Should You Be Buying Upstart?

Taking a Look at Upstart (UPST), Weekly Activity, & Portfolio Update

This Weeks Newsletter is Powered by Savvy Trader!

I’ve transitioned to Savvy Trader’s platform for more transparency and real-time tracking of my portfolio. Attached below is the link to my portfolio on Savvy Trader:

https://savvytrader.com/SteveWagsInvest/stevewagsinvest

If this has issues connecting, search for “Steve Wagner | Invest” as your 2nd option. Doing this, you should be able to find my portfolio. This is 100% FREE and will start putting more time into that platform.

What’s Going on with Upstart?

In the beginning of August, Upstart (NYSE: UPST) released its Q2 2023 earnings results, which received a mixed market response despite being “decent”. Yes, I said decent, because the quarter was actually not that bad. The share price took a 30%+ haircut, though it now appears to be stabilizing, presenting an attractive buying opportunity. Investors need to consider the context of UPST's performance, following a parabolic rise after their Q1 2023 results, Q2 needed to be exceptional for the stock to continue its impressive run. Despite the recent market turbulence, the Q2 report suggests an appealing long-term investment opportunity, once we look beyond the pessimistic narratives often seen on social platforms (creators pushing pessimism for likes/engagement). That said, let’s take a look at UPST’s most recent quarter and how this is an attractive long-term buying opportunity.

Q2 2023 Financial Snapshot

Revenue Insights: The quarter witnessed a total revenue of $136M, marking a 40% decrease compared to Q2 2022. Fee-based revenue stood at $144M, reflecting a 44% YoY decrement.

Transaction Metrics: The lending component introduced 109,447 loans in Q2, aggregating to $1.2B via our platform. This is a 64% decline relative to the preceding year's corresponding quarter. The conversion rate for rate requests landed at 9%, a drop from the previous year's 13%.

Operational Income: Operational losses amounted to $33.3M, a slight increase from the preceding year's Q2 loss of $32.1M.

Net Profit & Earnings Per Share (EPS): The reported GAAP net loss stood at $28.2M, an improvement from the $29.9M loss in Q2 2022. Conversely, the adjusted net profit experienced growth, reaching $5.4M from $1.0M. As such, GAAP diluted EPS was logged at ($0.34), while the diluted adjusted EPS reached $0.06, considering the average outstanding shares over the quarter.

Profit Contribution: Q2 2023 recorded a contribution profit of $95.9M, down by 21% YoY. Notably, the contribution margin was a robust 67%, a significant enhancement from the previous year's 47%.

