Tesla Misses Expectations, But the Future is Bright

Taking a Look at Tesla's (TSLA) Q4 & Full-Year Results.

Where is Tesla Heading?

Tesla (TSLA) reported their Q4 2024/full-year earnings after-hours today. The company missed expectations on both revenue and earnings per share (EPS) in its Q4 2024 report. The company reported $25.71B in revenue, falling short of the $27.22B analysts expected, and EPS of $0.73, missing the $0.77 forecast. The shortfall was driven by weaker vehicle deliveries, price cuts, and shrinking profit margins, which put pressure on earnings, which I’ll explain below. But if you take a closer look at the report, you’ll see it’s not actually that bad of a quarter. They are making significant investments and improvements that give it a head start on where society is heading—the next stage of human productivity, if you will. Many fail to see this.

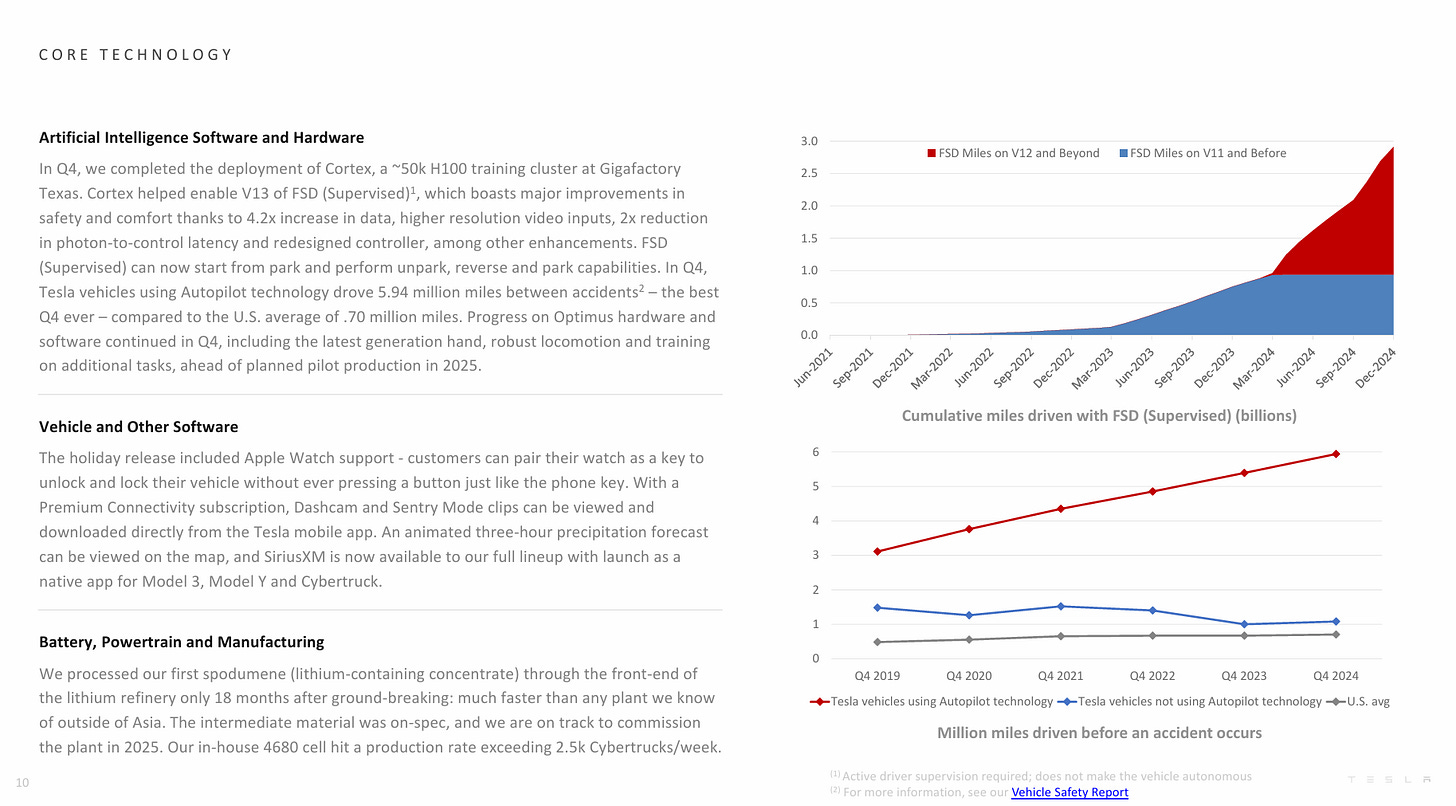

Tesla nailed its energy storage deployment targets, showing strong growth in what’s quickly becoming a standout segment for the company. Its Full Self-Driving (FSD) software revenue also stayed quite strong, further cementing their lead in autonomous tech—so far ahead that mentioning any “competition” feels irrelevant (stop with the Waymo). On top of that, FSD just passed 3 billion miles, which is an incredible milestone in its own right. The real hidden gem here lies in Tesla’s mountain of FSD data, which—when paired with plans for Robotaxi services and a ride-hailing app—will be a game-changer once society catches up to the idea of self-driving fleets. Elon Musk readily admits he’s not always spot-on with product timelines, but it’s still worth highlighting that Tesla plans to deploy its robotaxi services later this year in select U.S. regions. Meanwhile, the new “Cybercab” is slated to begin production in 2026. Meanwhile, they also continue to pour resources into AI for its internal operations, laying the groundwork for even bigger innovations. With all that in mind, let’s look at the Q4 and full-year numbers.

Tesla Q4 2024 & Full Year 2024 Earnings Report

Key Financial Highlights (Q4 2024)

Revenue: $25.71B (YoY increase of 2%)

Automotive revenue: $19.8B (-8% YoY)

