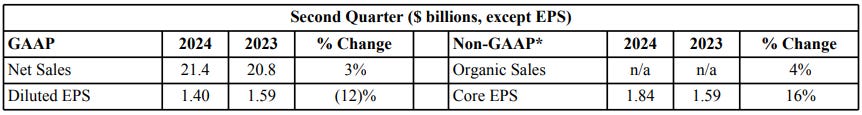

Key Financials at a Glance:

Net Sales: $21.4B, marking a 3% increase from the previous year.

Organic Sales: Reported a 4% rise, excluding foreign exchange and acquisitions/divestitures impacts.

Diluted EPS: Declined by 12% to $1.40, influenced mainly by a non-cash impairment of Gillette's intangible asset.

Core EPS: Increased by 16% to $1.84.

Cash Reserve: $8.2B

Operational Highlights:

Operating Cash Flow: Reached $5.1B.

Net Earnings: Totaled $3.5B.

Cash Return to Shareholders: PG returned $3.3B, with $2.3B in dividends and $1B in share repurchases.

Adjusted Free Cash Flow Productivity: Stood at an impressive 95%.

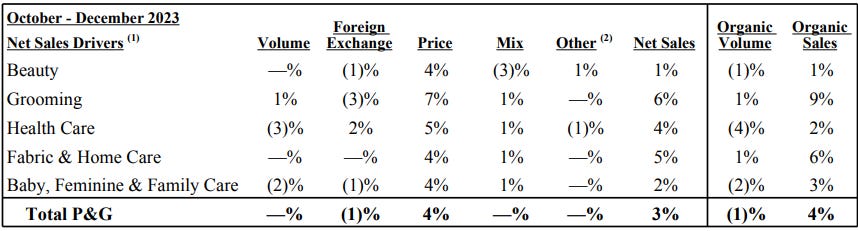

Segment Performance Analysis:

Beauty: Witnessed a 1% increase in organic sales. Hair Care showed robust growth, while Skin and Personal Care faced challenges.

Grooming: Showed a remarkable 9% organic sales growth, fueled by pricing, premium mix, and volume growth.

Health Care: Increased by 2% in organic sales, with Oral Care performing strongly.

Fabric and Home Care: Reported a 6% increase, driven by pricing and innovative product offerings.

Baby, Feminine, and Family Care: Saw a 3% rise, with mixed results across sub-segments.

Challenges and Adjustments:

Gillette Impairment: A $1.3B before-tax non-cash charge was recorded due to a reduction in Gillette's estimated fair value.

Market Restructuring: Announced limited market portfolio restructuring due to challenging macroeconomic conditions, particularly in Enterprise Markets.

Fiscal Year 2024 Guidance:

Sales Growth: Expected to be between 2 to 4%.

Organic Sales Growth: Projected at 4 to 5%.

Diluted Net EPS Growth: Revised to a range of -1% to in-line with the previous year.

Core Net EPS Growth: Raised to a range of 8 to 9%.

Capital Spending: Estimated to be about 4% of net sales.

CEO's Remarks: Jon Moeller, Chairman of the Board, President, and CEO, highlighted the company's resilience and commitment to its integrated strategy, emphasizing product superiority, productivity, and constructive disruption. He expressed confidence in the strategy's ability to deliver balanced growth and value creation.

Outlook: Amidst headwinds from foreign exchange rates and market challenges, P&G remains focused on its core strengths and strategic initiatives. The company's resilience in navigating the complex market landscape, combined with its strong brand portfolio and operational efficiency, positions it well for sustained growth and shareholder value creation in the coming fiscal year.

My Take

This quarter was great, and aside from the Gillette brand impairment charge, I observed no major issues. Additionally, I do think there's a significant amount of misinformation circulating about this particular topic. PG acquired The Gillette Company in 2005 for approximately $57B (one of the largest acquisitions for consumer goods at the time). An impairment charge is recognized when the carrying value of an asset exceeds its recoverable amount. In simpler terms, it means the company believes that the asset (in this case, the Gillette brand) is not worth as much as it used to be on its books.

Here’s my basic breakdown on this:

Change in Fair Value: The fair value of the Gillette brand might have decreased due to various factors like increased competition, changes in consumer preferences, or broader market shifts. This change can also be influenced by a higher discount rate used in valuation models or weakening of several currencies relative to the U.S. dollar, as mentioned in your provided information.

