The Stock Market, Rigged in the Long-Term Investors Favor?

Stock Market History, Understanding Long-Term Investing, & Investor Psychology.

Stock Market 101

Whenever we hear someone say “the market”, we often look no further than the Standard & Poor’s 500 Index (S&P 500). The reason being is because this Index serves as the benchmark for determining the state of the overall United States economy. Some will argue that the Dow Jones Industrial Average (DJIA) should be used to determine the economic health of the U.S., but that index is flawed for only containing 30 companies & is limited in the sectors it represents. The S&P 500, however, contains 500 of the largest U.S. businesses weighted by market capitalization. This gives the index a much broader scope of the 11 GICS (Global Industry Classification Standard) sectors, which are: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Communication Services, Utilities, and Real Estate.

The S&P 500 actually contains 503 stocks, since other businesses in the Index have different classifications of their stock. Ex: Alphabet Class A (GOOGL) & Alphabet Class C (GOOG).

The S&P 500 Index was formed in 1957, but it actually dates back to the 1920s, becoming a composite index tracking 90 stocks in 1926. From the formal inception date, the Index has had an impressive performance. The average annualized return (AAR) since adopting 500 stocks into the index in 1957 through Dec. 31, 2021, is around 11.8%. That is a tough return to beat.

This Index has been investable through an array of Exchange-Traded Funds (ETFs) & Index Funds. Some of the more popular ETFs / Index Funds have been: Vanguard S&P 500 ETF (VOO), SPDR S&P 500 ETF (SPY), Vanguard 500 Index Fund Admiral (VFIAX).

What’s in it for the “Long-term” Investor?

Since the S&P 500’s inception in 1957, it has delivered an exceptional return of 11.8%. If you invested $100 in the S&P 500 at the beginning of 1960, you would have about $38,905.10 at the end of 2022, assuming you reinvested all dividends. This is a return on investment of 38,805.10%. Look, that’s an insane ROI… but in order to see these types of returns, an investor had to maintain a true long-term mindset.

Now, what exactly is a “long-term” investor? That’s a question in which the answer will be tailored to each individual & their financial plans, goals, age, etc. However, to me, it’s anyone that is investing for 10+ years down the road. Most will be turned off with this time-horizon, but when you are able to expand your timeframe over decades, your odds of success increase dramatically in the market. The S&P 500 serves as a perfect example for this, laying out the statistic above.

Let’s be honest though, this is easier said than done. What you don’t see within this, is the years of patience, discipline, stomaching volatility, & consistency; also, having the battle with instant gratification. Which, in my opinion, is the hardest part about being a true long-term investor… having to break the barrier in your mind to delay gratification for a greater result in the future.

I will be the first to tell you, long-term investing is not a sexy strategy. Matter of fact, it’s very boring but that’s what good investing is supposed to be like. When you transition into this long-term mindset, being able to think in decades, your overall odds of success will increase significantly. Most investors fail to see this because they are unable to see beyond the present.

Take it from some of the greatest investors…

"If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring." - George Soros

“The stock market is a device to transfer money from the impatient to the patient.” - Warren Buffett

Investor psychology is an amazing thing, most of us claim to be a long-term investor until the times get rough. The bear market of 2022 was a prime example of this, the market sentiment was so negative & volatility plagued portfolios, it made investors question their investment strategies & process.

You vs. The World

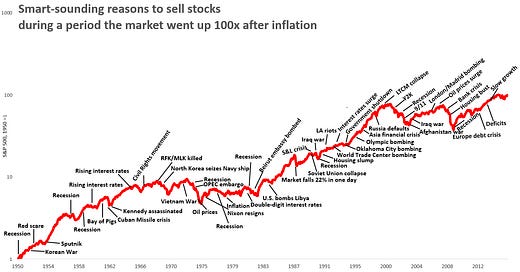

The key takeaway knowing the history of the S&P 500 Index, is that it serves as the benchmark for the overall U.S. economy. What’s hidden within the history of this Index is the longevity of its performance, despite the historical events that have taken place. There has always been a “smart-sounding” reason to sell and a “run for the hills” when the times got tough. Perma-Bears / Bears / Mainstream Media love to get off on this, they love to paint the most horrific panic-filled image. It’s simply just noise though. Don’t get me wrong… our society has gone through some serious historical events that impacted our economy, even the global economy, & it’s effected many lives. BUT, if you are able to see through this short-term noise, these happen to be some of the BEST times to invest for the long-term.

Here’s an illustration to get a better understanding of what I’m talking about:

What’s depicted here is the S&P 500 from 1950-2016, labeled with all the major historical events that have taken place. As you can see, you can make the conclusion that the U.S. market has always recovered & recovered to all-time highs from every correction, catastrophe, war, recession, depression, crash, & drawdown. But, the MSM & bears refuse to acknowledge these facts/data. The long-term investors that do, & take advantage of it, will be handsomely rewarded (assuming you are investing in quality).

“Be fearful when others are greedy, and greedy when others are fearful.” - Warren Buffett

“The real key to making money in stocks is not to get scared out of them.” - Peter Lynch

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” - Peter Lynch

Even with this data proving itself, bears & MSM will continue to bring up how “this time is different” or that we are heading into “uncharted waters”… this is all noise to the long-term investor. Yes, lots of these historical events were “different” or in “uncharted territory”, but the outcomes were ALWAYS the same… recovery & recovery to all-time highs.

These bears will even bring up how the opportunity lies in going all-cash, bonds, or even gold, especially in our current times with high inflation & interest rates. But again, the best place to deploy capital has always been within stocks. Stocks are one of the best hedges against inflation, & have outperformed bonds, cash, gold, & bills.

Here is an illustration to solidify this:

This illustration was put together by Jeremy Siegel who is a professor at the University of Pennsylvania, the senior investment strategy advisor to WisdomTree Investments and the author of the best-selling book, “Stocks for the Long Run” (Highly recommend reading this book). This graph shows the total real returns from each asset class between 1802-2013. As seen, there is no doubt stocks have been the top-performer, they even dominate fixed-income assets. Aside from that, they are excellent hedges against inflation.

By no means am I bashing these asset classes, they can be a great addition to diversify an investment portfolio. But, when we make the comparison over the long-term, investing in quality stocks is the better route.

The question you need to ask yourself is, do you have the patience & stomach to weather volatile times? If so, you already have 90% of what it takes to be a long-term investor, the other 10% is finding that quality investment. And sometimes that quality investment is right in front of us… *cough* S&P 500 *cough*

Sources: AAII.com, Fool.com, Investopedia.com, “Stocks for the Long Run” by Jeremy Siegal.