Earnings Reports (Oct 30th-Nov 3rd)

Taking a Look at Earnings Reports for SoFi Technologies (SOFI), Lemonade (LMND), Intercontinental Exchange (ICE), & Relay Therapeutics (RLAY), Weekly Activity, & Portfolio Update.

This past week was big for my growth names, with significant earnings reports from two of my major holdings: Lemonade (top 5) and SOFI (top 10). The Federal Reserve's decision to pause interest rate hikes, coupled with generally positive financial results across the board, introduced heightened volatility to the markets—fortunately, with an upward trend for many investors. I'd also like to offer my apologies for the delay in sharing SOFI's earnings analysis on Thursday; I took a much-deserved break abroad to rejuvenate. Refreshed and ready, I'm excited to dive deeply into the details of these four companies.

1. Relay Therapeutics (RLAY)

Nothing really happened with RLAY this quarterly report, since their major data readout was announced late October. I wrote an excellent article on this; I would reference it in my archive. Building on this momentum, the company is gearing up to launch trials for a new breast cancer treatment regimen by the end of 2023, targeting HR+/HER2- breast cancer with a powerful combination therapy. That said, the company did decide to make a significant transition with their cash runway, which I’ll highlight below.

Key Financial Highlights:

RLAY still maintains a robust financial position with cash, cash equivalents, and investments totaling around $810.6M, a decrease from the $1B at the end of the previous year. This capital is projected to support the company’s operations well into the latter half of 2026.

In Q3 2023, RLAY saw a significant increase in revenue to $25.2M, up from $0.3M in the same period the previous year, primarily credited to milestone payments (this is still a pre-rev biotech company) recognized through its agreement with Genentech, Inc. Research and development expenses rose to $81.5M due to heightened clinical trial activities and increased staff-related expenses, including stock compensation. General and administrative expenses also saw an uptick, primarily due to additional stock compensation costs, reaching $18.5M.

Despite the financial outlays, the company reduced its net loss to $65.7M in the Q3 2023, from an $84.2M net loss in the corresponding quarter of the previous year, showing an improvement in the loss per share.

On the developmental front, RLAY has decided to pause further development of RLY-2139, the CDK2 inhibitor (as vaguely mentioned in my last article). Meanwhile, the company anticipates a series of milestones ahead. In 2024, the company expects to provide additional tumor agnostic clinical data and a regulatory update on lirafugratinib. The next data update for the PI3Kα inhibitor is also slated for 2024, alongside the anticipated disclosure of new programs (these will be huge).

By reordering the priorities and streamlining its portfolio, Relay Therapeutics is focusing on its strengths while ensuring a strategic pathway to future successes and sustainability.

My Take

In my latest article, I covered the essentials, but I want to circle back to Relay Therapeutics after their latest update. The big news is how they’ve managed their money – they’ve got enough cash to keep going until late 2026, which is huge. They also put a hold on one of their pre-clinical trials, showing they're thinking carefully about where to focus their efforts. They’re making smart moves and seeing good results, which is great news for us investors. We just need to stick with them and be patient. Big gains could be on the horizon if things go as planned. For now, I’m holding off on buying more shares until 2024, but I’m still all in on RLAY and feeling optimistic about what’s ahead.

2. Intercontinental Exchange (ICE)

ICE also reported their Q3 2023 results, they continued their streak of revenue and earnings per share growth. Significantly, in early September, they achieved a major milestone with the acquisition of Black Knight (highlighted this in last quarterly breakdown). This strategic expansion not only widens their mortgage network but also reinforces the strength of their long-term growth trajectory.

Key Financial Highlights:

Net Revenues: Soared to a record $2B, an impressive increase of 11% YoY.

Earnings Per Share (EPS):

GAAP Diluted: Achieved $0.96.

Adjusted Diluted: Rose to $1.46.

Operating Income:

Reported: $845M, facing a 7% decrease YoY.

Adjusted: Reached $1.2B, up 10% from the previous year.

Operating cash flow through Q3 2023 was $2.6B and adjusted free cash flow was $2.5B.

Unrestricted cash was $837M and outstanding debt was $23.3B as of September 30, 2023.

Through the third quarter of 2023, ICE paid $713M in dividends.

Operating Margins:

Standard: 42%.

Adjusted: A robust 59%.

Strategic Moves:

Successfully completed the strategic acquisition of Black Knight as of September 5, 2023.

Segment Results

Total Revenues: The company pulled in $2B, with a big chunk coming from exchange activities ($1.1B), while fixed income and data services added $559M, and mortgage technology contributed $330M.

Profits from Operations: The income from operations hit $845M, which translates to an operating margin (how much out of every dollar earned is profit) of 42%.

Adjusted Financials: After making some adjustments, the income from operations actually looks even better at $1.2B, boosting the operating margin to an impressive 59%.

