Earnings Reports (October 23rd-27th)

Taking a Look at Earnings Reports for Waste Management (NYSE: WM) & STAG Industrial (NYSE: STAG).

Another action-packed week of earnings awaits us! Staying true to my promise, I'll be delivering detailed analysis of quarterly earnings reports from the businesses I monitor, entirely complimentary. This week, we'll be looking into two distinguished companies I deeply respect: Waste Management (WM) and STAG Industrial (STAG). Both have consistently ranked among my top 5 picks, with Waste Management often claiming the top spot and STAG solidly occupying the fifth position. Let's dive deeper into their notable performances this quarter.

1. Waste Management (WM)

Waste Management has once again demonstrated its financial strength with its Q3 2023 earnings this past week, underscoring a commendable expansion in operating EBITDA margin. The consistency of these strong results can be attributed to a focus on pricing discipline and optimization of cost structures. This quarter not only witnessed organic growth in the collection and disposal business but also substantial improvements in operating costs. Also, like mentioned in my archived article on WM’s blueprint for success, a heavy commitment to SG&A cost management has led to a significant surge of over 6% in adjusted operating EBITDA and an impressive 100 basis points boost in adjusted operating EBITDA margin expansion.

Key Financial Highlights:

Revenue Dynamics:

For Q3 2023, the core price registered at 6.6%, a slight dip from the 8.2% seen in Q3 2022. Notably, this core price surpassed inflationary cost increases for the quarter by approximately 100 basis points, fostering both margin and earnings growth.

The collection and disposal yield came in at 5.0% for this quarter, compared to 7.1% in the same period last year.

On an adjusted workday basis, the total company volumes rose by 1.0% with the collection and disposal volumes seeing a 0.7% uptick. Without adjustments, the growth was 0.5% and 0.3% respectively, a slight decrease from the 1.0% and 1.4% of Q3 2022.

Efficient Cost Management:

The operating expenses relative to the revenue have been effectively managed, marking 61.3% this quarter, showing improvement from the 62.2% in Q3 2022.

SG&A expenses were recorded at 9.0% of the revenue, down from the 9.3% in the same quarter of the previous year. This indicates a 20 basis points enhancement from the adjusted 9.2% in Q3 2022.

Insight into Profitability:

The operating EBITDA for the company’s mainstay, the collection and disposal business, saw an upswing by approximately $105M, reaching $1.7B this quarter. This segment's EBITDA as a percentage of revenue was 32.6%, an improvement from 31.9% in Q3 2022.

The recycling segment experienced a drop in operating EBITDA by $10M relative to Q3 2022, aligning with the company's anticipations. This decline can be attributed to roughly a 40% dip in market prices for single-stream recycled products. However, the silver lining is the marked enhancement in product quality, throughput, and labor costs at WM's automated facilities, offsetting the earnings pressure from commodity pricing.

The renewable energy domain also saw a decline in its operating EBITDA by $13M in comparison to Q3 2022. This drop, in line with the company’s projections, was predominantly due to the decrease in energy prices and renewable fuel standard credits.

Income from Operations:

2023: There's a slight variance between the reported income ($1.021B) and the adjusted income ($1.022B).

2022: The reported income from operations was $942M, and the adjusted value slightly higher at $950M.

Operating EBITDA:

2023: Reported EBITDA is $1.54B, with the adjusted figure being slightly more at $1.541B.

2022: The reported EBITDA is recorded at $1.445B, while the adjusted value reached $1.453B.

Operating EBITDA Margin:

2023: The margin remains constant at 29.6% for both reported and adjusted figures.

2022: For this year, the reported margin was 28.5%, and the adjusted margin was slightly higher at 28.6%.

Net Income:

2023: Reported net income is $663M, with a minor increase in the adjusted figure at $664M.

2022: The company reported a net income of $639M, while the adjusted net income was $645M.

Diluted EPS (Earnings Per Share):

2023: Both reported and adjusted diluted EPS stand at $1.63.

2022: The reported EPS was $1.54, with the adjusted value being a tad higher at $1.56.

Despite what you’ll see on social platforms and MSM, painting a negative outlook, it's evident that there has been a positive growth trajectory from 2022 to 2023 across almost all key financial metrics. The revenue, income from operations, EBITDA, and net income have all seen an upward trend. The operating EBITDA margin and diluted EPS also showcase an improvement in the company's operational efficiency and profitability respectively when comparing the two years.

Free Cash Flow, Capital Allocation, Sustainability, & Outlook:

Net Cash Provided by Operating Activities:

In 2023: $1.263B

In 2022: $1.182B

This shows an increase in net cash generated from the company's core operational business activities in 2023 compared to 2022.

Capital Expenditures to Support the Business:

In 2023: $(493)M

In 2022: $(547)M

WM spent less on capital expenditures in 2023 compared to the previous year, which could mean more efficient use of capital or fewer investments in business infrastructure.

