Why Lemonade is a Top 5 Position in My Portfolio

Checking in on Lemonade (LMND), Weekly Activity, & Portfolio Update.

This week marked a fantastic close to November, making it one of the best months for my portfolio in 2023. With recession fears subsiding, there's a growing sentiment that we might be seeing the future trajectory of interest rates, potentially on a downward trend. This shift is fostering more bullish market sentiments as we look towards 2024.

As the third quarter earnings season of 2023 concludes, we've now covered all the businesses in my portfolio, encompassing every company I currently hold. Moving forward, the focus will shift back to in-depth articles on my highest conviction stocks, weekly market trends, and strategies for long-term investing. Also, for the foreseeable future, every article you receive from me will be 100% FREE.

This week, I'm excited to dive into Lemonade (LMND). Long-time followers are familiar with my thesis and perspective on this company. For those new to my newsletter, I encourage you to explore my archived articles on LMND for a comprehensive understanding. Let's take a look!

“They Aren’t Even Profitable”

Tesla, Palantir, Uber, Apple, Amazon, Netflix – these industry giants, despite their current success, all share a common past: prolonged periods of operating at a loss, spanning quarters or even years. This aspect of their history often led to heavy criticism and doubt from skeptics, particularly those wary of their financial struggles. However, each of these companies eventually experienced a pivotal moment, almost a miraculous shift, to profitability. This turn of events greatly rewarded investors who had the foresight and conviction to trust in the companies' management and their strategic vision for the future. Enduring through relentless pessimism required not just faith but an iron stomach, demonstrating that being on the bullish side of the investment coin is not for the faint-hearted.

It's important to note, however, that not all companies achieve this critical inflection point of profitability. Many fail along the way, underscoring the inherent risks involved. A common hesitation among many investors is to engage with companies lacking earnings, a stance that is entirely rational given the increased risk profile. However, labeling such investment decisions as mere speculation is a point I disagree with, provided the company in question has a clear, strategic plan for reaching profitability, and its management has consistently demonstrated the ability to execute this plan. In my experience and research, the likelihood of success increases significantly for companies that combine a strong, strategic vision with effective leadership. This pattern is evident in the examples I initially listed.

Now, turning our attention to Lemonade (LMND). As many are aware, LMND is currently a start-up without earnings, but it's making waves in the insurance industry. Their mission? To transform and streamline how we engage with insurance, primarily through eliminating the friction traditionally experienced between insurance companies and consumers. LMND's approach, leveraging proprietary artificial intelligence, significantly expedites the claim submission and reimbursement process, often completing these tasks in mere seconds. While a specialized team is available for more complex claims, over 80% are settled instantaneously. This efficiency is at the heart of LMND's mission.

Recently, critics have pointed out that LMND's pricing aligns with that of traditional insurers in some areas. However, this critique misses the bigger picture. LMND's ultimate goal isn't necessarily to undercut competitors on price but to revolutionize the customer experience by removing the typical hassles associated with insurance. This vision, if realized, positions LMND as not just an industry disruptor but as a potential future leader in the insurance sector, following in the footsteps of those earlier mentioned companies that turned their early struggles into remarkable success stories.

Lemonade’s Journey to Sustained Profitability

A couple weeks ago, LMND announced their Q3 2023 earnings results. The company's revenue soared by 55% YoY to $114.5M, fueled by increased investment income and a 27% rise in gross earned premium, reaching $173.2M. The In-force premium (IFP) also saw an 18% jump, hitting $719M. Notably, the gross loss ratio improved by 11 percentage points to 83%, maintaining a steady gross loss ratio ex-CAT at 73%, comfortably below the targeted 75%. Customer growth is equally impressive, with the count reaching over 1.9M (actually just passed 2M), more than a 12% increase from the previous year. This rapid growth aligns with LMND’s announcement of surpassing the two-million-customer milestone early this month. Significantly, while the customer base doubled since late 2020, the premium per customer rose by roughly 70%, and operating expenses halved as a percentage of gross earned premium. These figures underscore LMND’s economies of scale and efficient business model, distinct from traditional insurance companies.

Regarding Metromile, LMND’s July 2022 acquisition, the integration had its challenges, particularly in gross loss ratios, exacerbated by slow rate-hike approvals and inflation-driven claims costs. However, this is set to improve with a recent 51% rate increase approval for its car insurance product in California, hinting at better loss ratios in future quarters.

Now, excitedly, LMND predicts turning cash-flow positive by late 2025, ahead of its previous 2027 target. This optimism is bolstered by the projection of having substantial unrestricted cash reserves, with adjusted EBITDA profitability anticipated in 2026. The company expects continued YoY improvement in adjusted EBITDA each quarter next year, even as it invests in growth and technology.