In short, the company's making good money from its core businesses, especially after making smart adjustments to its expenses. The profit margins are healthy, which indicates the company's efficient at turning revenue into profit.

Exchanges Segment Results

Revenues: Generated $1.1B in net revenues.

Operating Expenses: Recorded at $313M; however, adjusted expenses were slightly lower at $297M.

Operating Income: Reached $801M with an operating margin of 72%. Adjusted figures were even higher at $817M, resulting in a 73% adjusted operating margin.

Performance Highlights:

Energy: Saw a significant increase in revenues by 45%, hitting $384M.

Agriculture and Metals: Modest growth with a 7% increase in revenues.

Financials: Experienced a slight decrease in revenues by 8%.

Cash Equities and Equity Options: Small growth with a 5% increase.

OTC and Other: Dropped by 15% in revenue.

Data and Connectivity Services: Increased by 8%.

Listings: Declined slightly by 4%.

Recurring vs. Transaction Revenue: Recurring revenue grew by 4%, while transaction revenue saw a bigger leap of 15%.

Fixed Income and Data Services Segment Results

Revenues: Brought in $559M.

Operating Expenses: Reported at $358M, with adjusted expenses down to $316M.

Operating Income: Produced $201M with a 36% operating margin. Adjusted income improved to $243M, which equates to a 44% adjusted operating margin.

Mortgage Technology Segment Results

Revenues: Collected $330M.

Operating Expenses: Were high at $487M; adjusted expenses were much lower at $199M.

Operating Income/Loss: Unfortunately, the segment incurred a loss of $157M, translating to a -48% operating margin. On a brighter note, the adjusted figures show an operating income of $131M and a healthy 39% adjusted operating margin.

Overall, the segment results demonstrate strong performance in the Exchanges and Fixed Income and Data Services segments, with solid revenue growth and operating margins. The Mortgage Technology segment, while facing a loss on an unadjusted basis, shows promising potential with a solid adjusted operating income and margin.

Financial Outlook:

Operating Expenses: For GAAP, ICE projects operating expenses to fall between $1.21B and $1.22B. When adjusted, they anticipate a slightly leaner range of $955M to $965M.

Non-Operating Expenses: On a GAAP basis, these expenses are estimated to be between $240M and $245M. Their adjusted forecast is a bit lower, predicting a range of $225M to $230M.

Share Count: The expected count for diluted shares is aimed to be in the bracket of 572 million to 576 million for the fourth quarter.

Capital Expenditures: For the year, ICE updated capital expenditure expectations to range from $500M to $525M, taking into account Black Knight's contributions for four months.

My Take:

ICE has shown a decent financial performance, with solid YoY growth in revenues and a great operating margin, which suggests strong operational efficiency. I’m actually more impressed, since my expectations were low considering our current macro. The acquisition of Black Knight, however, is a strategic move that could offer long-term benefits, including increased market share in the mortgage sector and potential for cross-selling opportunities (this will be great for them in then future). The exchange's core segments, particularly the Exchanges Segment, have performed well, which may reflect ICE's competitive positioning and the high demand for its financial and commodity markets. This core strength is a critical factor in the company’s financial health and resilience.

On the other hand, the Mortgage Technology Segment's operating loss indicates challenges that need to be addressed (but this kind of should be expected). However, the adjusted figures for the segment are positive, suggesting that the losses may be attributed to non-recurring or non-core expenses. The company's guidance and projected capital expenditures indicate a commitment to investing in future growth, which is a good sign for continued innovation and expansion.

Overall, ICE appears to be in an unenthusiastically “good” financial position with effective strategic direction. The positive aspects of its financial performance, such as revenue growth and operational efficiency, appear to mitigate the concerns raised by the operating loss in one segment. The company’s strategic investments and acquisitions could well position it for future growth, although close attention to segment-specific performance will be important to ensure long-term success. For me personally, I don’t see myself adding to this position for a while. My conviction still stands at high.

3. SoFi Technologies (SOFI)

SOFI delivered a solid performance this quarter, surpassing revenue expectations by a notable 2.9%. The company witnessed a significant inflow of $2.9B in deposits, comfortably exceeding its forecasted target of over $2B. Q3 2023 also set a new benchmark for consecutive product additions and scored as one of the strongest quarters for gaining new members. For the first time in recent quarters, both product and member YoY growth rates have shown an uptick. Despite the brisk pace of new member acquisition, the ratio of products per member has been maintained at 1.5 times, indicating that existing members are engaging with multiple offerings (nice!!).

Key Financial Highlights:

Impressive Financial Growth in Q3 2023

GAAP and Adjusted Net Revenues: $537M GAAP net revenue, a 27% increase; Adjusted net revenue also rose by 27% to $531M.