Proceeds from Divestitures of Businesses & Other Assets:

In 2023: $22M

In 2022: $7M

WM experienced a notable rise in proceeds from the sale or divestment of assets or businesses in 2023.

Free Cash Flow Without Sustainability Growth Investments:

In 2023: $792M

In 2022: $642M

Before accounting for sustainability growth investments, the free cash flow was higher in 2023, indicating healthier financial performance.

Capital Expenditures - Sustainability Growth Investments:

In 2023: $(180)M

In 2022: $(210)M

WM reduced its expenditure on sustainability initiatives in 2023 when compared to 2022.

Free Cash Flow (final figure after all allocations):

In 2023: $612M

In 2022: $432M

After considering all capital expenditures and other cash flows, the final free cash flow in 2023 was significantly higher than in 2022. This demonstrates a stronger financial position for the company in 2023. WM showed improved financial performance in 2023 across most metrics, especially in net cash from operations and FCF. The data also suggests more efficient capital expenditure management and a greater emphasis on sustainability growth investments.

Sustainability Advancements & Projections

WM is focused on propelling its sustainability growth initiatives, particularly in renewable energy and recycling. Management remains optimistic, forecasting that the previously divulged investments will yield an approximate $740M surge in annual adjusted operating EBITDA by 2026. A detailed breakdown reveals anticipated contributions of about $500M from renewable energy endeavors and an estimated $240M from recycling projects.

Recent Achievements & Upcoming Milestones

Q3 witnessed significant technological advancements at WM, with two recycling facilities receiving automation upgrades. Looking ahead, by the close of this year, two more automation projects are slated for completion, alongside the inauguration of a fresh market facility. In a noteworthy development set for January, the company is gearing up to operationalize its seventh renewable natural gas facility, marking the third installation in its ambitious growth program.

Financial Overview on Sustainability Investments

For the rest of 2023, the projected capital expenditure dedicated to sustainability growth has been revised to approximately $750M. This adjustment, stemming from a rescheduling of expenditure over the ensuing quarters, is expected to positively influence the FCF. As a result, the anticipated FCF for 2023 is set between a strong $1.825B and $1.925B.

Like mentioned in my archived article, WM is making remarkable strides in its commitment to sustainability, with a clear focus on renewable energy and recycling initiatives (I don’t think many investors fully understand how this will have a positive impact to their top and bottom line). Management's forward-looking projections suggest an impressive $740M increase in annual adjusted operating EBITDA by 2026, underpinned by significant contributions from both renewable energy and recycling ventures. The third quarter was particularly productive, with technological upgrades at multiple WM recycling facilities. Moreover, the company's diligent financial management, marked by a revised 2023 capex for sustainability, forecasts an optimistic FCF. It's pretty clear that WM’s sustainable endeavors are not only advancing its eco-conscious objectives but also fortifying its financial growth trajectory.

My Take

Who would have thought garbage could be so valuable? WM is a garbage company that continues to produce tremendous value for shareholders. This past quarter showcased a solid performance trajectory between 2022 and 2023, as mirrored in its financial metrics. From revenue and operational income to EBITDA and net income, WM has reported consistent growth, reflecting the company's sound financial and operational strategies. Notably, both the operating EBITDA margin and diluted EPS have strengthened over this period, further emphasizing the company's increased operational efficiency and profitability. A deeper dive into WM's financials reveals a positive momentum in FCF and capital allocation. The net cash provided by their operating activities has grown YoY, and while the company continues to invest significantly to bolster its operations, the FCF shows a favorable uptick.

WM remains steadfast in their commitment to sustainability, emphasizing both renewable energy and recycling. By 2026, the company expects its sustainability growth investments to usher in an additional $740M in annual adjusted operating EBITDA. Q3 also saw technological advancements at their recycling facilities, and with more projects in the pipeline, WM is poised for more sustainable growth and organic growth (which continues to go overlooked??). WM’s projected sustainability growth capital spending of around $750M in 2023, and the anticipated FCF nearing $2B.

To me, the company's proactive approach to business, combined with its forward-thinking sustainability initiatives, sets the stage for WM to remain a formidable player in its industry, with the promise of delivering both environmental and financial dividends in the coming years. They are a true hegemony in their market and will continue to chip away more market share from “competitors”. I am more than comfortable having WM as my top position, just recently surpassing VOO (S&P 500). I plan to consolidate this position at the start of next year, my conviction remains high.

2. STAG Industrial (STAG)

Today, STAG Industrial released their Q3 2023 earnings results. STAG has shown pretty good operating results and consistent growth in cash flow throughout the entire year. With the current dynamics of the capital market, their strong leverage and liquidity puts them in an advantageous position to seize emerging opportunities. Let’s take a look.