The Q3 2023 results present a strong case for continued optimism among Lemonade (LMND) investors. The company's progress towards sustained profitability is increasingly evident, reinforcing my decision to keep LMND as a top five position in my portfolio. My belief in the company's mission is coupled with a recognition that the window for significant investment returns is narrowing. Once LMND announces profitability, the opportunity for outsized gains may diminish. Currently, the high short interest reflects market skepticism, but as LMND continues to deliver solid quarters and moves closer to its profitability timeline, we can expect a shift in investor sentiment, making now a crucial time for those seeking substantial returns.

Weekly Activity (November 27th-December 1st)

Nothing.

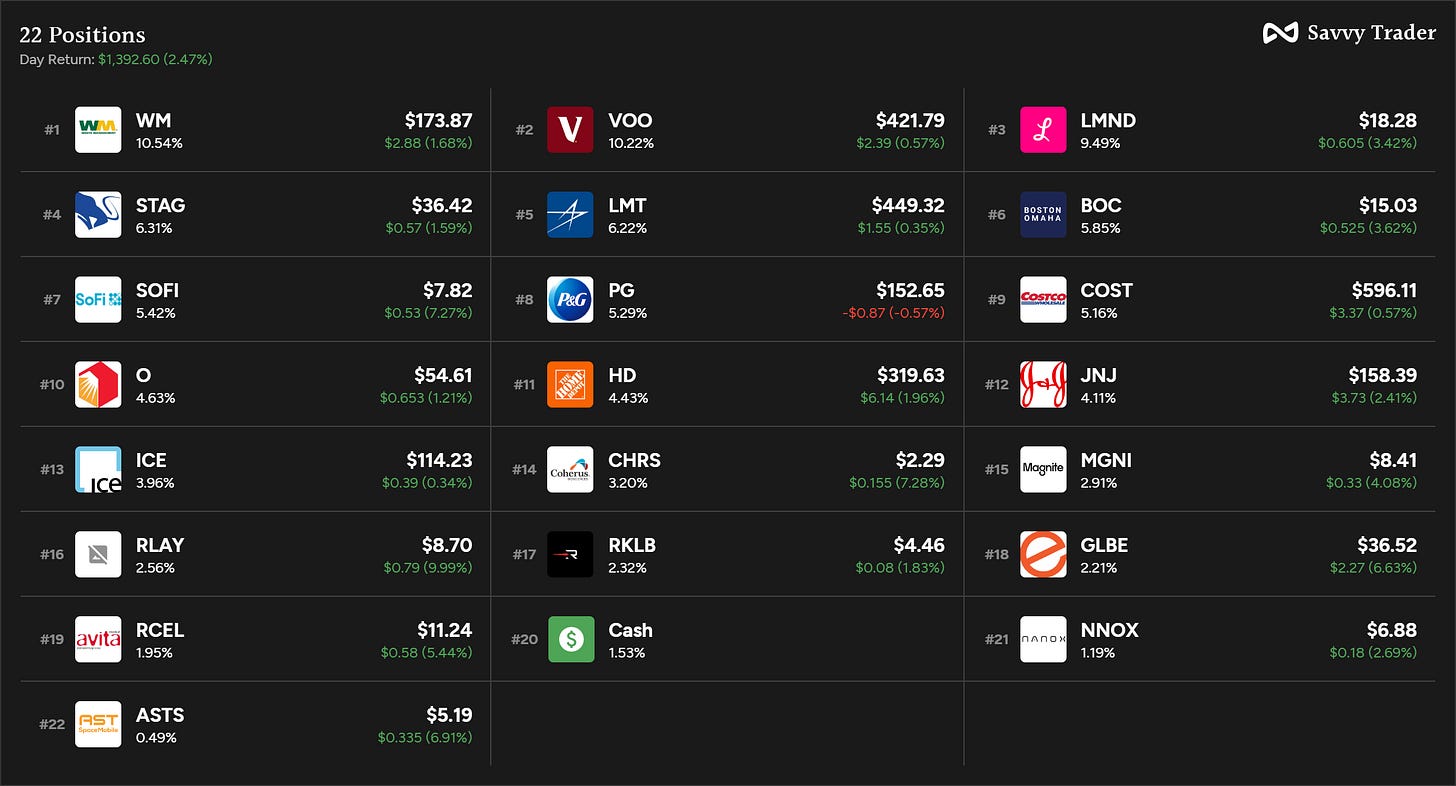

Portfolio Update

Last week I talked about PHGE (which is no longer a holding) and how BX004 could be a major catalyst upon a successful data readout… it was actually a dud. The company reported “positive” results, but when analyzed with placebo for the full timeframe, the placebo was actually performing better than BX004. Hence, the market’s reaction. I do have cash leftover; I plan to allocate those proceeds wherever I see opportunity.