SoFi Has Record Full-Year Profitability

Taking a Look at SoFi Technologies (SOFI) Quarterly/Full-Year Results.

I've transitioned to exclusively logging my weekly activity and tracking my portfolio in real-time on Savvy Trader.

For those not yet in the loop, I invite you to join me on this journey. Subscribe using the link below to gain direct insights:

By subscribing, you'll engage directly with me regarding specific companies, access my performance in real-time (with data starting just over a year), and get detailed views of my investments, real-time trading actions, cash positions, and more. This move is driven by my commitment to transparency. I believe that sharing my analytical insights and the reasoning behind my investment choices offers immense value, empowering you with the information you need to make informed decisions.

“2024 was SoFi's best year ever"

This morning, SoFi Technologies (SOFI) reported its Q4 2024 and full-year results, and I believe the negative pre-market reaction was unwarranted—especially for investors with a long-term outlook.

Q4 2024 Highlights:

Net Revenue: $734M (GAAP), up 19% YoY; $739M (adjusted), up 24% YoY.

Net Income: $332M (GAAP), up 594% YoY; $61M (adjusted), up 27% YoY.

Earnings Per Share (EPS): $0.29 (GAAP); $0.05 (adjusted).

Adjusted EBITDA: $198M, up 9% YoY with a 27% margin.

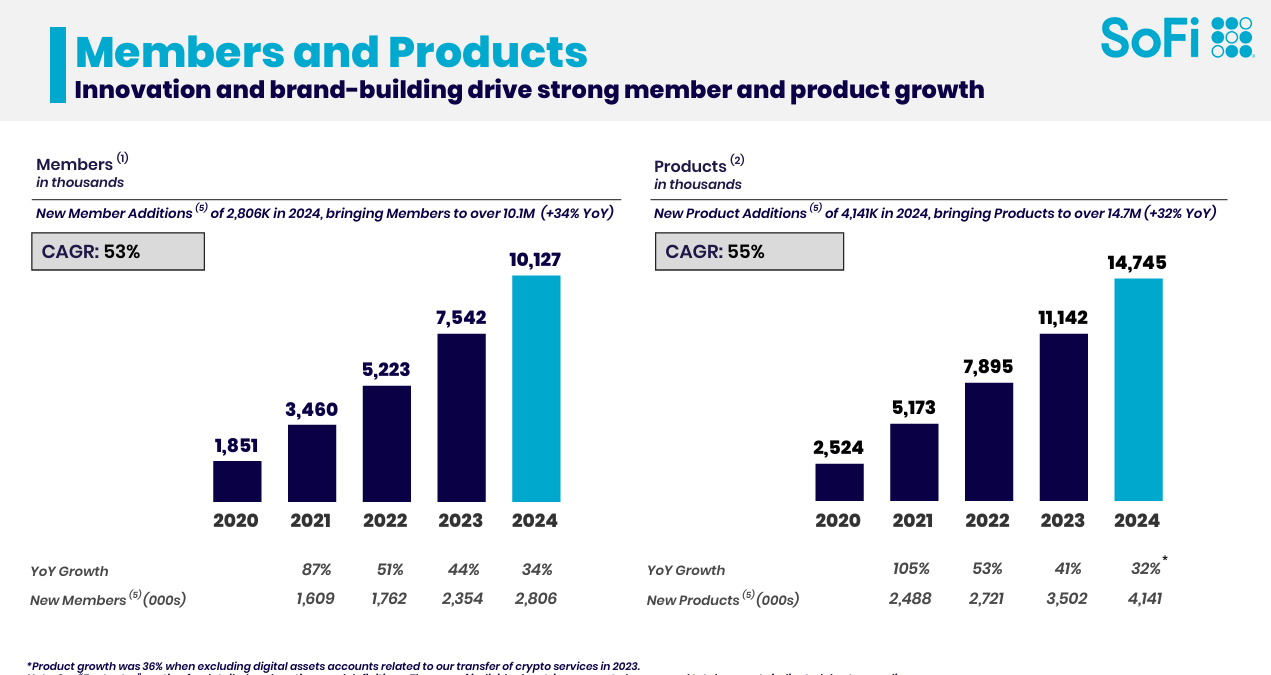

Membership Growth: Added 785,000 new members, reaching 10.1M total (+34% YoY).