Non-Cash Charge: It's important to note that an impairment charge is a non-cash expense. It does not involve actual cash outflow but represents a reduction in the value of the asset on the company's balance sheet. For Gillette, a $1.3B before-tax ($1B after-tax) non-cash impairment charge was recorded.

Impact of Non-Core Restructuring Program: The impairment could also likely be linked to the non-core restructuring program PG mentioned. This program could involve strategies like divesting certain assets, exiting specific markets, or other operational changes that impact the perceived value of the Gillette brand.

Effect on Earnings Per Share (EPS): The impairment charge negatively impacts the company's reported earnings, as seen in the diluted EPS decrease above. However, when assessing the company's operational performance, this one-time charge is typically excluded from core EPS, which is why PG’s core EPS still showed growth.

Reflecting Market Realities: Recording an impairment charge is also a way for a company to align its financial statements with the current market realities and expectations for future earnings and cash flows from the asset.

Long-Term Strategy: To play a bearish perspective, a charge like this can indicate a strategic shift or a reevaluation of the brand's role in the company's portfolio. For PG, this might mean reassessing how the Gillette brand fits into their broader market strategy.

So, essentially, the Gillette brand impairment in PG's financial report is a significant accounting adjustment reflecting changes in the brand's valuation. It impacts the financial statements, particularly the EPS, but is non-cash in nature and often excluded from core operational performance metrics. Overall, while this was the sole aspect that raised my concern, it has not altered my overall stance on the company in any significant way.

2. Lockheed Martin (LMT)

LMT released its financial results for Q4 2023, showcasing robust performance and strategic advancements in its defense technology sectors.

Financial Highlights:

Net Sales: Achieved $18.9B in Q4 2023, slightly down from $19B in Q4 2022, while annual sales rose to $67.6B from $66B in 2022.

Net Earnings: Reported $1.9B in Q4, translating to $7.58 per share, compared to $7.40 per share in Q4 2022. Annual earnings reached $6.9B ($27.55 per share) in 2023, up from $5.7B ($21.66 per share) in 2022.

Cash Operations: Generated $2.4B from operations and $1.7B in FCF in Q4 2023. Annual figures were $7.9B for cash from operations and $6.2B in FCF.

Shareholder Returns: Returned $3.8B to shareholders in Q4 through dividends and share repurchases, totaling $9.1B in 2023.

Record Backlog: Achieved a record backlog of $160.6B.

CEO's Perspective: Jim Taiclet, Chairman, President, and CEO, reflected on the strong finish in 2023, emphasizing the continued demand for the company’s diverse defense technology solutions. The company invested significantly in research and development ($1.5B) and capital expenditures ($1.7B) to enhance its 21st Century Security capabilities. These investments align with LMT's vision of integrating traditional and breakthrough technologies to support global security efforts.

Outlook: Looking forward to 2024, the company expects to continue its growth trajectory, with a focus on digital transformation (1LMX initiative) to improve operational speed, resilience, efficiency, and competitiveness. LMT remains committed on delivering innovative solutions for global security challenges and anticipates sustained growth in cash flow and revenue.

My Take

LMT's recent earnings report presented is not bad but interesting, surpassing expectations yet experiencing a dip in stock value post-earnings, primarily attributed to a somewhat stagnant outlook for 2024. The company operates in a unique market dynamic, dominated by a single major customer, which is the U.S. Government. This has long been the norm, but now it kind of looks like there is a mini shift. The government seems to be exerting its monopsony power more assertively, aiming to negotiate lower prices. This trend is squeezing margins not just for LMT but for its industry peers as well.

Amidst these challenges, the company has been remarkably proactive in rewarding its shareholders. In FY2023, the company repatriated significant free cash flow, amounting to a $6B share repurchase and $3B in dividends. This has resulted in a notable 2.7% YoY decrease in share count (awesome). On a brighter note, LMT's role as a pivotal contributor to NASA, particularly the Artemis program aiming for lunar exploration by 2026, should not be overlooked. The space sector, the fastest growing among Lockheed's four business segments, has shown impressive growth, clocking $12.6B in sales (a 9% increase YoY) and a 10% YoY increase in operating profit, reaching $1.2B in FY2023.

But, while the earnings picture is mixed, the fundamental investment thesis remains defensive, both in geopolitical terms and as a portfolio stabilizer. In a world where security risks are heightened, the defense sector, including companies like LMT, is likely to thrive. The Pentagon's focus will be on bolstering defense capabilities, not on cost-cutting, especially given the current challenges with supply chains and production delays. Moreover, with the Space segment increasingly influencing LMT's financial health, the company's prospects remain intriguing. LMT’s performance may lag in a peaceful global environment, but in a scenario of escalating tensions, it could emerge as a rare beacon of stability in an otherwise turbulent market. My stance does not change on this business and will remain a top position.