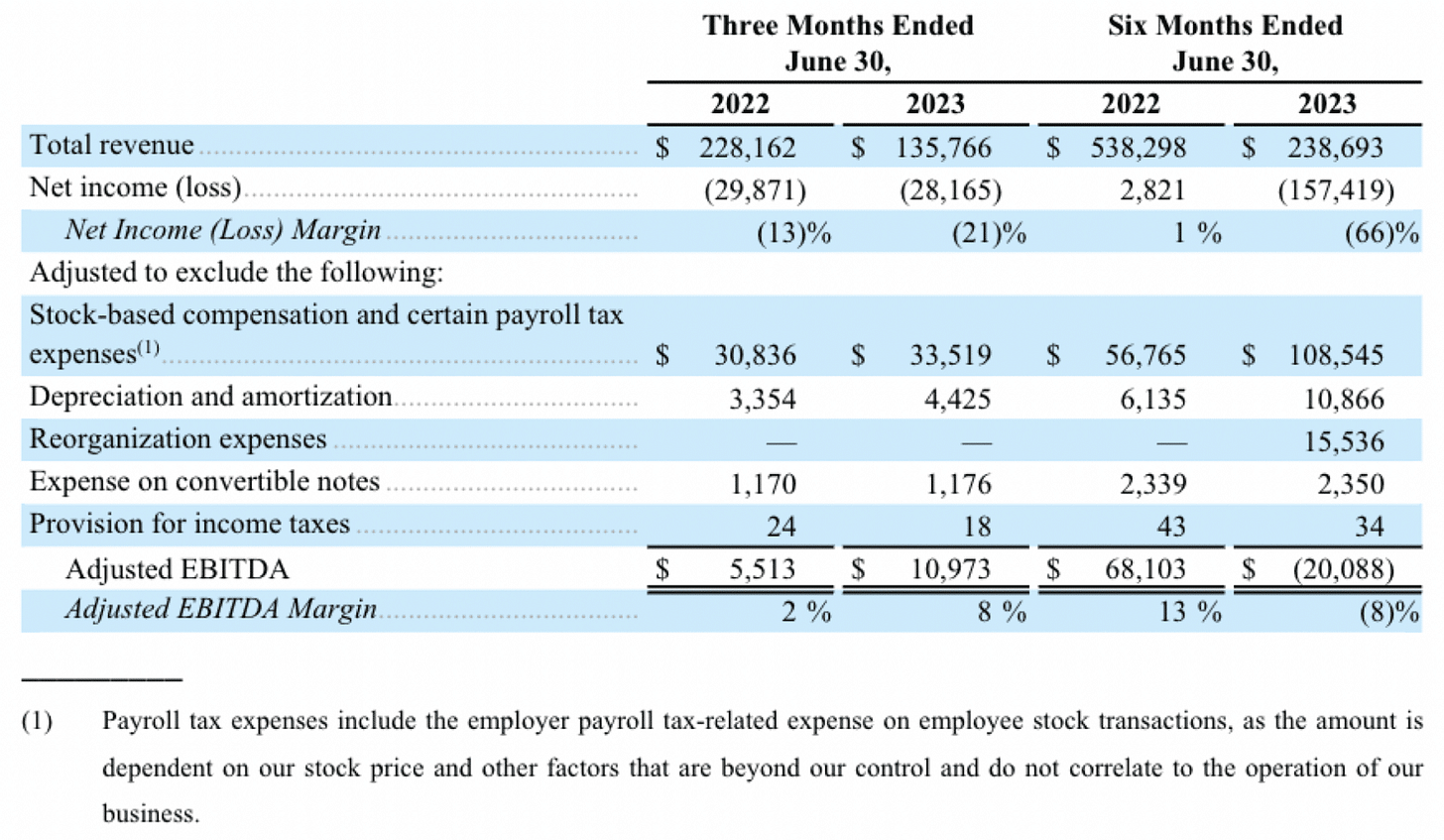

Adjusted EBITDA: A promising growth in the adjusted EBITDA was observed, standing at $11.0M, up from Q2 2022's $5.5M. The adjusted EBITDA margin for Q2 2023 was 8% of the overall revenue, an uptick from the previous year's 2%.

Future Financial Outlook (Q3 2023)

Upstart anticipates the following for Q3 2023:

Revenue: Approximately $140M

Fee-Based Revenue: Roughly $150M

Net Interest Profit (Loss): Estimated at ($10)M

Contribution Margin: Projected around 65%

Net Profit (Loss): Around ($38)M

Adjusted Net Profit (Loss): Estimated to be ($2)M

Adjusted EBITDA: Projected at $5M

Basic Average Share Count: Approximately 84.5M shares

Diluted Average Share Count: Circa 84.5M shares

Upstart's Financial Review

Agree to disagree, but UPST showcased decent results:

Fee-Based Revenue Performance: The company reported a fee revenue of $143.7M, marking a substantial growth of 23% compared to Q1 2023. This performance actually surpasses UPST's initial guidance of $130M. This favorable momentum is attributed to a strategic shift towards institutional funding, complemented by other rate optimization endeavors (which reiterates managements words on peak losses behind the company in Q1 2023).

Overall Revenue Analysis: A net interest loss of approximately $8M was recorded, culminating in a total revenue figure of $135.8M. While Upstart's projection stood at $135M, the slight overshoot was primarily due to unforeseen interest losses amounting to -$8M, deviating from the anticipated interest gain of +$5M. It's crucial to highlight that this unexpected interest loss was influenced by a notable (yet unrealized) fair value adjustment coupled with escalating charge-offs within the R&D portfolio, especially noticeable within early vintage auto loans (Bears/Shorts don’t want to talk about this).

Loan Transactions & Average Size: The period saw a sequential increase of about 30% in loan transactions. The average loan size was reported at $11,000, reflecting a 4% growth compared to the previous equivalent period. However, there was a sequential dip, which can be ascribed to the proliferation of smaller-value loans.

Contribution Margin: The contribution margin reached an unprecedented peak of 67%. Defined as the fee revenue less variable expenses associated with borrower acquisition, verification, and servicing (expressed as a percentage of fee revenue), this underscores the exemplary unit economics characterizing UPST's business model.

Operational Expenditures: For Q2, the operational expenses were registered at $169M. This represents a commendable reduction of 35% on a YoY basis and 28% sequentially. This fiscal prudence can be attributed to strategic restructuring initiatives executed by the leadership team (They have done an excellent job with this).

GAAP Net Loss: The company reported a net loss of $28M, consistent with the previous year's same period. This stability, in the face of a 40% YoY decline in revenue, underscores the company's commitment to stringent fiscal measures and resource management.

Adjusted EBITDA: Rising to $11M, this doubled from the previous year, further highlighting the adept expense management during challenging times.

Automation: 87% of unsecured consumer loans issued were fully automated, reaching a record high. Efforts to streamline finance processes play a pivotal role in sustainable growth (this is HUGE).

Balance Sheet Overview:

Loans: Q2 concluded with loans valued at $838M on their balance sheet, marking a decrease from the prior quarter's $982M. Of this, R&D loans, predominantly auto, accounted for $493M.

ABS Transaction: A $200M ABS transaction was finalized post quarter-end. This saw Q2 loan vintages from the balance sheet being sold in the ABS market, effectively reducing the loan position subsequently (Bears don’t want to talk about this either).

Cash Reserves: Excluding the aforementioned ABS deal, the company's cash reserve stood at a robust $510M.

Macroeconomic Landscape & Loan Performance:

Upstart Macro Index (UMI): As cited from UPST's official sources, UMI gauges the macroeconomic influence on credit loss for Upstart-empowered unsecured personal loans. The UMI reached 1.68 in June, the steepest since June 2020, indicating a challenging environment for subprime personal lending. While a high UMI doesn't inherently indicate surging losses, it does suggest potential lending constraints (We want this UMI to start declining, this shows how difficult the current climate is).

Keep reading with a 7-day free trial

Subscribe to Pierce Capital Research to keep reading this post and get 7 days of free access to the full post archives.