This week’s newsletter is powered by MindsetMojo, where it’s their mission to help you unlock your full potential by providing you with the inspiration, motivation, and strategies you need to succeed.

Whether you're looking to achieve your goals, improve your mindset, or simply live a happier and more fulfilling life, they lay out systems that help you along your journey.

You can find them on YouTube @MindsetMojoOfficial. With MindsetMojo, you'll join a community of individuals who are committed to personal growth and self-improvement. So, if you're ready to take your life to the next level, consider subscribing.

Did We Already Bottom?

Those that have been following me since day one, understand I’ve been neutral on what may or may not happen in the near future of the market. I have never been a fan of predicting the macroeconomic environment, or the direction of where the market will take us (up or down). I do believe those that attempt to predict what will happen only end up damaging their reputation/credibility, because you are going to be wrong more times than you are right… the odds are never in your favor. To be frank, nobody knows where we will end up or what is going to happen, we can only go off historical data, business fundamentals, and conviction for our decision-making (See my pinned publication if you want to argue with me).

One thing that is a fact and I can predict, however, is the market will recover and recover to all-time highs. There is nothing new to this, see the illustration below:

Your time-horizon DOES matter… the longer that it is, the higher your chances are in performing well in the market are. As seen in the illustration above, which represents the Standard & Global 500 Index, the market has gone up 100% of the time over 20-year periods. Now, some of you don’t have 20+ year time-horizons, I get that. I’m simply just displaying the facts/historical data on the importance of having a long-term investment horizon and the market always recovering to all-time highs.

This week I want to give my two cents on where we stand in this market, it will give more transparency on my weekly activity; also, I want to disclose the businesses I’ve been buying the past couple weeks since I’ve deployed a significant amount of capital (which I’ll get to later).

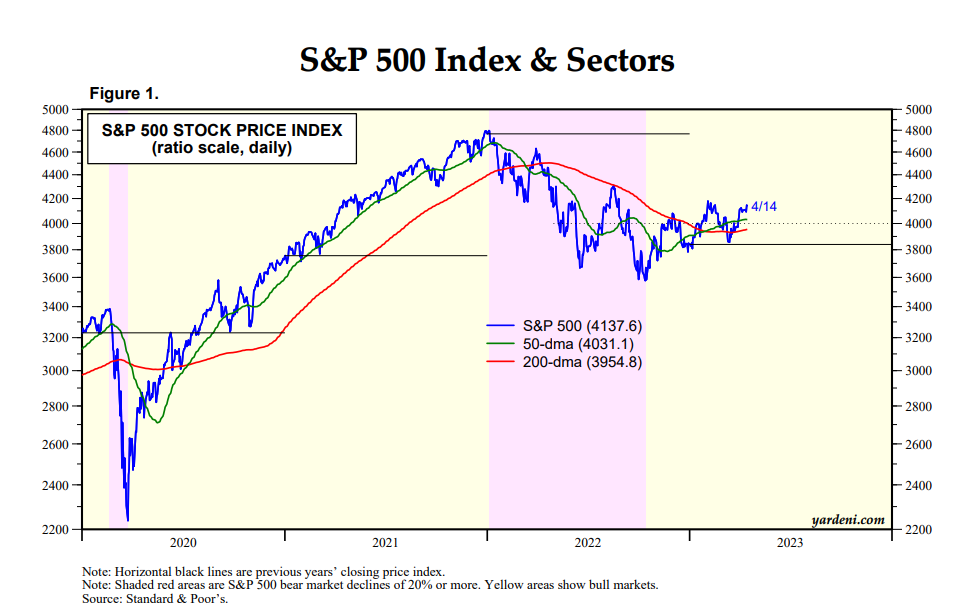

When we take a look at the S&P 500 Index over the past 3-years, we can see the

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.