Position Update & News

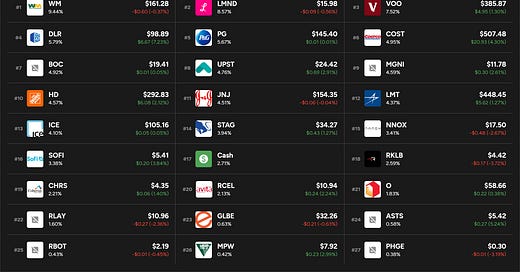

It’s that time again… this week I’ll be giving a portfolio update since Q1 2023 earnings results have officially been completed for me. Like I’ve mentioned previously in the past, after every quarter I’ll be releasing a portfolio update. Now, if you’ve been following me since my last portfolio update, you know I’ve made some major changes to my overall portfolio. These changes were regards to selling, trimming, and doubling down on my existing positions, and starting new ones. It wasn’t necessarily a portfolio rebalancing. Below you will see positions like LMND, DLR, UPST, SOFI, BOC, WM, and many others that made significant jumps in my portfolio. This was mainly due to the time of accumulation, being undervalued then rising YTD. Ultimately, the byproduct of doing this, my cost-basis was lowered on “some” names; also, I just transitioned to a new software called Savvy Trader, which tracks my portfolio in real-time with a more accurately weighted portfolio layout (Big news coming soon with this).

My Portfolio

Let me clarify something quickly… originally, I had a total of 27 holdings, but I’ve sold JMIA. This brings my portfolio down to a total of 26 holdings now (even though it says 27 still, that’s because it’s counting my “Cash” as a position). So, lets dive into some important updates. I will start with the smallest weighted positions in my portfolio and work my way up to my largest positions that have had notable moves with the underlying business.

Jumia Technologies (JMIA) - 0.18% SOLD

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.