What are Biotechnology Stocks?

Biotechnology has been shaping our development since early civilization. But what exactly is biotechnology, and what does a “biotech” company do? Biotech companies exploit cellular and biomolecular processes to develop products and technologies that improve our lives and the health of our planet. The industry primarily includes businesses that develop drugs and diagnostic technologies for the treatment of diseases and medical conditions. Often, these are smaller start-up/micro-cap companies, but it’s also filled with large well-established businesses. According to the Global Industry Classification Standard (GICS) sectors, biotech falls under the umbrella of “Health Care”. Many seasoned biotech investors would argue against this, but it’s a fact (don’t take it out on me!). Examples of these would include the following: Johnson & Johnson, Amgen, Eli Lilly, Pfizer, AbbVie & many other larger incumbents.

These biotech businesses products MUST go through rigorous, costly, and time-consuming trials before potentially obtaining approval, or clearance, from the U.S. Food and Drug Administration (FDA). This means that investors may wait years and years before knowing whether a drug under development will pay off. The overall success rates from Phase I to FDA approval is only 9%.

FDA Approval is a higher standard, because the safety and effectiveness of the specific product has been tested. FDA Clearance is a lower standard, and in many cases the product is cleared because it is similar to an existing product, rather than that it has passed rigorous independent safety trials. In other words, specific testing on FDA Cleared products may be absent or minimal.

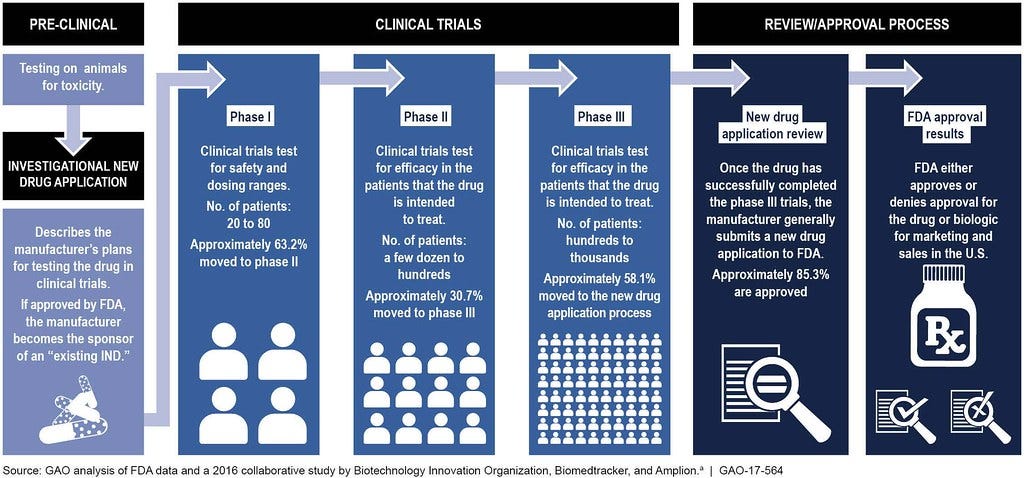

Here is an illustration to get a better understanding of how the FDA Approval process works:

The process starts with preclinical (animal) testing. Then, an investigational new drug application (IND) outlines what the sponsor of a new drug proposes for human testing in clinical trials. Next, is Phase 1 studies which typically involves 20 to 80 people. Then proceeds to Phase 2 studies which typically involves a few dozen to about 300 people. Phase 3 studies typically involve several hundred to about 3,000 people. Then the submission of an NDA is the formal step asking the FDA to consider a drug for marketing approval. After an NDA is received, the FDA has 60 days to decide whether to file it so it can be reviewed. If the FDA files the NDA, an FDA review team is assigned to evaluate the sponsor's research on the drug's safety and effectiveness. The FDA reviews information that goes on a drug's professional labeling (information on how to use the drug). Then, the FDA inspects the facilities where the drug will be manufactured as part of the approval process. Lastly, the FDA reviewers will approve the application or issue a complete response letter.

Like just mentioned above, this industry is filled with many early-stage companies that generate little to no revenue, so it can be known to be extremely volatile. I always make the joke that biotech investors are a different breed of investors, because the amount of volatility they are able to handle is quite impressive. You truly need an iron stomach for these types of investments. The past 1 1/2 years haven’t helped these businesses either, pummeling the majority down to historic lows.

With that said, when investing in biotech stocks, investors must decide on the level of risk they are willing to take. For instance, a large, established biotech company with a multibillion-dollar market cap is less likely to succumb to bad market conditions than a more speculative, newly listed company with no revenue in the pre/clinical trial phase. This applies to any business outside of just this industry though, you have to understand the risks at play; but it’s important to emphasize that smaller biotech companies do in fact come with more volatility than others.

How do I invest in smaller biotech companies? I first identify biotech companies that have a robust and transformative pipeline and a relatively large amount of cash, especially if these are pre-revenue businesses. This gives me confidence, let’s say, if the business were to report horrible results for a potential drug candidate in their pipeline and they discontinue, they would have enough cash to fund operations and to focus on other pipeline candidates. Now, if a business has shown execution and promise, I will make a small starter position and ONLY accumulate more as execution continues. This has worked well for me in the past and is the safest way to protect yourself from over-allocating to a potential loser, in my opinion.

Taking a Look at Avita Medical

Avita Medical (RCEL)

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.