Earnings Reports (November 13th-17th)

Taking a Look at Earnings Reports for HD, GLBE, & ASTS.

We've had another eventful week filled with earnings reports, and so far, Mr. Market seems to be in a positive mood. This optimism is largely driven by the latest U.S. CPI/Core CPI data, which provides more clarity on the Federal Reserve's potential actions regarding interest rate hikes. While making predictions in this area feels irrational to me, as it's beyond our control, it appears the market is anticipating a possible pause or reduction in interest rates in the future.

Turning our attention to specific businesses, a few companies within my coverage area reported this week. These include Home Depot (HD), Global-E (GLBE), and AST SpaceMobile (ASTS). The earnings releases from these companies were generally favorable, but there are a few key points that stand out and merit further discussion. So, let's dive into the details.

1. Home Depot (HD)

Home Depot released its Q3 2023 results this past week, and it's good news for investors. The company exceeded expectations in both earnings and sales. However, it's worth noting that, compared to last year, YoY growth represents a decline. Also, HD has adjusted its future outlook, opting for a more cautious approach in their guidance. This suggests they're being careful about how they predict their business performance in the coming months. For those keeping a close eye on Home Depot, these results offer an overall positive performance and a cautious stance looking forward.

Key Financial Highlights:

Sales Performance:

Total sales amounted to $37.7B, marking a 3% decrease from the third quarter of fiscal 2022.

Comparable Sales:

Overall comparable sales declined by 3.1%.

In the U.S., comparable sales saw a slightly higher decrease of 3.5%.

Net Earnings:

Net earnings were reported at $3.8B.

Earnings per diluted share stood at $3.81.

This compares to the third quarter of fiscal 2022, where net earnings were $4.3B, with earnings per diluted share at $4.24.

The YoY figures for HD present a nuanced picture. Despite the company surpassing estimates for this quarter, which is certainly commendable, there's a noticeable trend of slight decreases when we look at the YoY comparisons. It's essential to recognize that HD has experienced a period of exceptional growth over the past three years, and what we're seeing now is a stabilization or leveling out of that explosive growth. As the management has repeatedly pointed out, the company is currently navigating through a year characterized by "moderation." This phase is marked by a recalibration of the rapid growth previously seen.

Additionally, it's important to highlight that certain external factors have influenced the company’s sales. Notably, lumber deflation has played a significant role, along with adverse weather conditions in California. These elements have had a tangible impact on the company's performance, contributing to the moderation in sales growth. Understanding these factors is crucial in contextualizing Home Depot's current financial standing and its strategic responses to these market dynamics.

Financial Outlook:

Sales and Comparable Sales:

Expected to decline by 3% to 4% compared to fiscal 2022.

Operating Margin Rate:

Projected to be between 14.2% and 14.1%.

Tax Rate:

Anticipated to be approximately 24.5%.

Interest Expense:

Forecasted to be around $1.8B.

Diluted Earnings Per Share:

Predicted to decline by 9% to 11% compared to fiscal 2022.

The company cut its expectations for the year with as shift in spending becomes clearer with the economy slowing and costs rising for builders and homeowners.

My Take

I'm maintaining a measured approach to my position in this company, recognizing that results aren't always linear, especially over an extended period. It's crucial, however, to be aware of the challenges the company faces. As an investor, it's not rational to overlook any aspect of the business, whether positive or negative. Management has been transparent about the current year not matching the explosive growth of previous years. However, they anticipate a modest reacceleration as we move into 2024.

From my perspective, I'm content with my current stake in the company. While I believe in its long-term potential, I'm not planning to increase my investment at this time. I'm open to the possibility, though, should a significant opportunity arise that justifies further investment. This cautious but open approach allows me to balance my confidence in the company's future with a prudent investment strategy.

2. AST SpaceMobile (ASTS)

ASTS recently shared their Q3 business update and financial results. At the time of writing, the stock has gone parabolic, with shares increasing by over 20%. This rise in share value is somewhat surprising, given that the earnings reported were, in my assessment, relatively neutral. Before we dive into the specifics of their quarterly performance, it's important to understand the context of this company. ASTS is currently pre-revenue and represents a highly speculative growth position in my portfolio. With that in mind, it's encouraging to see that the business is on course for their planned commercial launch, indicating progress in line with their strategic goals.

