The Power of Compounding Dividends: A Long-Term Investor's Best Friend

Compounding Dividends, Company News, & Weekly Activity

Compounding Dividends is a Powerful Force

When it comes to investing, the power of compound interest is often touted as one of the greatest tools in an investor's arsenal. But what about the power of compounding dividends?

What makes dividends so powerful is the compounding effect they have, especially with your dividend growth stocks. When an investor reinvests their dividends back into the same stock, they are essentially buying more shares, which in turn generates even more dividends. Over time, this compounding effect can result in a significant increase in wealth.

Let me try to give you a simple example, imagine an investor buys 100 shares of a stock that pays a 3% dividend yield. In the first year, they would receive $3 per share in dividends, for a total of $300. If they reinvested those dividends back into the same stock and the stock price remained constant, they would now own 103 shares. In the second year, they would receive $3.09 per share in dividends, for a total of $318.27. If they continued to reinvest their dividends, by year 10, they would own 139 shares and receive $4.22 per share in dividends, for a total of $586.58. And that's assuming the dividend yield remained constant… in reality, many companies increase their dividends over time & produce capital appreciation, which only adds to the compounding effect. And of course, this only shows a one-time investment, it assumes the investor didn’t consistently invest more capital.

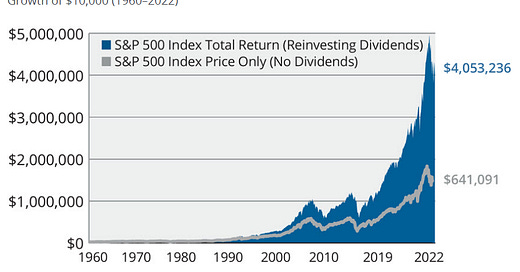

Now let’s look at a visual representation of compounding dividends with the S&P 500, when going back to 1960, 69% of the total return of the S&P Index can be attributed to reinvested dividends and the power of compounding. Take a look at the illustration below:

This is the growth of $10K from 1960-2022, dividends have played a significant role in the returns investors have received during the past 50 years.

The power of compounding dividends is not limited to just one stock/stocks, like just shown above with the S&P 500. Many investors choose to invest in dividend-paying mutual funds or exchange-traded funds (ETFs), which provide diversification and potentially even higher dividend yields. In fact, some dividend-focused ETFs have yielded an average annual return of over 10% over the past 10 years, significantly outperforming the broader market (ex: SCHD).

With that said, the real magic of compounding dividends is its ability to generate wealth over the long-term. While the examples above may seem small in the grand scheme of things, over several decades, the compounding effect can result in a substantial increase in an investor's wealth.

So, what does this mean for investors? Simply put, the power of compounding dividends is a long-term investor's best friend. By investing in high-quality dividend-paying stocks or funds, and reinvesting those dividends back into the same investment, investors can harness the power of compounding to potentially grow their wealth significantly. As the legendary investor Warren Buffett once said, "Our favorite holding period is forever." With the power of compounding dividends on their side, long-term investors may just achieve that “forever” holding period with ease.

Company News & Weekly Activity (April 24th-28th)

Keep reading with a 7-day free trial

Subscribe to Steve Wagner | Invest to keep reading this post and get 7 days of free access to the full post archives.