Why You Should Stay the Course

Exploring Stock Market History, the Principles of Long-Term Investing, and the Impact of Investor Psychology.

I've transitioned to exclusively logging my weekly activity and tracking my portfolio in real-time on Savvy Trader.

For those not yet in the loop, I invite you to join me on this journey. Subscribe using the link below to gain direct insights:

By subscribing, you'll engage directly with me regarding specific companies, access my performance in real-time (with data starting under a year), and get detailed views of my investments, real-time trading actions, cash positions, and more. This move is driven by my commitment to transparency. I believe that sharing my analytical insights and the reasoning behind my investment choices offers immense value, empowering you with the information you need to make informed decisions.

The Market's True Benchmark

When people refer to “the market,” they are usually talking about the Standard & Poor’s 500 Index (S&P 500). The reason is simple: this index serves as the benchmark for measuring the overall state of the U.S. economy. Some argue that the Dow Jones Industrial Average (DJIA) should be the go-to index, but its limited scope—covering only 30 companies and a handful of sectors—makes it less comprehensive. In contrast, the S&P 500 includes 500 of the largest U.S. companies, weighted by market capitalization, offering a broader representation of the 11 GICS (Global Industry Classification Standard) sectors. These sectors include Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Communication Services, Utilities, and Real Estate.

In reality, the S&P 500 contains 503 stocks, as some companies, like Alphabet, have multiple classes of shares—such as Alphabet Class A (GOOGL) and Alphabet Class C (GOOG). The S&P 500, officially launched in 1957, traces its roots back to the 1920s, when it began tracking 90 stocks in 1926. Since adopting the 500-stock format, it has delivered impressive performance, with an average annualized return (AAR) of over 10% from 1957 through December 31, 2021. That’s a tough benchmark to beat.

Investors can gain exposure to the S&P 500 through a variety of Exchange-Traded Funds (ETFs) and Index Funds. Popular options include Vanguard S&P 500 ETF (VOO), SPDR S&P 500 ETF (SPY), and Vanguard 500 Index Fund Admiral (VFIAX).

The Long-Term Investor's Perspective

Since its inception, the S&P 500 has delivered an average return of 10.5% per year. To put that in perspective, if you had invested $100 in the S&P 500 at the beginning of 1960 and reinvested all dividends, at current, your investment would have grown to approximately $59,591.70—a return of 59,491.70%. That’s an extraordinary return, but it comes with a crucial requirement: a true long-term mindset.

What exactly is a “long-term” investor? The answer varies depending on personal financial goals, plans, and circumstances. However, for most, it means investing with a time horizon of at least 5 years and more. While many are deterred by this timeframe, those who can stretch their view over decades dramatically increase their chances of success. The S&P 500’s track record is a perfect example of this.

Of course, this is easier said than done. What’s not immediately visible are the years of patience, discipline, volatility, and consistency required to stay the course. And perhaps the hardest part of long-term investing is overcoming the instinct for instant gratification. In my opinion, this mental battle is the most challenging aspect of being a true long-term investor: breaking the barrier in your mind to delay gratification for a greater reward down the road.

I’ll be the first to admit, long-term investing isn’t glamorous. In fact, it’s often downright boring—but that’s what good investing is supposed to be. When you start thinking in terms of decades, your odds of success increase dramatically. Unfortunately, most investors can’t see beyond the present.

As some of the greatest investors have said:

“If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring.” - George Soros

“The stock market is a device to transfer money from the impatient to the patient.” - Warren Buffett

Investor psychology is fascinating—many claim to be long-term investors until the markets turn rough. The bear market of 2022 was a perfect example. Negative sentiment and volatility shook portfolios, making investors question their strategies and processes.