Key Financial Highlights & Business Updates:

BlueWalker 3 Achievements:

Made history with space-based 5G cellular broadband capabilities.

Increased performance to 14 Mbps data rates per 5MHz channels.

Commercial Launch and Manufacturing:

First five commercial satellites expected to launch in Q1 2024.

Manufacturing is at full speed in Midland, Texas facilities.

Approximately 85% of planned capital expenditures paid as of September 30, 2023 (overlooked imo).

Operating Expenses Forecast:

Expected to decrease by $10M to $15M per quarter starting Q1 2024.

Reduction driven by completion of Block 1 design and development, substantial ASIC design completion, and partial Block 2 design completion, with no significant change in headcount.

Intellectual Property Growth:

IP portfolio now includes more than 3,100 patent and patent pending claims worldwide (this gives them a competitive advantage).

Strategic Investment Process:

Progressing on definitive documentation and due diligence with multiple strategic partners.

Aim to close and fund with partners in November or December 2023.

No guarantee of transaction completion on the expected terms or timeline.

Third Quarter 2023 Financials:

Cash, cash equivalents, and restricted cash totaled $135.7M as of September 30, 2023 (decent, but no more delays!).

Total operating expenses for Q3 2023 were $59M, a slight increase from Q2 2023.

Adjusted operating expenses for Q3 2023 were $37.3M, a decrease from $38.4M in Q2 2023.

Incurred approximately $265.8M in gross capitalized property and equipment costs, with accumulated depreciation and amortization of $41.6M.

Couple notable updates here, first the target launch date for commercialization, then the strategic investors, capital expenditures already accounted for, and a reduction in opex.

My Take

There are several factors from ASTS's recent report that give rise to both bullish and bearish sentiments about the company's future. Let’s begin with the more prominent bearish perspectives, which primarily revolve around competition from Starlink and concerns over delays in commercialization, as well as the uncertainty surrounding the closure of deals with strategic investors. I personally view the Starlink competition as a bit of a misinterpretation. Starlink primarily focuses on providing Wi-Fi through ground satellites, which requires users to pay a monthly premium for the connection. ASTS, on the other hand, is carving out a niche by addressing the unmet need for direct satellite-to-phone connectivity, particularly useful in emergency scenarios or in areas lacking infrastructure. Therefore, I don’t see Starlink, led by Elon Musk, as a direct competitor to ASTS in this sense.

Another concern is the potential for further delays in ASTS’s operations, a pattern the company has previously exhibited. Such delays could significantly deplete their cash reserves, compounded by the uncertainty of whether strategic investments will materialize. This combination of factors, if realized, could spell financial trouble for ASTS.

Conversely, there are compelling reasons to be optimistic. ASTS boasts considerable competitive advantages, a ready subscriber base awaiting commercial launch, and what I perceive as astute management decisions that keep the company several steps ahead in its journey toward commercialization. The opportunity to tap into a vast addressable market with disruptive technology makes ASTS an intriguing, albeit highly speculative, calculated risk.

Given these considerations, I'm keeping ASTS as a small portion of my portfolio until I witness a successful launch in Q1 2024. While some may argue that waiting until then might be too late, I find it more prudent to wait for this significant milestone before considering any major investment moves. This cautious approach balances the potential for high reward with the need to manage the risks inherent in such a speculative venture.

3. Global-E (GLBE)

GLBE recently released their Q3 2023 results, which presented a mixed picture. Alongside these results, the company lowered their future guidance, a move that was unfavorably received by the market. Consequently, at the time of writing, GLBE's shares have dropped close to -30%.

In the short-term, the outlook appears somewhat uncertain, with geopolitical risks and revised revenue guidance casting shadows. Despite these challenges, I maintain a positive long-term view on GLBE’s prospects. I believe the company has strong potential for future growth, even in the face of current market turbulence.

