Generational Buying Opportunity or Hard Lesson to Be Learned?

Taking another Look at Coherus BioSciences (CHRS), Weekly Activity, & Portfolio Update.

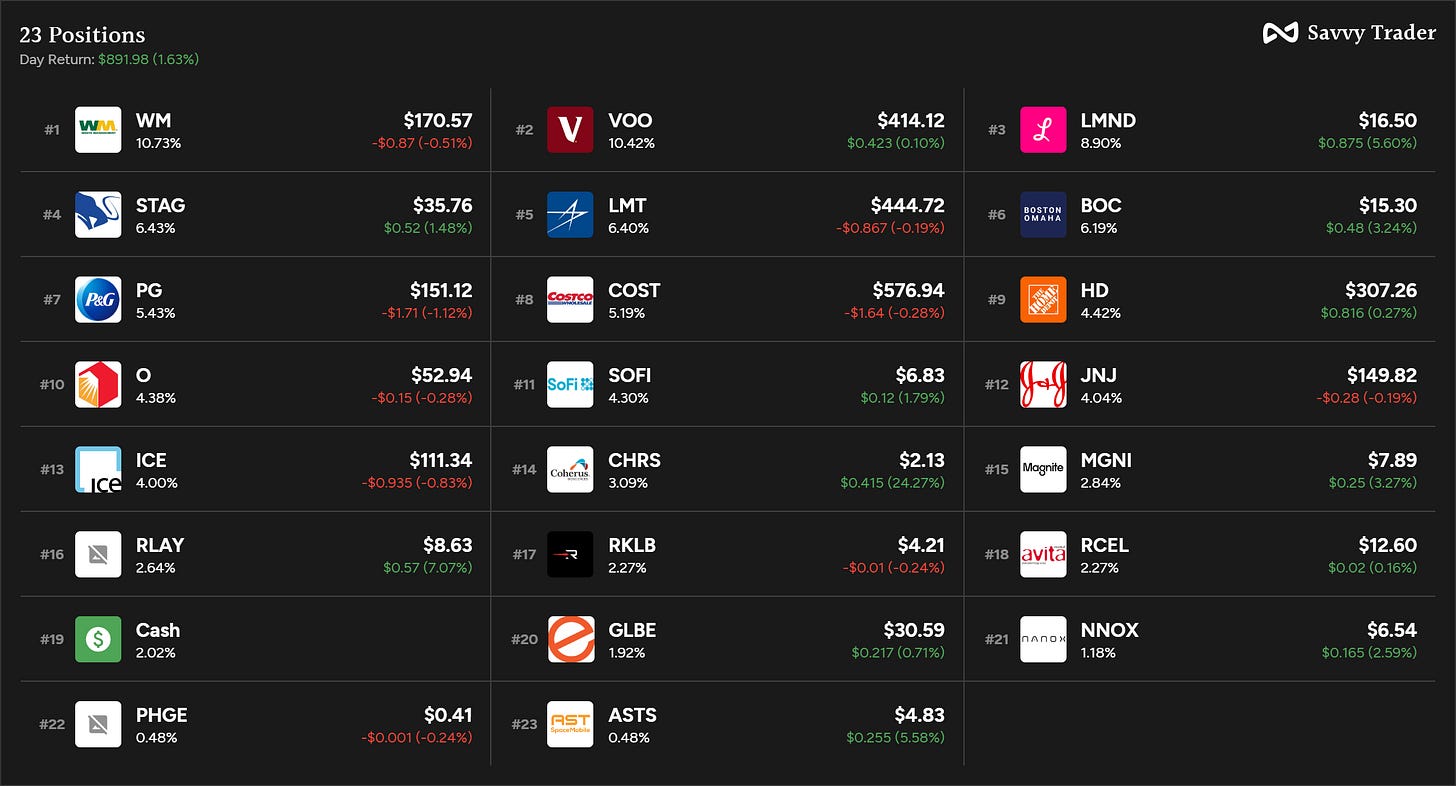

As we wrap up another eventful earnings week, we looked into the reports from Home Depot (HD), AST SpaceMobile (ASTS), and Global-E (GLBE). Looking ahead, next Monday (no article this Thursday) we are going to explore the results from Boston Omaha (BOC). Although BOC released their report this past week, they follow a similar approach to Berkshire Hathaway in terms of earnings disclosures – no calls or quarterly letters/business updates. I've been actively analyzing BOC’s performance and engaging with other prominent investors to broaden my understanding and perspective (and I must say, it looks like a strong quarter… I even added to my position last week).

This weekend, I want to revisit and emphasize Coherus BioSciences. My conviction remains strong that CHRS is on the path for great future success, especially considering the numerous catalysts in their pipeline that investors should be aware of. However, it's also crucial to stay cognizant of the risks involved, which we will be addressed. In my opinion, the potential rewards significantly outweigh these risks here. The current undervaluation of the business presents what I believe to be an excellent entry point, offering a substantial margin of safety. So, let’s take a closer look at this company, which specializes in biosimilars, and unpack what makes it an intriguing investment idea.

