Rocket Lab's Preliminary Earnings Results & Debt Offering

Taking a Look at Rocket Lab's (RKLB) Prelim Earnings & Private Debt Offering, Weekly Activity, & Portfolio Update.

Disappointing Results & More Dilution

I might be out on a limb here, but I sense that Rocket Lab (RKLB) is on the cusp of something great. Despite this, the current market valuation hardly reflects the potential I see in it. The stock took a hit this past week, plunging over 15%, a downturn fueled by disappointing preliminary results and news of an equity offering that could water down current shares.

Digging into RKLB's recent performance, the company previewed its Q4 earnings, hinting at revenues between $59M to $61M, this actually misses the mark compared to the anticipated $66M. Additionally, they're expecting a net loss ranging from $49M to $52.5M. However, it's not all doom and gloom; their gross profit margin is anticipated to hit nearly 26%, a significant leap from last year's 3.5%. The delay of a single Electron rocket launch has been pinpointed as a key reason for these less-than-stellar figures. Though this postponement is seen as a minor hiccup that won't derail the company's long-term ambitions, the market's impatience has been palpable.

RKLB also unveiled plans for a $300M convertible senior notes offering, set to mature by February 1, 2029. This move could potentially dilute existing shares by over 15% if all notes are converted at the set strike price of $5.13 per share, a 29% premium over the last closing price (the dilution scares me). The offering aims to bolster the company’s finances by about $290M, or up to $343.5M if an additional purchase option is exercised. This financial move really sparks curiosity about RKLB's liquidity needs, especially after the company reported a cash reserve of $144M at the end of Q3 2022. With a cash burn of about $101M through the first three quarters of 2023, the rationale behind securing additional funds becomes clearer, especially in anticipation of the Neutron launch vehicle (thesis-breaking event), which boasts a $50M price tag per launch. It's a strategic move to shore up finances now, suggesting Rocket Lab is playing a long game.

Something that most haven’t thought of with this offering, is the possibility of an acquisition looms large with this new capital. RKLB's hint at using the funds for potential strategic transactions hints at ambitious plans for growth through acquisition. This strategy isn't new for the company, which has already made several strategic acquisitions, including a significant purchase from Virgin Orbit, positioning itself as a consolidator in the fragmented space industry. In conversations with Rocket Lab's CEO, Peter Beck, and CFO, Adam Spice, back in 2021, the vision for the company was clear: strategic acquisitions are key to securing an early lead in the space race. The recent purchase near its headquarters is just the beginning, serving as a springboard for the eagerly awaited Neutron program.

My Take

RKLB is on track to finalize its funding round shortly, with plans to announce definitive Q4 2023 earnings by February 27, 2024. Given its current expenditure rates, it's understandable that the company is seizing the chance to secure more funds while the opportunity is still favorable. Keep an eye out, as it wouldn't be shocking if RKLB announces another strategic purchase soon. Despite the recent dip in stock price, my confidence in RKLB’s potential remains unshaken. I see this as a golden moment for steadfast investors to either initiate or expand their holdings cautiously, viewing the recent market reactions as a window of opportunity rather than a setback. It is important to note, the entire bull thesis for this company relies on the upcoming launch of Neutron. If this isn’t successful, it could be game over for long-term bulls. But if it is successful, buckle-up for lift off. I don’t plan on adding to my position until we pass the Neutron milestone successfully.

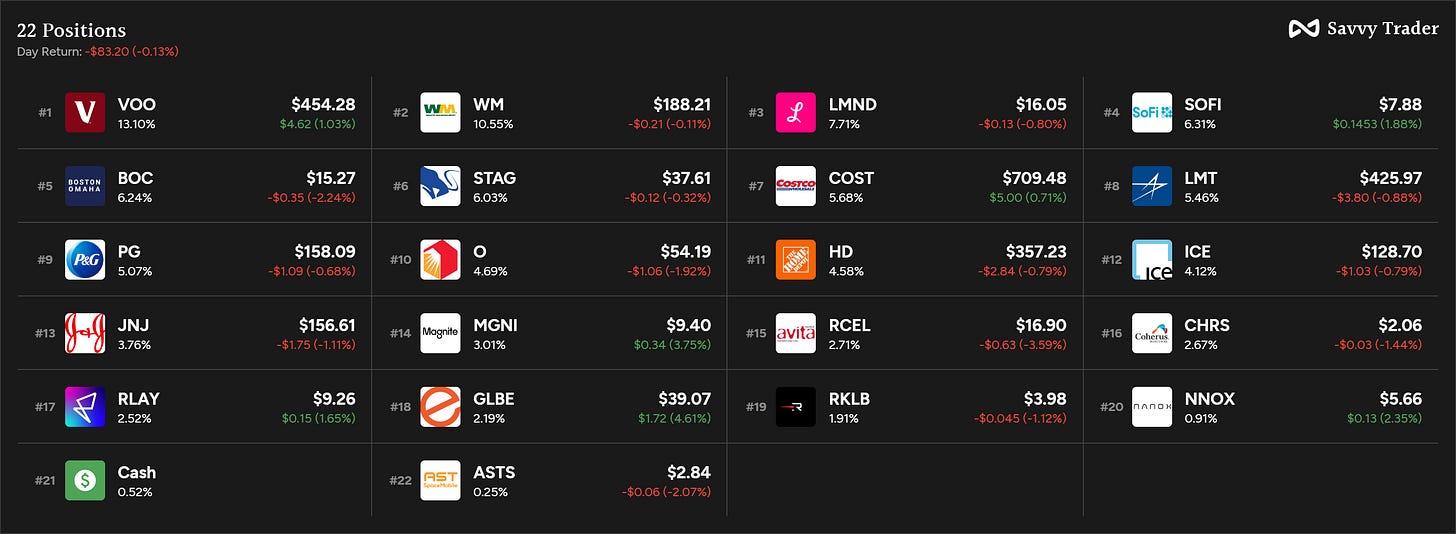

Weekly Activity (Jan 29th-February 2nd)

1 shares of VOO (S&P 500)

50 shares of SoFi Technologies (SOFI)