Key Financial Highlights:

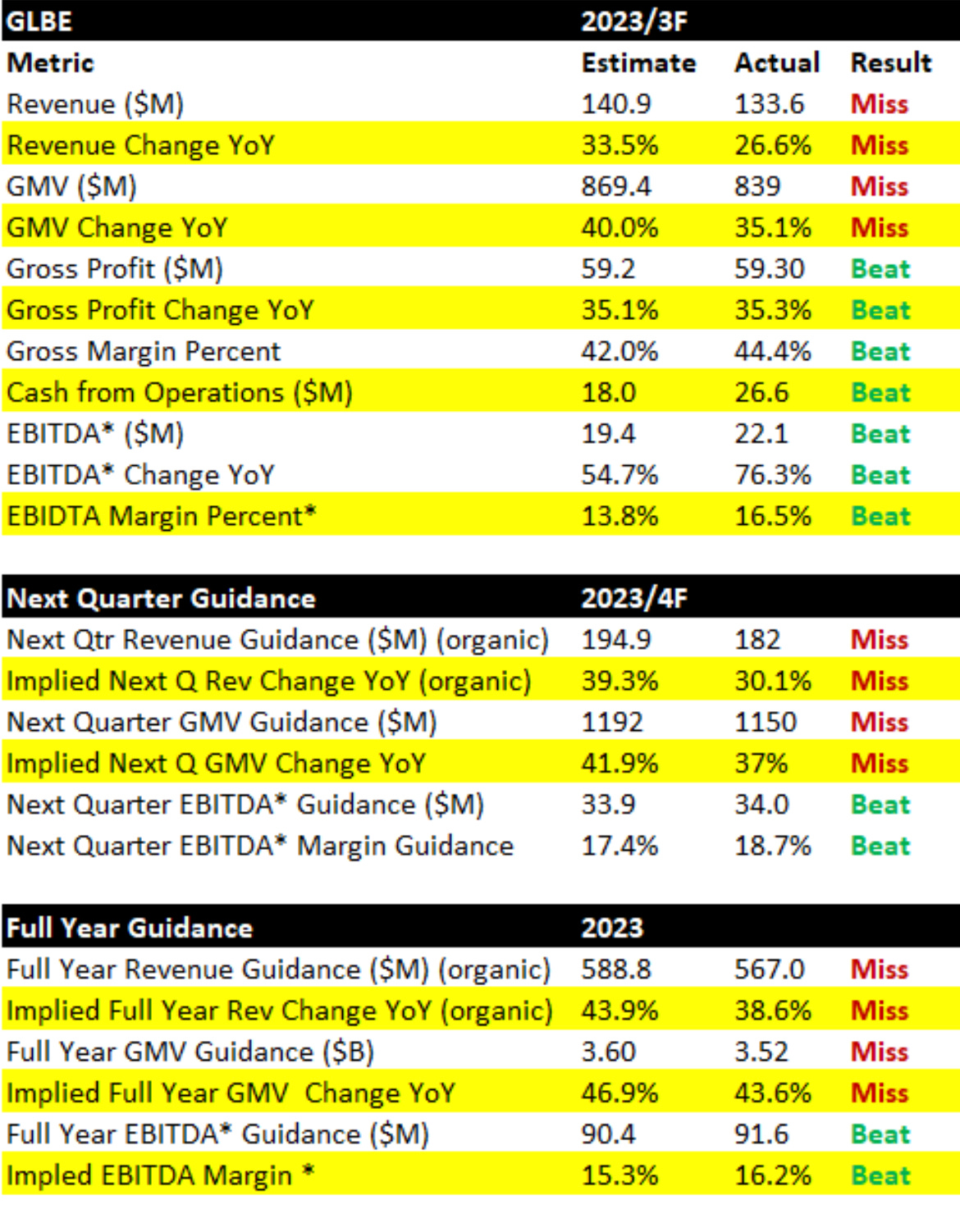

I found this visual on Twitter/X, I believe this is extremely helpful. Credit: Ophir Gottlieb

Gross Merchandise Volume (GMV):

$839M, a 35% increase YoY.

Revenue:

Total: $133.6M, up 27% YoY.

Breakdown: Service fees revenue at $62.4M; Fulfillment services revenue at $71.2M.

Gross Profit:

Non-GAAP: $59.3M, a 36% increase YoY.

GAAP: $56.5M.

Gross Margin:

Non-GAAP: 44.4%, a rise of 290 basis points from 41.5% in Q3 2022.

GAAP: 42.3%.