Hidden Gem or Fool’s Gold?

For more than two years, I have been tracking Coherus BioSciences (CHRS), eagerly anticipating their effective execution in advancing their pipeline. Since early 2023, CHRS has demonstrated impressive progress, prompting me to initiate a position with the company. This period has been marked by significant volatility in the financial markets, particularly within the biotech sector. The extent of distress and lack of liquidity in the sector is almost comical, capturing my focused attention this year due to the exceptionally low trading levels of many companies in this space. As many of you are aware, I have actively increased my investments in a few select biotech names, notably Relay Therapeutics and Avita Medical. However, there is one company that distinctly stands out in this landscape, compelling me to emphatically emphasize once more – Coherus BioSciences (CHRS).

The recent Q3 2023 financial results from the company weren't received favorably by the market, leading to a sharp decline in the share price by over 30%. I dissected the reasons behind this market reaction in my article a few weeks ago. Since then, there's been a notable turnaround, with shares surging by an additional 20%. This upswing was partly triggered by Baird initiating coverage on the company, rating it as an 'outperform' with a price target of $11 (meaningless). I firmly believe that this company is a hidden gem in the current market landscape, underestimated by Wall Street and not fully appreciated by retail investors (many big pharma fan boys don’t like the idea of biosimilars… I wonder why? *sarcasm*). The potential for growth and revenue generation from the array of biosimilars in their pipeline is just beginning to unfold.

Their pipeline consists of Udencya, Cimerli, Loqtorzi, and Yusimry. Loqtorzi (Toripalimab) has successfully secured regulatory approval this past quarter, marking a significant milestone. Additionally, Cimerli, the biosimilar to Lucentis, has been launched since the beginning of this year (Cimerli is really picking up speed). There's also positive news regarding Udenyca OBI, which is projected to receive approval before the end of 2023. Furthermore, Yusimry, the biosimilar to Humira (the world’s best-selling drug), has been launched as planned. These recent developments within the company, which I believe are often misinterpreted/misunderstood, actually signify crucial advancements in expanding the company’s product portfolio and enhancing its market presence.

I want to address the main concern I see floating around, which is, albeit exaggerated, bankruptcy. Financially, CHRS is well-cushioned with $131M in cash on their balance sheet and an additional $100M credit facility at its disposal. This suggests a stable footing to navigate any immediate cash flow challenges in the upcoming quarters if commercialization for products does not live up to expectations. The company’s current trajectory suggests it will achieve cash flow positive operations by the second half of 2024. However, this could be affected by factors such as insurance coverage delays or unexpected surges in trade receivables. With $131M in cash as of September 2023 and access to a $100M credit facility, the company appears well-positioned to manage its finances effectively through this period. The anticipated cash generation from new products like Loqtorzi, Yusimry, and Udenyca OBI further strengthens this outlook. Despite intense market competition from big pharma, the company is showing promising improvements across key metrics and is on course for cash flow positive operations by the second half of 2024. Essentially, while CHRS faces intense market competition and some immediate financial challenges, its strategic product launches, potential for market share growth, and upcoming financial reliefs paint a picture of a company poised for a significant turnaround and sustainable growth. Investors just need to be patient.

I strongly encourage investors interested in CHRS to explore my archive of articles on the company. In these archives, you'll discover comprehensive analyses and the foundational thesis that underpins my perspective on the company. These pieces offer detailed insights and a deeper understanding of CHRS's market position, strategic moves, and potential future trajectory. They serve as valuable resources for anyone looking to gain a more nuanced view of the company's operations and investment potential.

My Take

In the short term, stocks can often be at the mercy of market sentiments. However, it's the consistent execution of a company's strategies, or the lack thereof, that fundamentally drives share prices over meaningful stretches of time. In this regard, CHRS stands in a particularly strong position. The management team at CHRS has been meeting, and often surpassing, their set objectives throughout 2023, laying a robust foundation for 2024. But I will say, there have been times where management has been caught in a whirlwind of delays, not questioning management but frustrated. That said, it’s important to note that certain aspects, such as regulatory delays often caused by external third parties or restrictions on international travel, fall outside the management’s control. Nevertheless, the company has adeptly navigated these challenges, staying true to its long-term multi-product strategy. This strategy, long awaited by investors, has now been realized, marking a significant milestone in the company's trajectory.

The recent extensive sell-off by Wall Street presents what I believe could be a generational buying opportunity for retail investors. This isn't to suggest that results will follow a linear path or that the share price will skyrocket immediately, but rather, from a long-term perspective, there's a strong potential for significant, multi-bagger returns. It's common for retail investors to feel daunted by the small-cap biotech sector, often clouded with complex jargon, but history has shown that it can be a fruitful ground for substantial gains. As for me personally, I'm planning to increase my stake in CHRS at the beginning of 2024. Currently, I hold 750 shares, with an average purchase price slightly above $4 per share. My plan is to actively accumulate more shares, irrespective of the market price at that time. My confidence in CHRS remains steadfast, and I'm committed to bolstering my position, anticipating strong future growth.

Weekly Activity (November 13th-17th)

Nothing this week.