SoFi Surges Nearly 20% After Q4 Earnings

Taking a Look at SoFi Technologies (SOFI) Q4 2023 Earnings Report.

This Newsletter is Powered by Savvy Trader!

I'm thrilled to share that I've decided to fully commit and partner with the Savvy Trader team. My portfolio will now be monitored in real-time, showcasing performance, buying, and selling activities. Additionally, members will have the unique opportunity to directly chat with me about any positions in my portfolio at their convenience.

Become a member below through my referral link:

If there are issues with the link, just search “Steve Wagner | Invest” through the Savvy Trader platform.

First-Ever GAAP Profit Delivered by SoFi

SoFi Technologies (SOFI) shares grew nearly 20% on Monday, following the company's impressive performance in its Q4 2023 report, where it handily beat expectations. Although shares increased significantly on Monday, the stock price has now taken a beating, eclipsing $7/$8 per share as of this writing. The banking and fintech company reported its first-ever GAAP net profit, a significant milestone.

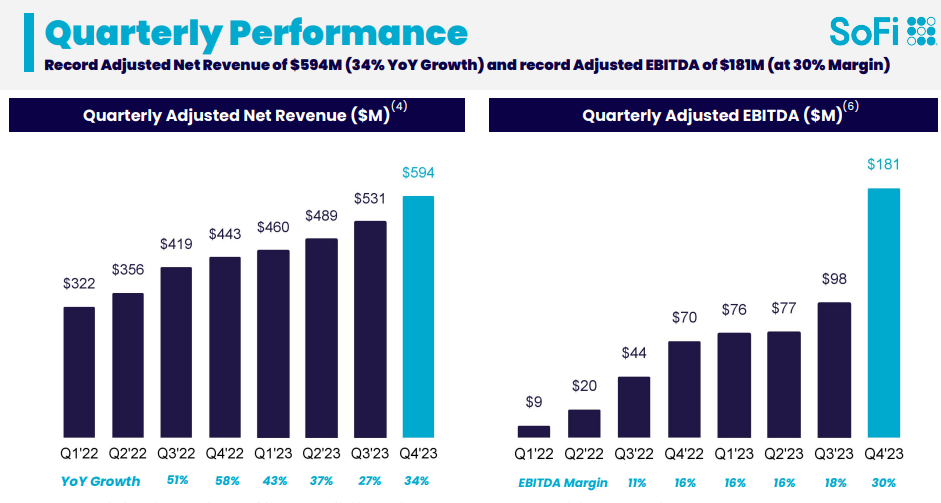

Revenue Growth: The 35% YoY growth in GAAP Net Revenue to $615M and a 34% increase in Adjusted Net Revenue to $594M signifies an expansion in the company's revenue streams. This growth was primarily driven by an increase in customer base, expansion of service offerings, & improvements in existing services.

Profitability: Achieving a record Adjusted EBITDA of $181M (159% increase YoY) and a positive GAAP Net Income of $48M indicates significant operational efficiency and effective cost management. This is a major inflection point for the company.

Member and Product Growth: The growth in total members (up 44% to 7.5M) and total products (up 41% to over 11.1M) highlights the company's successful marketing and customer retention strategies (often overlooked, in my opinion). This points to a strong appeal of SOFI's products and services to its user base.

Segment Performance: The growth in both Lending and Non-Lending segments is part of their diversified and balanced growth strategy. The substantial contribution of the Non-Lending segments to adjusted net revenue suggests a successful expansion beyond traditional lending services (awesome!).

Deposits and Book Value: The increase in total deposits to $18.6B and the tangible book value rise of $204M for the quarter reflect strong customer trust and financial solidity. This points to a robust capital position and asset growth.

Outlook: The guidance for 2024 and the longer-term outlook provided by management highlights confidence in continued revenue growth and margin expansion. Over time, as SOFI continues to execute QoQ/YoY, they will eventually become more liquid enhancing capital appreciation.

My Take

SOFI's Q4 was excellent. They witnessed a remarkable 35% YoY growth in adjusted (non-GAAP) revenue, reaching $594M. This translated to adjusted earnings of $0.04 per share. More notably, the company achieved a positive consolidated GAAP net income of $48M, or $0.02 per share, for the first time ever. These figures surpassed analysts' expectations, who had predicted a break-even quarter with lower revenue of $571.7M. They also added nearly 585,000 new members in the quarter, increasing its total membership to over 7.5M, a 44% increase from the previous year. Additionally, the quarter saw a deposit growth of $2.9B, bringing the year's total to $18.6B.

CEO Anthony Noto highlighted that this growth in high-quality deposits led to a lower cost of funding for SOFI's loans. He also pointed out, "Record revenue at the company level was driven by record revenue across all three of our business segments." Notably, 40% of the adjusted net revenue came from the non-Lending segments (Technology Platform and Financial Services).

Looking forward, the company has set ambitious targets for 2024. The company expects an adjusted EBITDA margin of 30% by year-end, translating to $580M to $590M. This assumes that revenue from its Tech Platform and Financial Services segments will collectively represent about half of its top line. Moreover, SOFI anticipates full-year GAAP net income to range between $95M and $105M, or $0.07 to $0.08 per share. Beyond 2024, management is aiming for a compound annual revenue growth of 20% to 25% from 2023 through 2026. This projection is based on the current macroeconomic environment and does not factor in significant new business launches or acquisitions. SOFI’s recent financial results represent a clear 'beat and raise' scenario, leaving little room for skepticism.

The stock price of SOFI experienced a dramatic surge following the release of their earnings report on Monday morning, soaring as much as 20% in a single trading day. This initial burst of investor enthusiasm, however, was short-lived. As the week progressed, the stock faced significant selling pressure, primarily due to a series of downgrades and reiterated price targets from institutional analysts (meaningless). A consensus seems to be forming among both bullish and bearish investors: the current market dynamics around SOFI’s stock might be influenced by market manipulation (I agree). At present, financial institutions perceive SOFI as a potential disruptor/threat in the sector. However, there's a growing sentiment that as SOFI continues to escalate its performance, these institutions will no longer be able to overlook its potential. One of the key issues at play is liquidity. Currently, institutional investors are holding back from significant involvement with SOFI's stock, given the company just recorded its first ever GAAP profit. Yet, the expectation is that this will change in the near future. As the company solidifies its standing and demonstrates sustained high-level performance, it's anticipated that these institutions will inevitably begin to engage more actively, providing the much-needed liquidity to the stock. My personal conviction remains strong with this business, I plan on adding to my position.