Adjusted EBITDA3:

$22.1M, a 76% increase from $12.5M in Q3 2022.

Net Loss:

$33.1M.

New Merchant Onboarding:

Globally diverse, including European brands like Ted Baker and Lacoste+UNDW3, US brands such as Tory Burch and Guess Watches, and APAC brands like Kotomi Swimwear.

High-end electronics brand Bang & Olufsen.

Expansion with Existing Merchants:

Added three LVMH maisons – Repossi, Emilio Pucci, Patou.

Onboarded Purdey of the Richemont group.

Shopify Partnership:

General availability of Shopify Markets Pro in the US from September.

Near completion of migrating legacy Shopify-based enterprise merchants to a new solution.

Renewed 3rd party partnership agreement for another year.

Platform Partners Network Expansion:

Integrated into Wix Commerce, expanding the network of platform partners.

When we put the statistics side by side with the initial estimates, the situation for GLBE appears more favorable than it might initially seem. Although there were misses on several metrics compared to the forecasts, it's important to note that the figures show a healthy YoY increase. Results aren’t always linear.

Financial Outlook:

Gross Merchandise Value (GMV):

For Q4 2023, GLBE expects GMV to be between $1.125B and $1.175B.

The FY 2023 GMV guidance is between $3.493B and $3.543B.

This FY 2023 guidance shows a slight increase from the previous FY 2022 guidance, which was between $3.480B and $3.640B.

Revenue:

The revenue for Q4 2023 is projected to be between $178M and $186M.

For FY 2023, the revenue is expected to be between $563M and $571M.

This is a decrease from the previous FY 2022 guidance, which was between $570M and $596M, indicating that GLBE expects to earn less revenue than initially projected for the previous year.

Adjusted EBITDA:

Adjusted EBITDA for Q4 2023 is anticipated to be between $31.5M and $36.5M.

For the full FY 2023, Adjusted EBITDA is expected to be between $89.1M and $94.1M.

This FY 2023 EBITDA guidance range is slightly higher than the previous FY 2022 guidance of $85M to $93M, suggesting an improvement in profitability.

Overall, GLBE's guidance indicates that while they are expecting a moderate increase in profitability (Adjusted EBITDA) for the full year, they are projecting a lower revenue range than what was estimated for the previous fiscal year. The GMV guidance for FY 2023 is relatively stable compared to the previous year, showing some growth but also reflecting a narrowed estimate range.

My Take

Global-e Online Ltd. (GLBE) reported their Q3 2023 earnings with a mixture of progress and setbacks. Although the company experienced shortfalls against some of their forecasted metrics, their YoY growth tells a story of resilience and forward momentum. In particular, their GMV saw a significant YoY increase, and both non-GAAP and GAAP gross profits improved. These increases in gross profit margins are especially noteworthy and demonstrate a healthier profitability potential.

The company's financial outlook, however, has been adjusted downward, likely contributing to the nearly 30% drop in share price. This adjustment may be a reaction to a range of factors, including market reception to the revised forecasts and broader economic considerations. Short-term challenges such as geopolitical tensions and the revised revenue guidance have injected a degree of uncertainty. Nevertheless, GLBE's diverse onboarding of new merchants across various global markets and the strategic partnership with Shopify underscore the company's ongoing strategic expansions and collaborations.

Looking ahead to Q4 2023, GLBE projects a GMV between $1.125B and $1.175B and anticipates revenue to be between $178M and $186M. This projection, while conservative compared to the previous fiscal year's outlook, signals a company adapting to current market conditions. The projected increase in Adjusted EBITDA for FY 2023, ranging from $89.1M to $94.1M, suggests an expected improvement in profitability despite the anticipated lower revenue.

GLBE's situation is emblematic of the volatile nature of growth in the tech and e-commerce sectors. The company is navigating through a complex business environment with a strategic approach, balancing the expansion of its merchant network and deepening platform partnerships. While the immediate future presents its challenges, the company's long-term strategy and market positioning keep the prospect of growth and success on the horizon. Investors may find the company's proactive measures and adaptability as positive indicators for its future trajectory, even as they brace for the impact of current market headwinds. For me personally, I’ve been heavily considering consolidating my position. My conviction remains high.