Product Growth: Added 1.1M new products, totaling 14.7M (+32% YoY).

Fee-Based Revenue: Record $290M, up 63% YoY.

FY 2024 Highlights:

Net Revenue: $2.7B (GAAP), up 26% YoY; $2.6B (adjusted), up 26% YoY.

Net Income: $499M (GAAP); $227M (adjusted).

Adjusted EPS: $0.15.

Adjusted EBITDA: $666M, up 54% YoY with a 26% margin.

Tangible Book Value: Increased by $1.4B to $4.89B.

Loan Originations: Record $23.2B (+33% YoY), driven by personal, student, and home loans.

Deposits: Grew to $26B, with strong adoption of direct deposits.

Key Business Achievements:

Launched new financial products, including credit cards and a robo-advisor platform.

Achieved record results in the Loan Platform Business and secured significant partnerships through Galileo (Tech Platform).

Improved credit performance, maintaining life-of-loan losses below the 8% tolerance level.

First full-year of profitability.

Outlook for 2025:

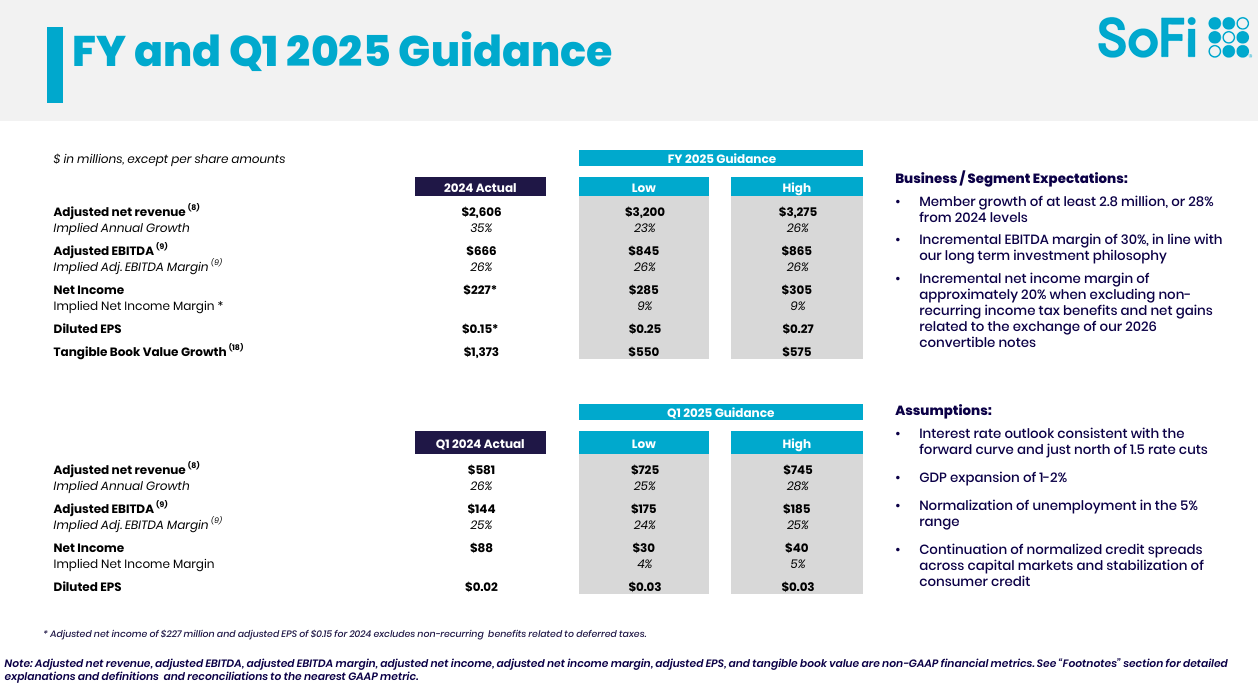

Anticipates $3.2-$3.3B in adjusted net revenue (+23-26% growth YoY).