You vs. The World

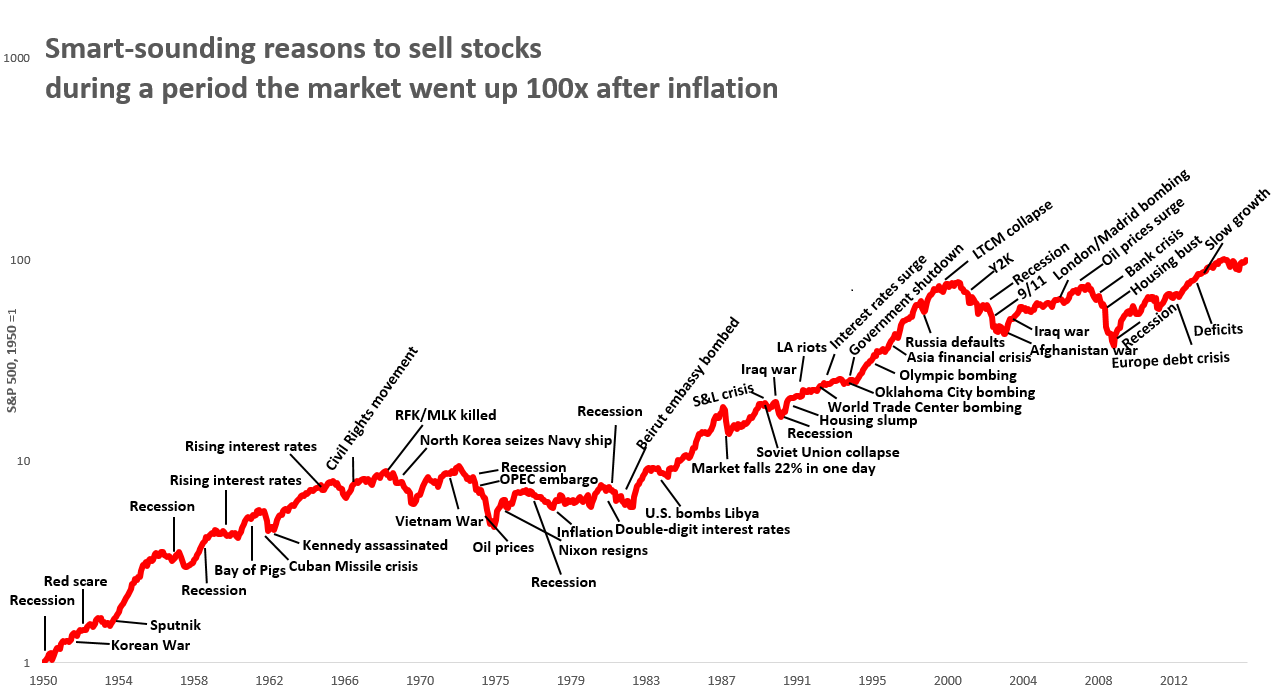

The key takeaway from the S&P 500’s history is that it serves as a reliable benchmark for the U.S. economy. What’s hidden within its long-term performance is how it has weathered countless historical events. There has always been a “smart-sounding” reason to sell and “run for the hills” during tough times. Perma-bears and the mainstream media thrive on this narrative, painting panic-filled pictures of doom. But for the true long-term investor, this noise is just that—noise.

Make no mistake, historical events have had real, sometimes devastating impacts on the economy and people’s lives. However, those able to look past the short-term noise often find the best opportunities to invest for the long-term.

Here’s an example illustrated by Morgan Housel:

The S&P 500 from 1950 to 2016 is littered with labels of major historical events—recessions, wars, crashes, and crises. Despite these disruptions, the U.S. market has always recovered, often reaching new all-time highs. Bears and the media frequently ignore this, but long-term investors who understand the data and act on it are rewarded handsomely, assuming they invest in quality companies.

“Be fearful when others are greedy, and greedy when others are fearful.” - Warren Buffett

“The real key to making money in stocks is not to get scared out of them.” - Peter Lynch

“Far more money has been lost by investors trying to anticipate corrections than has been lost in the corrections themselves.” - Peter Lynch

Even with all this historical evidence, bears and the media will insist “this time is different” or that we’re in “uncharted waters.” But to the long-term investor, these claims are just more noise. Yes, every historical event has been unique in some way, but the outcome has always been the same—recovery, and often to new all-time highs.

These same naysayers will argue that going all-cash, investing in bonds, or even buying gold is the way to go—especially in times of high inflation and rising interest rates. But once again, the best place to deploy capital has historically been in stocks. Stocks are one of the best hedges against inflation and have outperformed bonds, cash, gold, and other asset classes.

Here’s an illustration to solidify this:

The following graph, put together by Jeremy Siegel—professor at the University of Pennsylvania and author of the best-selling book Stocks for the Long Run—shows the total real returns from different asset classes between 1802 and 2013. Stocks have been the top performer, even dominating fixed-income assets and serving as excellent inflation hedges.

I’m not bashing other asset classes—they can be great for diversification. However, when you compare long-term returns, investing in quality stocks is the better option.

The key question you need to ask yourself is: Do you have the patience and the stomach to weather volatile times? If so, you already have 90% of what it takes to be a long-term investor. The other 10% is finding quality investments—and sometimes, that quality investment is right in front of you… cough S&P 500 cough.