Garbage to Gold: Waste Management's Blueprint for Success

Taking a Look at Waste Management (NYSE: WM), Weekly Activity, & Portfolio Update

Why You Should Love Garbage Too

Diving deep into my portfolio, I'm compelled to bring Waste Management (WM) into the spotlight, a company I've held in high esteem and is currently one of my largest holdings. With the sentiments from my recent publication on Costco, WM holds a special place as one of my foundational investments in my investing journey. Their dominance in the industry is undisputed, fortified by an incredibly resilient competitive edge that I only see amplifying over time. Let's look into the intricacies of this garbage business (puns will continue).

First off, I want to start with WM’s most recent financial performance for Q2 2023, which highlighted a focus on disciplined pricing and rigorous cost optimization. Jim Fish, WM’s President and CEO, commended the team's strategic efforts, which led to a 60-basis-point expansion in adjusted operating EBITDA margin for the quarter, driven by robust SG&A cost control and their primary collection and disposal business.

Financial Highlights Q2 2023:

Revenue: $5,119 million, up from $5,027 million in Q2 2022.

Income from Operations: Stable at $944 million.

Operating EBITDA: $1,467 million adjusted, reflecting a growth from $1,415 million adjusted in Q2 2022.

Net Income: $617 million adjusted, a rise from $599 million adjusted in the prior year's quarter.

Diluted EPS: $1.51, an increase from $1.44 in Q2 2022.

Fish also addressed challenges, noting, "While facing persistent cost inflation, subdued renewable energy prices, and decelerated event-driven volumes, our team showcased resilience. Our strategic pricing has effectively countered escalating costs, and we are on a trajectory towards impressive growth as market pressures ease."

Operational Highlights:

Revenue Metrics: Core price growth for Q2 2023 stands at 6.9% compared to 7.5% in Q2 2022. Collection and disposal yield was 5.8%, showing a slight dip from 6.2% in the previous year.

Cost Management: Operating expenses as a percentage of revenue improved to 62.2% from 62.5% in Q2 2022.

Profitability: A notable uptick in the operating EBITDA from the company's collection and disposal business, which has reached $1.63 billion, representing a margin of 31.6%.

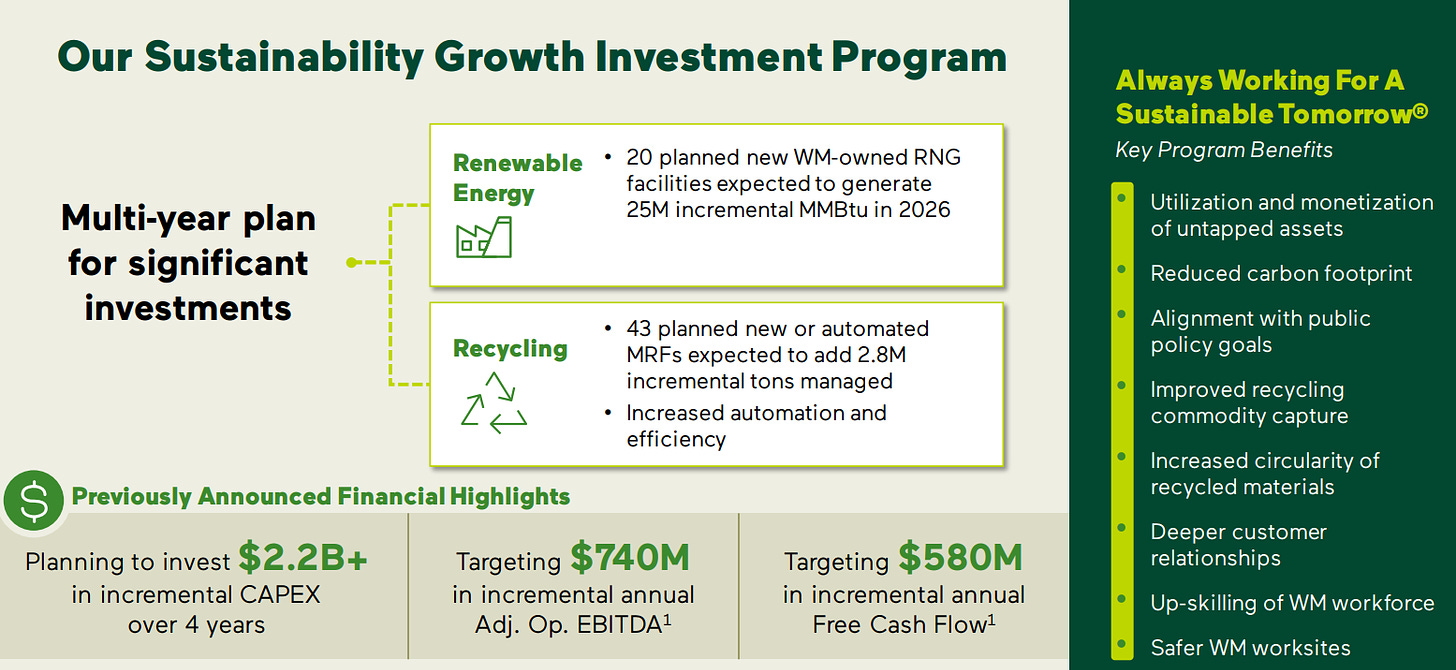

The company also highlighted sustainability endeavors, with three growth projects being commissioned this quarter, and continued investments in its sustainability growth strategy, which is projected to add approximately $740 million in annual adjusted operating EBITDA by 2026.

Revised Outlook for 2023:

WM updated its full-year outlook for 2023, factoring in H1 results and changing expectations for H2, primarily attributed to the anticipated slower recovery in recycled commodity prices and reduced event-driven volumes.

Key updates include:

Expected revenue growth between 3.25% and 4.25%.

Predicted adjusted operating EBITDA between $5.775 and $5.875 billion.

Free cash flow forecasted between $1.675 and $1.775 billion.

Concluding, Fish asserted, "We’re steering into H2 2023 with a focus on efficiency and cost optimization. Despite market challenges, our commitment ensures sustained margin expansion."

Trash to Treasure

The WM executive team has always emphasized the importance of compounding shareholder value through several methods. They have stable, growing, and recurring revenue streams, fueled by a broad range of assets and capabilities which are unparalleled in their industry. With their strong track record in enhancing profit margins, this is attributed to disciplined pricing strategies and effective cost control measures. Additionally, they prioritize an innovative organizational culture with a focus on the latest technologies to maximize value from their vertically integrated assets. The company also has a history of strategically balancing its capital allocation between organic and inorganic growth while ensuring consistent returns to shareholders. This has created the behemoth it is today, and it will only continue.

Their strategy for long-term profitable growth is grounded on sustainability, differentiation, and optimization. They operate with an extensive network, including numerous collection routes, hauling operations, transfer facilities, and active solid waste landfills. They've made significant investments in Material Recovery Facility automation, innovative truck technology, and tools to enhance the customer experience. Their global presence in recycling and their knowledgeable team in routing and logistics positions them as the “go-to” provider, making their competitors nonexistent/irrelevant.

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.