Forecasts $845-$865M in adjusted EBITDA with a continued focus on incremental profitability and growth.

My Take

This was an excellent quarter, contrary of what you’ll see on social platforms from bulls with shaky conviction and bears pointing to net cumulative losses on loans. First thing I want to do, is address the full-year results then secondly, address the pessimism surrounding the stock after their earnings release.

SOFI increased it’s customer count to 10.127M, which is an increase of 34% YoY and the highest increase this year QoQ hitting 8.1%. Since 2020, this now calculates SOFI to a 53% compound annual growth rate (CAGR) in member growth. Let’s not forget how well this company is scaling on this front.

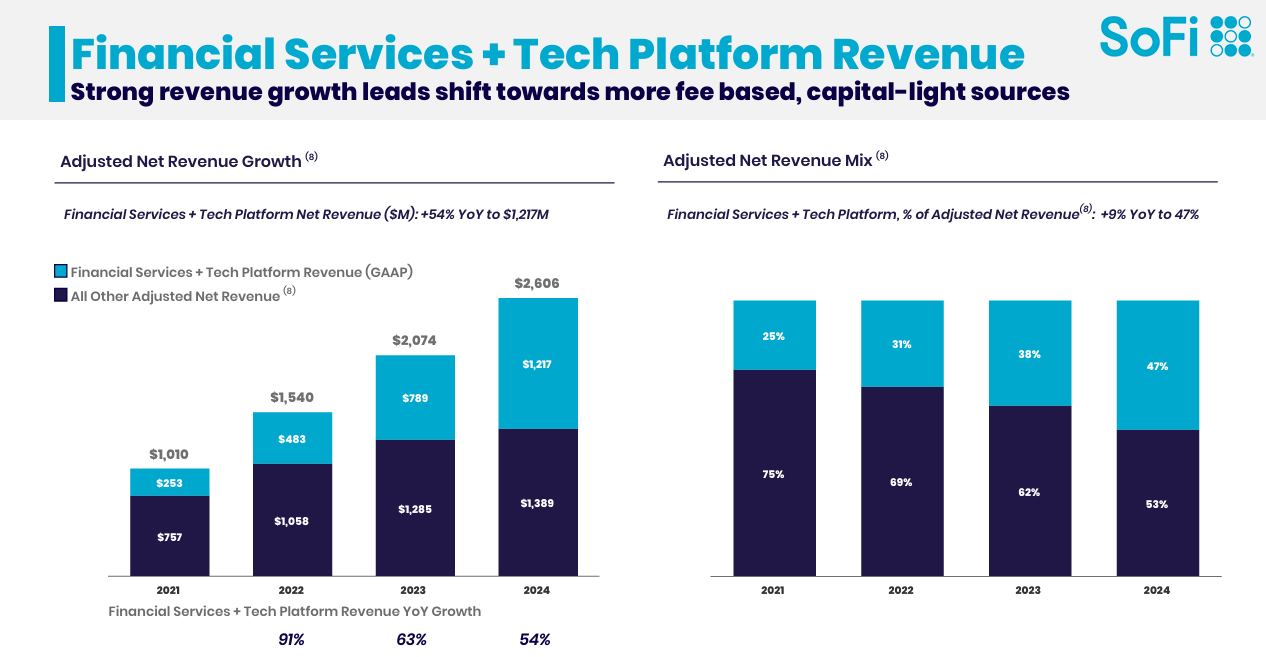

This slide shows SOFI’s transformation as it pivots toward smarter, more sustainable revenue streams. In 2024, the company saw its Financial Services and Tech Platform revenue surge by 54% YoY to hit $1.217B—a massive leap from just $253M in 2021. I think we are forgetting again, how effective Mr. Noto has been at scaling this business. Also, total adj. net revenue climbed to $2.606B, with Financial Services/Tech Platform now playing a bigger role than ever.

What’s exciting here is the shift in how SOFI makes its money. These capital-light, fee-based revenue sources now make up 47% of the company’s total revenue, a big jump from just 25% back in 2021. This means they are moving away from the more traditional (and riskier) lending-heavy model. Instead, they’re building a business that thrives on innovation, scalability, and diversified offerings. It’s not just growth—it’s strategic growth.