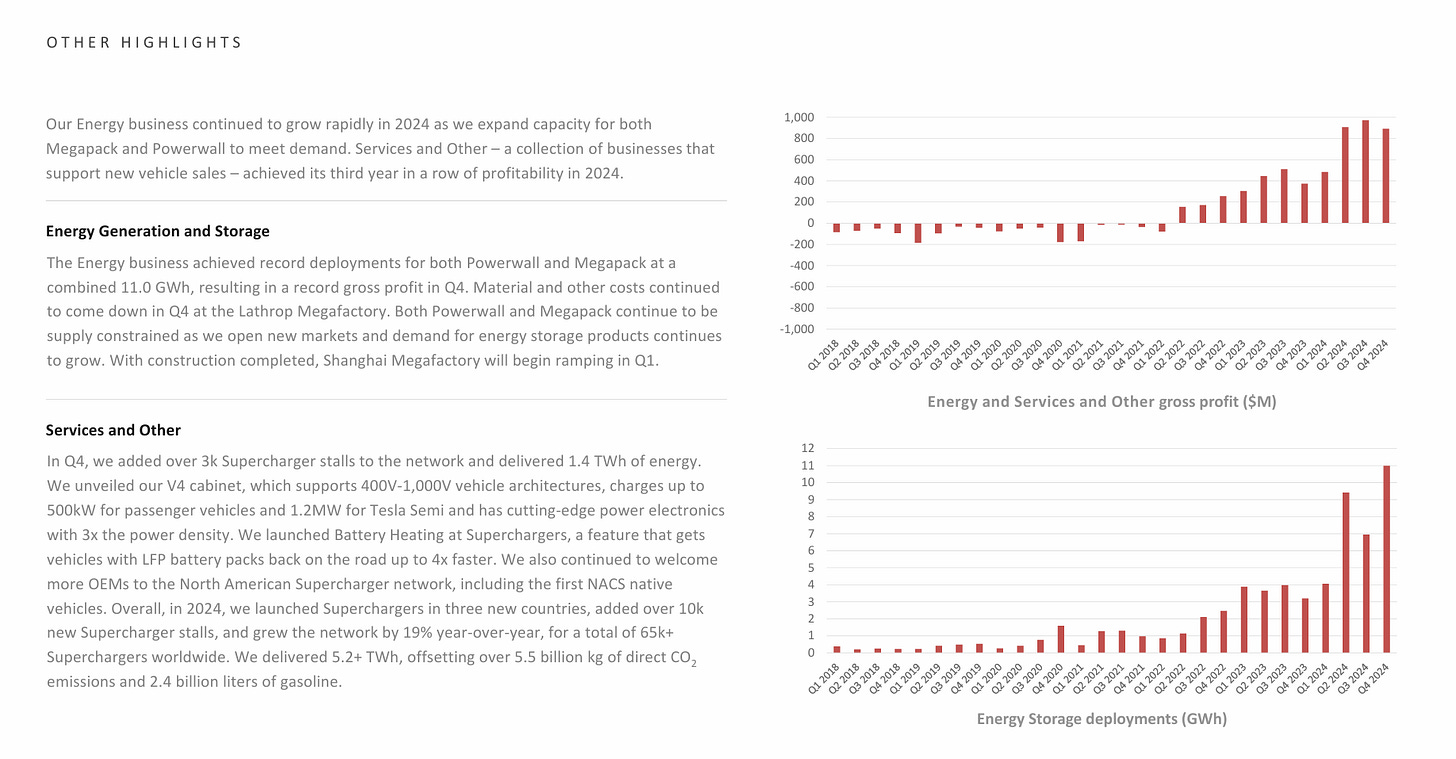

Energy generation & storage revenue: $3.06B (+113% YoY)

Services & other revenue: $2.85B (+31% YoY)

Earnings Per Share (EPS) (Non-GAAP): $0.73 (missed expectations of $0.77)

GAAP Net Income: $2.3B

Operating Income: $1.6B (-23% YoY)

Operating Margin: 6.2% (-204 bps YoY)

Free Cash Flow: $2B

Cash & Investments: $36.6B (+$7.5B YoY, very nice!)

Full Year 2024 Results

Total Revenue: $97.69B (+1% YoY)

Total Deliveries: 1,789,226 vehicles (-1% YoY)

GAAP Net Income: $7.09 B (-53% YoY)

Free Cash Flow: $3.58B (-18% YoY)

Operating Margin: 7.2% (-194 bps YoY)

R&D Spending: Increased due to AI, vehicle autonomy, and new product development

Operational & Business Highlights

Vehicle Production & Deliveries

Q4 deliveries: 495,570 vehicles (+2% YoY)

Model 3/Y production: 436,718 units (-8% YoY)

Cybertruck production ramping with initial deliveries underway

Global vehicle inventory days of supply: 12 days (-20% YoY)

Pricing & Margins

Lower Average Selling Price (ASP) due to price cuts, financing incentives, and model mix changes

COGS per vehicle reached a record low of <$35,000, helped by raw material cost improvements

Regulatory credit revenue increased but was not enough to offset price reductions

Energy Storage Business

Record deployments of 11.0 GWh in Q4, leading to the highest-ever quarterly gross profit in this segment

Megafactory Shanghai construction completed, ramping up production in Q1 2025

Full Self-Driving (FSD) & AI

Over 3 billion miles driven cumulatively on FSD (Supervised)

Cortex AI training compute increased 400% in 2024

Version 13 of FSD (Supervised) deployed with major safety & performance improvements

