ICE... ICE... Baby!

Overlooked Metrics by Dividend Growth Investors, Intercontinental Exchange (ICE), & Weekly Activity.

2 Metrics Overlooked by Dividend Growth Investors

When people think of dividend growth stocks, they will more than likely reference back to the “Dividend Kings” of the industry. These are dividend-paying businesses that have increased their annual dividend for at least 50 consecutive years. Businesses such as: Procter & Gamble, AbbVie, Johnson & Johnson, 3M, Abbott Laboratories, Coca-Cola, PepsiCo, & many others. Inasmuch as I want to agree with referencing back to Dividend Kings as top dividend growth stocks, I have to disagree and say that’s essentially flawed to an extent. It’s a classification you should take into consideration when identifying potential dividend growth stocks, but there are a couple other metrics that need to be analyzed along with it.

There are three “primary” classifications of dividend growth stocks. These are Dividend Kings, Dividend Aristocrats, & Dividend Achievers. Dividend Kings are at the top of the list with at least 50 consecutive years of annual dividend increases, then Dividend Aristocrats with at least 25 consecutive years of annual dividend increases, and lastly, we have Dividend Achievers with at least 10 consecutive years of annual dividend increases.

There is nothing wrong with investing in one of these classifications of dividend growth stocks. All I’m saying, is there are other metrics that need to be considered, as a long-term dividend growth investor. The two primary metrics I like to emphasize is Market Capitalization, which is essentially emphasizing capital appreciation, and the Dividend Growth Rate (DGR). Market Cap is probably one of the most overlooked metrics by investors; especially, when it ties heavily into future capital appreciation. Let me try to give an example for a better understanding… let’s use the Dividend King, Procter & Gamble (PG). PG is highly unlikely to give you 10x-100x return on investment over the next decade. This is because PG is a mega-cap business, which means it has a market capitalization greater than $200B, which is fluctuating around $330B. To calculate the market cap, you have to take the number of outstanding shares (2,385,500,000 shares) & multiply that by the current stock price, let’s just use $140. This will give you the current market cap of the business.

Now let me explain why this matters… let’s use PGs market cap of around $330B, 2,385,500,000 outstanding shares, and controlled stock price of $140. For PG to 10x, the stock price is going to have to reach $1,400 price per share. If we multiply this stock price with the total amount of outstanding shares, this would make PG a $3.3T company. I mean, that’s simply just not possible… that’s only for the business to 10x. It’s a mature business, in a consolidated market, which means slowed growth. This is an important metric that I don’t think many investors take into consideration when they evaluate potential dividend growth opportunities, because you don’t just want a hefty dividend payment, you want significant capital appreciation as well.

I’ve seen investors get too caught up on the classifications of dividend growth stocks, not realizing capital appreciation is not in their favor. “Most” of the time, whether you agree or disagree, you will not find Dividend Kings producing market beating returns. They are either right on the edge of it or way below. That’s because the majority is filled with mature large/mega-cap businesses with slowed growth, so capital appreciation won’t be as significant. The whole goal of this metric is to emphasize capital appreciation.

Examples of Dividend King’s with low capital appreciation (AAR) over a 10-YR period are Altria Group (MO) 9.23%, Coca-Cola (KO) 7.68%, Procter & Gamble (PG) 9.1%, 3M (MMM) 3.17%, Johnson & Johnson (JNJ) 9.96%. Low capital appreciation is determined from the S&P 500’s 10-YR AAR which is 10.42% (Inflation adjusted), anything below that should be looked at as underperformance.

DGR is another metric I heavily consider when identifying potential dividend growth investments. The DGR is the annualized percentage rate of growth that a stock's dividend undergoes over a period of time. For example, one of the top-performing dividend growers, Visa (V), has a 10-year DGR of 19.38%. So, on average, Visa has increased their annual dividend by 19.38% for the past 10 years, that’s pretty impressive. I like to personally focus on both 10/5-year DGR’s with at least a 10% average. The ultimate goal with this metric is to help emphasize the dividend growth, since this is why we are dividend growth investors in the first place. Again, like mentioned above, many investors get too hung-up on the classification of dividend growth stocks and assume they are getting the “best bang for their buck”. That’s flawed since there are quite a few Dividend Kings that serve as prime examples for this… Coca-Cola (KO), not only has had poor capital appreciation, but their 10-YR DGR is a lousy 5.61%. Yes, KO provides stability to a portfolio, but if you’re truly investing for dividend growth, there are much better options out there (I’m not a Coca-Cola hater, just using them as an example).

Now, of course I understand past performance is not indicative of future results, but most of the time, if you’re investing in quality the trend continues and likely upward. There are obviously many other metrics that need to be analyzed in a business such a free cash flow, margins, price-to-earnings, return on equity, net income & revenue growth, and many others. However, I chose Market Capitalization and DGR because its often overlooked by long-term dividend growth investors and needs to be considered when evaluating potential opportunities.

Taking a Look at Intercontinental Exchange

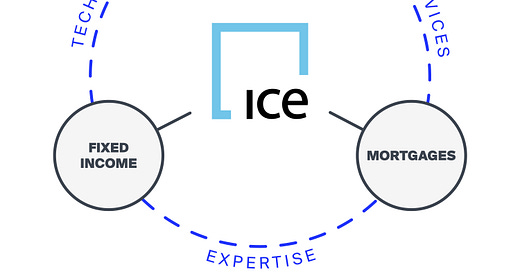

Intercontinental Exchange (ICE)

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.