For investors, this is a clear signal: SOFI isn’t just chasing numbers; they’re building a sustainable, future-proof business. By leaning into its Financial Services/Tech Platform, the company is not only reducing risk but also creating a well-balanced revenue mix that’s built to last. It’s a smart move, and it shows they’re playing the long game.

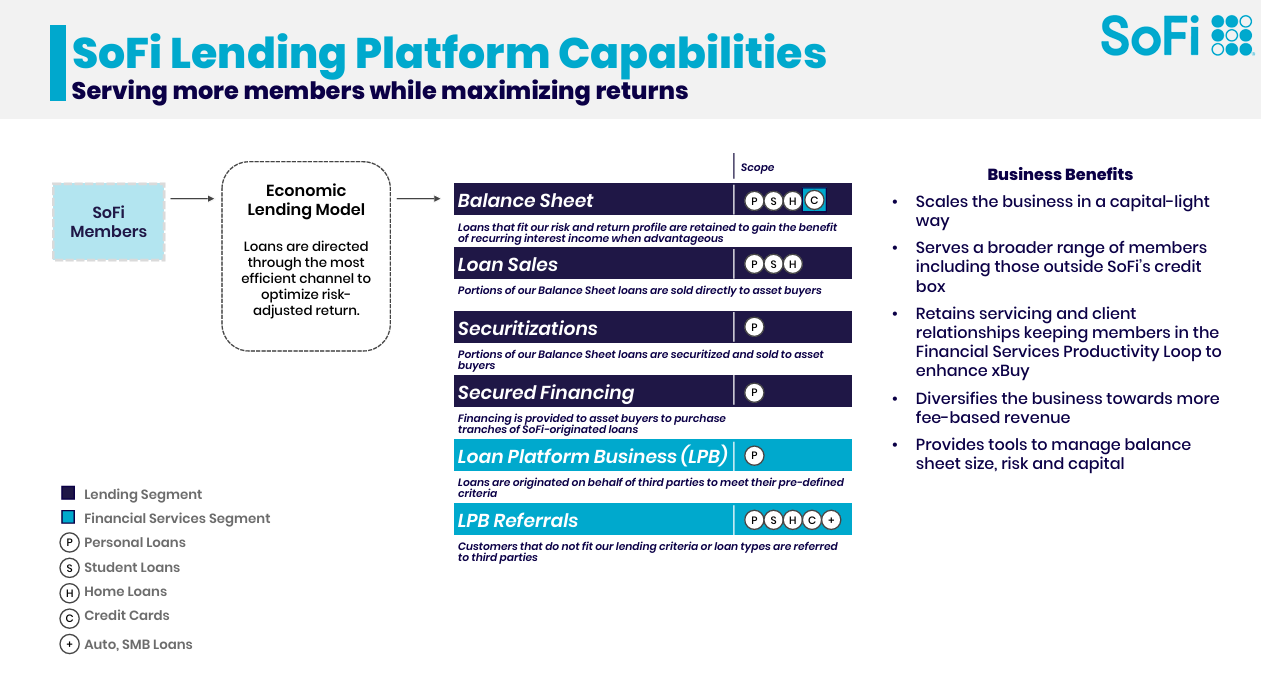

SOFI is also becoming more smart, efficient, and people-focused on innovation. This comes from its core, their economic lending model, which ensures every loan is channeled through the most effective strategy to balance risk/maximize returns. It’s not a one-size-fits-all approach—far from it. Some loans are kept on their balance sheet because they’re a perfect fit, providing steady, recurring interest income. Others are sold directly to buyers, creating liquidity and freeing up resources. Then there’s securitization, where loans are bundled and sold to spread out risk and boost revenue. They’ve even got secured financing, where SOFI helps buyers fund their purchases of these loans, making it a win-win for everyone.