Key Financial Highlights

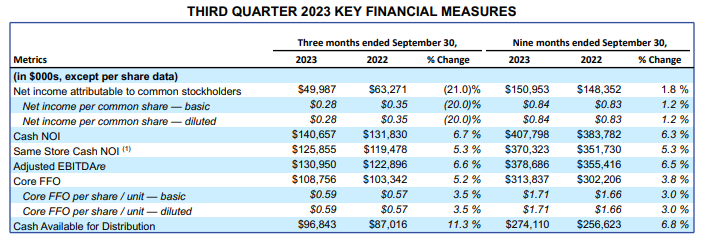

Net income per basic and diluted common share stood at $0.28 for Q3 2023, a decrease from $0.35 in Q3 2022.

The company reported a net income of $50M for Q3 2023, down from $63.3M in Q3 2022.

Core FFO per diluted share for Q3 2023 was $0.59, marking a 3.5% growth from Q3 2022's figure of $0.57.

Cash NOI (Net Operating Income) witnessed a growth of 6.7%, resulting in $140.7M for Q3 2023, up from $131.8M in the same quarter of the previous year.

Same Store Cash NOI was $125.9M in Q3 2023, which is a 5.3% rise from Q3 2022's $119.5M.

The company observed an 11.3% growth in Cash Available for Distribution, reaching $96.8M in Q3 2023 from $87M in Q3 2022.

Property & Acquisition Insights:

During Q3 2023, 12 buildings were acquired, spanning 1.5M square feet, at an investment of $204.3M. This acquisition came with a Cash Capitalization Rate of 6.2% and a Straight-Line Capitalization Rate of 6.7%.

The company divested two non-core buildings, totaling 719,466 square feet, for $28.4M in the third quarter.

As of September 30, 2023, the total portfolio boasted an impressive Occupancy Rate of 97.6% (excellent!), while the Operating Portfolio was even higher at 98%.

Leases for the Operating Portfolio commenced on 2.3M square feet in Q3 2023, setting records with a Cash Rent Change and Straight-Line Rent Change of 39.3% and 54.2%, respectively.

Lease retention for the quarter was at 74.4%, covering 2.2M square feet of the expiring leases.

Strategic and Forward-Looking Actions:

On July 27, 2023, the company settled the remaining net proceeds of $61.2 million, a forward sale associated with the ATM offering program completed in Q2 2023.

As of October 24, 2023, STAG Industrial has effectively addressed 97.9% of the anticipated 2023 new and renewal leasing. This covers a vast area of 12.9 million square feet, and the achieved Cash Rent Change stands at 30.1%.

STAG's Q3 2023 performance was decent. While net income saw a slight dip from the previous year, key metrics like Core FFO, Cash NOI, and Same Store Cash NOI grew by 3.5%, 6.7%, and 5.3%, respectively. The 11.3% increase in Cash Available for Distribution highlights financial robustness. With 12 strategic acquisitions, the company has been proactive in portfolio management. High occupancy rates and addressing most of 2023 leasing expectations underscore their market foresight. Overall, STAG is on an upward trajectory, primed for consistent growth.

My Take

STAG has managed to maintain a resilient financial footing as evidenced by several key indicators, despite the unpredictable/uncertain real estate landscape. The uptick in Core FFO per diluted share, Cash NOI, Same Store Cash NOI, and Cash Available for Distribution compared to Q3 of 2022 really highlights its operational efficiency and potential for increased profitability. This growth, ranging between 3.5% to 11.3%, signals strong management and a sustainable business model.

Also, STAG's proactive acquisition strategy, highlighted by the purchase of 12 buildings, adds a feather to its cap, reflecting both its ambition and capacity to expand. The shedding of two non-core buildings suggests a clear strategy of refining the portfolio for optimized performance. The company has managed to maintain high occupancy rates, which are crucial for steady revenue streams in real estate (key indicator, it’s all about the vetting process). The commencement of operating portfolio leases leading to record Cash Rent Change and Straight-Line Rent Change further showcases STAG's capability to maximize its assets. The forward-looking activities of the company, like addressing almost 98% of the expected 2023 new and renewal leasing, emphasizes a solid grasp of the market trends. While there's a decrease in net income per share compared to the previous year, the overarching financial trajectory seems promising, especially when considering the overall increase in cash flow metrics.

In my view, with its strong leverage and liquidity profile, STAG appears well-poised to capitalize on upcoming opportunities. The blend of strategic acquisitions, high occupancy rates, and successful leasing strategies paints an optimistic picture for the company's future, suggesting that STAG is on a path of sustained growth and resilience in the real estate market. STAG is fluctuating in and out of my top 5 at the moment. I plan on consolidating this position at the start of next year (just like WM), my conviction with the business remains high.