Portfolio Update: An In-Depth Look at My Positions

The Year of Accumulation, Abstract of Each Position in My Portfolio, Conviction Ratings, & Weekly Activity

2022: The Year of Accumulation

I don’t know if you know this, but we were in a historic bear market in 2022 (still are until we get more bull signals and “could” get worse). Lots of investors struggled to maintain their investment strategies, processes, mindset, etc., and some even liquidated their assets to go all cash. The true “long-term” investors that stuck with it and looked at these declines in the market as an opportunity to accumulate in quality businesses and funds, will be handsomely rewarded in the future. If you go back to some of my previous publications, I emphasize investor psychology greatly during these times and we have been watching it play out in real-time. Many investors 5+ years from now will look back at 2022 and wished they invested more.

Almost every sector was plagued by volatility, with the exception of Energy equities, with information technology (IT) sector being a top sector hit the hardest. The IT sector was down almost 36% off its high; specifically, software businesses taking the brunt of volatility. As it was obviously not just the IT sector that opened up investment opportunities, but many other sectors that brought light to attractive opportunities as well. Investors that had vision and maintained a long-term perspective, focused on potential future returns, took advantage of these opportunities. If you were a long-term investor, 2022 was the year of accumulation.

“Be fearful when others are greedy, and greedy when others are fearful.” - Warren Buffett

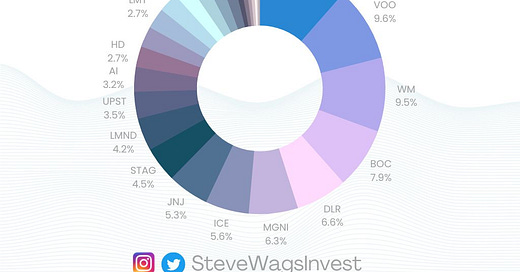

My Portfolio

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.