What’s particularly exciting is how they expand their reach. Through their Loan Platform Business (LPB), SOFI originates loans on behalf of third parties, enabling them to serve members who might not fit their traditional criteria. And for those who aren’t eligible, SOFI doesn’t turn them away—they connect them with trusted partners through referrals. It’s a platform built to ensure everyone gets the help they need.

This is a smart business. They are scaling their operations in a capital-light way, relying on fee-based revenue rather than heavy investments. They’re also broadening their reach, serving a wider range of members while keeping their existing clients engaged through strong relationships and ongoing servicing. By diversifying their revenue streams and managing their balance sheet with precision, again, they are building a sustainable, forward-thinking business model.

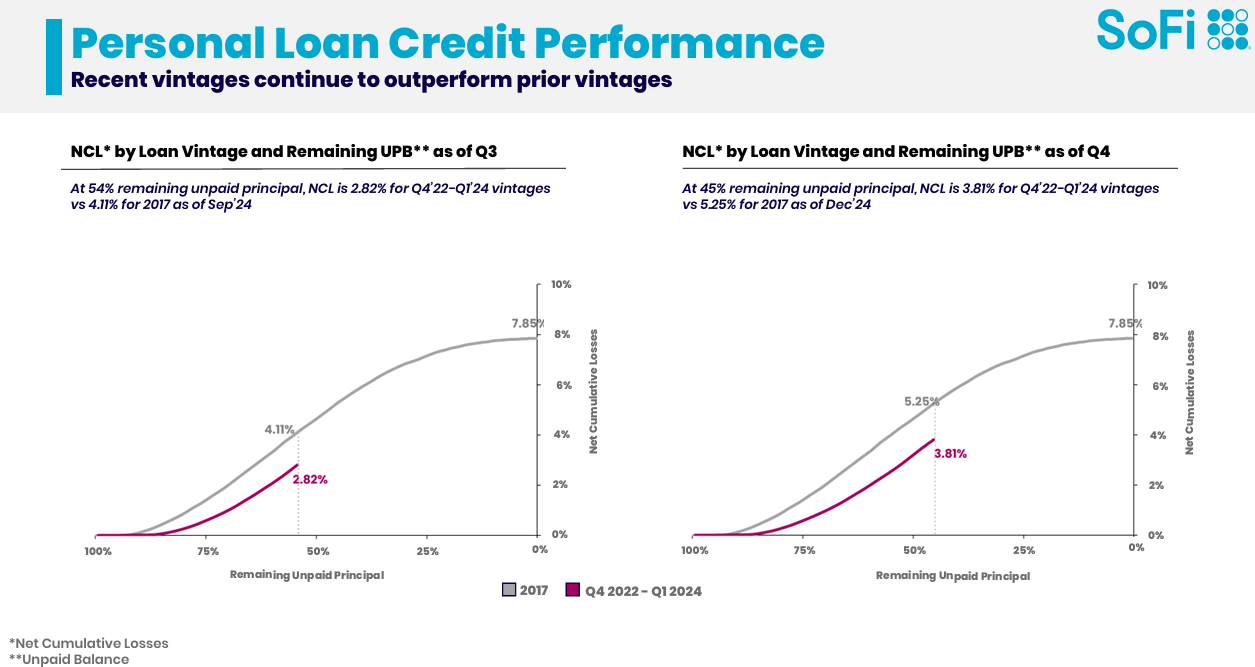

To SOFI’s lending strategy, they have come a long way. This shows their recent personal loan vintages clearly outperforming older ones. It’s a testament to how the company is getting smarter and more efficient in managing credit risk. When you compare loans issued in 2017 to those issued between Q4 2022 and Q1 2024, the difference is notable. By Q3 2024, the newer loans had a net cumulative loss (NCL) of just 2.82%, while the 2017 loans were at 4.11% at the same point in their lifecycle. Fast forward to Q4 2024, and the gap grows even wider—recent loans showed a 3.81% NCL with 45% of unpaid principal remaining, compared to 5.25% for the 2017 cohort.

This isn’t just about better numbers here; it’s about their ability to adapt and improve. The lower losses on their newer loans show they’ve seriously stepped up their game when it comes to underwriting and risk management. It’s clear they’ve fine-tuned their credit evaluation process, and the results are paying off. These improvements mean they are taking on less risk while continuing to grow its loan portfolio—a win for both the company and its investors.