Outlook for 2025

Robotaxi Business Launch in 2025

Tesla expects to begin launching its Robotaxi service in parts of the U.S. later this year

Full Self-Driving (Supervised) rollout will continue, with plans to expand into Europe & China

Cybercab (Tesla’s dedicated Robotaxi vehicle) is in development with volume production scheduled for 2026

New Vehicles & Product Roadmap

More affordable models launching in 2025

Vehicles will leverage Tesla’s next-generation manufacturing platform for cost efficiency

Cybertruck ramp-up continuing, with expectations for eligibility for IRA tax credits

Profitability & Cash Flow

Tesla expects energy storage deployments to grow at least 50% YoY in 2025

Company plans to optimize costs while investing in AI, autonomy, and new vehicles

Strong balance sheet ensures funding for product expansion and manufacturing growth

My Take

Depending on what lens you are using, this quarter was not bad but exciting. Yes, there’s constant pessimism swirling around Tesla and Musk, and we’ll see plenty of mainstream/social media criticism for reasons I’ll touch on shortly. But honestly, most of that is just noise. Investors should keep their eyes on the business and where Tesla is headed. That’s easier for those who can think beyond the here and now—anyone stuck on the present headlines alone might miss the bigger picture. They are paving the road to the next stage of human productivity. A lot of people can’t see that yet, but make no mistake—it’s already happening, even if we’re still in the early innings. If you can recognize that, this quarter’s results look a whole lot more promising than the doubters would have you believe.