3. Johnson & Johnson (JNJ)

JNJ has announced its financial results for Q4 2023 and the full year of 2023, demonstrating significant growth and strategic progress across its diverse portfolio.

Financial Performance Highlights:

Q4 Sales Growth: Reported a robust increase of 7.3% to $21.4B, with operational growth of 7.2% and adjusted operational growth of 5.7%. Excluding the impact of the COVID-19 Vaccine, operational growth was an impressive 10.9%.

Q4 Earnings Per Share (EPS): EPS for the quarter stood at $1.70, a significant increase of 39.3%, and the adjusted EPS grew by 11.7% to $2.29.

Full-Year Sales Growth: For 2023, Johnson & Johnson reported a sales growth of 6.5% to $85.2B, with operational growth of 7.4% and adjusted operational growth of 5.9%. Excluding the COVID-19 Vaccine, the operational growth was 9.0%.

Full-Year EPS: The EPS for the full year was $5.20, reflecting a decrease of 15.3%, impacted by a special one-time charge in the first quarter. The adjusted EPS, however, grew by 11.1% to $9.92.

2024 Guidance: The company has reconfirmed its guidance for 2024, projecting operational sales growth of 5%-6% and adjusted operational EPS of $10.55-$10.75, indicating a growth of 7.4% at the mid-point.

Segment Results:

Innovative Medicine (previously Pharmaceutical)

Q4 2023 Sales: $13.7B, a 4.2% increase from $13.2B in Q4 2022.

Full Year 2023 Sales: $54.7B, up 4.2% from $52.5B in 2022.

Operational Growth: Excluding the COVID-19 Vaccine, worldwide operational sales grew 7.2%.

Key Growth Drivers: The growth was primarily driven by products such as DARZALEX, ERLEADA, TECVAYLI in Other Oncology, CARVYKTI in Oncology, STELARA and TREMFYA in Immunology, and SPRAVATO in Neuroscience.

Offsetting Factors: Partially offsetting this growth were declines in ZYTIGA and IMBRUVICA in Oncology and REMICADE in Immunology.

MedTech

Q4 2023 Sales: $7.6B, a significant increase of 13.3% from $6.7B in Q4 2022.

Full Year 2023 Sales: $30.4B, up 10.8% from $27.4B in 2022.

Operational Growth: Worldwide operational sales grew by 12.4%, with the acquisition of Abiomed contributing 4.7% to this growth.

Key Growth Contributors: The growth in the MedTech segment was primarily fueled by electrophysiology products in Interventional Solutions, contact lenses in Vision, wound closure products in General Surgery, and biosurgery in Advanced Surgery.

CEO’s Perspective: Joaquin Duato, Chairman and Chief Executive Officer of Johnson & Johnson, highlighted the company's comprehensive and competitive performance in 2023. He emphasized their relentless dedication to patient care and expressed confidence in leading the next wave of health innovation. Entering 2024 from a position of strength, Johnson & Johnson is poised to continue its trajectory in healthcare innovation.

My Take

This was a good quarter, my stance on the company and its future is cautiously optimistic. JNJ has demonstrated resilience and adaptability in a complex and evolving healthcare landscape. The robust growth in both the Innovative Medicine and MedTech segments, especially in the absence of COVID-19 vaccine contributions, is a testament to the company's strong product portfolio and strategic focus. The growth driven by key pharmaceutical products and advancements in medical technology indicates a solid foundation in core areas of healthcare. Looking ahead to 2024, JNJ's guidance suggests continued growth, albeit at a moderate pace. The projected operational sales growth and adjusted EPS growth are positive indicators. However, the healthcare industry is rapidly changing, with increasing competition and regulatory challenges. JNJ will need to continue its focus on innovation and strategic investments to maintain its market position.

One concern is the reliance on a few key products for a significant portion of the revenue growth. While this has been beneficial so far, and something I’ve noted in the past, it does pose a risk should there be any setbacks in these product lines. Additionally, the healthcare sector is highly sensitive to policy changes and regulatory environments, both of which can have a significant impact on JNJ's operations. Overall, nothing changes for me and JNJ will continue to serve as an anchor to my portfolio.