Now, to those shaky bulls and relentless bears (this is what makes investing fun), you’re going to see a lot of wobbly investors freaking out over this earnings release simply because the stock dropped. That kind of reaction shows they can’t separate their emotions from the market—sure, it’s tough, but learning to do so is key to success. They’ll complain about management and guidance, but they’re overlooking the bigger picture of how the business has performed over the last five (or decade) years. Unfortunately, markets can be irrational, and that’s exactly what I believe is happening with SOFI right now. It’s as if the market is shouting, “Screw business performance and healthy growth, we want good guidance!” and using that as an excuse to sell off (sarcasm). See below.

For the full year, the company expects adjusted net revenue to hit between $3.2B and $3.275B, this is 23-26% growth from last year’s $2.606B (at these levels, is this something to really be upset about?). Adj. EBITDA is projected to land in the range of $845M to $865M, maintaining a healthy 26% margin. Net income is expected to fall between $285M and $305M, with an implied margin of 9%, while diluted EPS is forecasted to grow to $0.25 to $0.27. On top of that, they plan to see tangible book value growth of $550M to $575M.

For Q1 2025, adj. net revenue of $725M to $745M, up 25-28% from Q1 2024. Adjusted EBITDA is expected to reach $175M to $185M, with net income projected at $30M to $40M and diluted EPS of $0.03. So, they are aiming to add at least 2.8M new members in 2025, which would represent a 28% increase over last year (this is bad, apparently!). They’re sticking to their game plan of maintaining a 30% incremental EBITDA margin, which aligns with their long-term vision for growth. Even more impressively, they expect a 20% net income margin, excluding one-time benefits like tax credits.

What’s Wall Street’s and the shaky bulls’ response? (Doghouse.) Historically, SOFI has been known for being conservative with guidance and then revising it upward as the year goes on, so I’m not sure why anyone’s surprised—this should be expected. Personally, I’d prefer a management team that underpromises and overdelivers (paired with excellent execution) rather than one that touts guidance and then fails to meet it. If SOFI’s history is any indicator, they’ll likely meet and surpass expectations (with revisions) as the year progresses. Eventually, the market will have to give SOFI the credit it deserves. Unfortunately, as I mentioned, markets can be irrational, and I think today’s sell-off shows that. What you’ll start seeing from some bulls with shaky conviction is them trashing the guidance (when they should probably trust the company’s track record).

When we look at the pessimism on the bear front now, we have the ole net cumulative losses narrative which apparently bears can’t read between the lines. See below.