I hear the concerns—Tesla’s deliveries weren’t as strong as expected, price cuts have squeezed margins, some folks worry that production isn’t growing as fast as anticipated, etc. But let’s pause and take a broader view. The notion that Tesla is suffering from weak demand is simply off-base. Affordability is a challenge across the entire auto industry right now, especially with higher interest rates hiking up car payments. Like mentioned in the past numerous times too, they adjusted prices to keep sales volume strong and capture more market share. And despite those price cuts, they still managed to deliver nearly half a million vehicles in Q4.

Let’s also address profitability. Critics might claim Tesla is overspending but is actually investing in the future of society. Sure, AI, energy storage, and next-gen manufacturing incur big costs up front, but these investments are what is fueling part of Tesla’s long-term strategy. In 2024 alone, they ramped up AI training compute by 400%—not just an expense, but a launchpad for FSD, autonomy, and the Robotaxi business. This is how Tesla evolves from just “selling cars” to selling software, energy solutions, and AI-driven services.

Their cash and investments soared to $36.6B by the end of Q4, marking a $7.5B jump from the previous year. The company pulled in $3.6B in free cash flow for FY24, with $2B coming in Q4 alone. Even after splashing out on AI, new vehicle production, and energy storage, operating cash flow remained solid at $14.9B for the year—$4.8B of which came in Q4. A $600M mark-to-market gain on digital assets also added to Tesla’s financial cushion. The operational efficiencies helped fuel these gains too. They trimmed vehicle supply days to just 12 (down 20% YoY), speeding up sales and improving cash flow. The cost of goods sold per vehicle hit a record low of under $35K, which kept margins healthy, while higher regulatory credit revenue and record energy storage profits further boosted liquidity.

On production, a slight dip doesn’t spell doom—it’s part of a deliberate approach. They are gearing up for new models, Cybertruck ramp-up, and upgrades to its manufacturing processes. In the meantime, the company is operating more efficiently than ever, with cost of goods sold per vehicle hitting an all-time low of under $35K in Q4, like shown/mentioned above. That points to progress, not trouble.

Another topic people love to bring up is regulatory credits. This actually helps Tesla, because they are already profitable without them. And as competitors inch closer, Tesla’s energy division is stepping up fast. Energy storage deployments jumped 244% Yoy in Q4, delivering record profits. We have to stop referring them to as a just car company; it’s a technology and energy powerhouse with multiple revenue streams.

Then there’s the so-called competition. Every year, rumors swirl that Tesla is losing ground, yet every year they remain on top. The Model Y was the world’s best-selling vehicle in 2024—outperforming not just electric cars, but every car on the road. Meanwhile, companies like Rivian and Lucid are still trying to scale production and find profitability (which by the way, reg credits will hurt most with these names). Meanwhile, Tesla’s Robotaxi service is set to roll out later this year, and more affordable models are slated for 2025. This isn’t a company in retreat; it’s expanding its reach.

Yes, margins are tighter and changes are happening, but these aren’t signs of weakness. They’re calculated moves to position for sustained growth. Price adjustments boost market share, AI investments pave the road for future profits, and production shifts lay the groundwork for the next phase. While some obsess over short-term metrics, Tesla keeps playing the long game—and so far, it’s winning.

Like I mentioned earlier, it’s tough to see what Tesla is really up to if you’re fixated on the here and now. The real story lives in the future, and they are far ahead of the pack in FSD, already logging more than 3 billion miles and counting.

That market alone could push Tesla’s valuation to absurd levels if they capture the share they’re aiming for. Sure, it’s nearly impossible to pin down an exact figure for the FSD space—especially once you factor in “cybercab” and other robo services—but there’s no denying it’s massive. Adding in the energy segment, which is still very young but growing fast, pushing out innovative new vehicle models, and securing a hefty cash reserve, all of that points to a company that’s in solid shape in the interim. Yes, the journey might be bumpy in the short term, but for investors who can think long-term, Tesla’s next phase of growth could be incredibly rewarding.