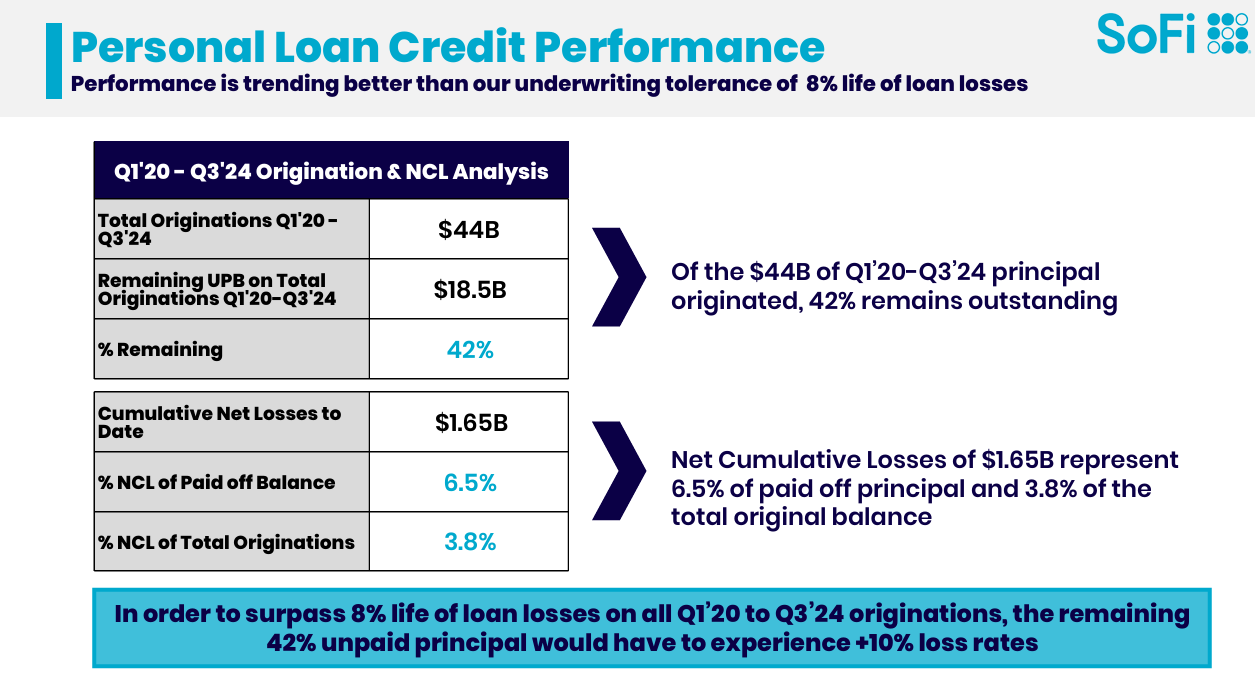

This slide shows how SOFI is managing its personal loan portfolio, keeping losses far below its tolerance of 8% life-of-loan losses. Since Q1 2020, they have originated a whopping $44B in personal loans, and 42% of that ($18.5B) is still outstanding. Of the loans that have been paid off, cumulative net losses stand at just 6.5%, and when you look at the total originated balance, losses come in at a mere 3.8%. These numbers don’t show how bad SOFI’s credit performance is, it’s quite the opposite.

This is absolutely normal for banks/financial institutions to experience unpaid cumulative net losses in their loan portfolios, and there are good reasons why this happens. Lending, by its very nature, carries risk. When a bank issues loans, there’s always the chance that some borrowers will fail to repay, resulting in net losses. But this isn’t a bad thing—it’s a calculated risk that banks manage carefully. They assess each borrower’s creditworthiness and set loan terms, like interest rates, to offset the expected losses while still making a profit overall.

Banks also plan for these losses with tools like loan loss reserves, which act as a safety net. SOFI’s 8% life-of-loan loss tolerance is a perfect example of how they account for potential defaults. Essentially, they’ve built a cushion into their model, knowing that some losses are inevitable. As long as those losses stay below their tolerance threshold, the loan portfolio remains healthy and profitable.

Even with these losses, loans are a major revenue generator for banks. Interest payments, fees, and other income from performing loans typically far outweigh the losses, making lending a highly profitable business if managed well. And let’s not forget, even the best-performing loan portfolios have some level of losses. For high-quality loans like mortgages, a 1–3% loss rate is common. Riskier products, like personal or subprime loans, naturally see higher losses but are priced accordingly with higher interest rates to compensate.

There you go bears. The losses are not just expected—they’re built into the model. What matters is keeping them under control and within planned thresholds, as they are doing with its 8% tolerance. In fact, their performance is better than expected, showing they’re not only meeting their targets but outperforming them. This is a clear sign of strong risk management and profitability, and it’s reassuring for both the company and its investors. This is not a weight on SOFI’s back. Banks aren’t perfect, but they don’t need to be; they just need to be prepared—and that is what they are doing.

I plan to hold onto my shares as long as the company keeps delivering on its strategy and execution. Sure, the market might get a bit rocky in the short term, especially with sentiment-driven reactions like DeepSeek’s take on AI (which I honestly find pretty shortsighted). If only I had a crystal ball to predict how things will play out!

That said, if SOFI’s stock keeps heading downward after their earnings release, it might shape up to be a really compelling buying opportunity. The company’s fundamentals and long-term potential make it worth considering adding more shares during any dips. For now, my focus remains on the company’s execution—if they stick to their plan and keep performing, I’ll stay the course.