EBITDA Achievements: Adjusted EBITDA reached a record $98M, soaring by 121% compared to the previous year.

Earnings Per Share (EPS): Reported a GAAP EPS loss of $0.29; excluding goodwill impairment, the loss narrows to an EPS of $0.03.

Strong Membership and Product Expansion

Member Growth: Over 717,000 new members joined, elevating the total member count to over 6.9M, up by 47% year-over-year.

Product Expansion: Added nearly 1,047,000 new products, with the total count of products reaching over 10.4M, a 45% increase YoY.

Significant Growth in Customer Deposits

Deposit Growth: Total deposits surged by $2.9B, marking a 23% increase in the third quarter alone, bringing the total to $15.7B.

Increase in Tangible Book Value

Tangible Book Value Growth: Witnessed an increase of $68M in tangible book value, and $171M over the trailing 12 months.

Optimistic Future Outlook

Raised Guidance for FY 2023: Management has increased the full-year guidance for 2023, signaling confidence in continued growth.

As seen above, SOFI has some good news for its investors this quarter. Let's start with the revenue here: they've seen a 27% increase, reaching $537M. It’s not just the revenue that’s up; their profits have soared too, with a 121% jump to $98M compared to last year's figures. SOFI's money-making isn't just from one place; they've successfully pulled in over $74M from different parts of their business, like their tech platform and financial services. That's a big deal because it shows they're not relying on just one thing to make money. Plus, they're now actually making a profit on the financial services side of things, which they weren’t just a few months ago.

What's also impressive is their net interest income, basically the money they make from loans after paying the interest on the money they borrow to fund those loans. It's up a whopping 119% from last year. What’s intriguing is their net interest margin, which tells us how efficient SOFI is with its lending business, which hit a record high. SOFI’s been smart with their lending, shifting more towards using customer deposits which is a cheaper way for them to get the money they lend out. This smart move is a big part of why their numbers are looking so good. All in all, the company seems to be on a roll, and if they keep this up, it looks like they might start turning a consistent profit soon.

Segment Results

Lending Segment:

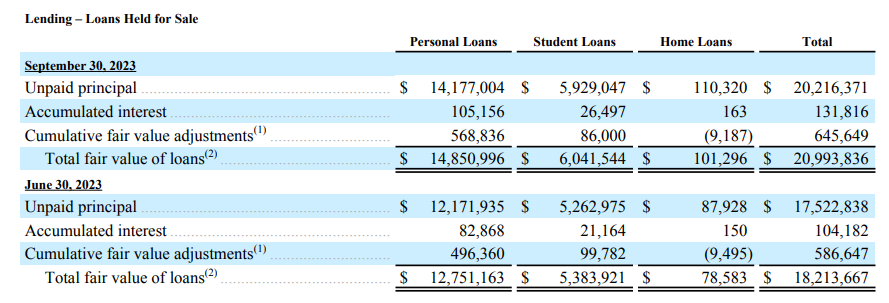

Let’s break down how the lending side of the business did in the Q3 2023. The lending segment's revenues are up, with a 16% increase in GAAP net revenues and a 15% increase in adjusted net revenues, reaching almost $349M and $342.5M, respectively. What's behind this boost? It’s mainly because SOFI has more loans out there earning interest, and they're making more from each loan compared to last year, that’s what they mean by “net interest margin expansion.” When we look at profits that come directly from the lending business after covering specific costs, there's more good news. The contribution profit, a number that shows the direct profitability from lending, rose to $204M, which is 13% higher than the same time last year. And while you're crunching numbers, know that for every dollar SOFI made from lending, 60 cents were profit, which is pretty stable compared to last year's 61 cents.

In simple terms, SOFI is seeing a strong and healthy demand for its loans, and they're making the most of it, not just by having more loans out but by earning more from each of them. It’s a positive sign for the company’s grip on the lending market.

Also, in the lending segment, they saw an impressive 48% YoY increase in total loan origination volume. This surge reflects the strong market demand for SOFI's personal loans and a significant uptick in student loan originations, particularly as students and graduates geared up for the reinstatement of student loan payments in October.

Zooming into specifics, personal loans were a standout with a record $3.9B originated in the third quarter, a remarkable 38% increase from the same period last year. Sequentially, this represents a stable 4% growth. On the student loan front, the figures are even more striking: over $919M in loans, doubling the volume year-over-year with a 101% increase, and a sharp 133% rise from the previous quarter, indicating a significant bounce back in this area.

Home loans also showed healthy gains. With a 64% increase over last year, SOFI's strategic move to integrate Wyndham Capital Mortgage seems to be paying off, likely due to enhanced fulfillment capacity stemming from the acquisition earlier in the second quarter. This growth in home loans is a testament to SOFI's expanding capabilities and appeal to homeowners. Overall, across personal, student, and home loans, SOFI is capturing a growing share of the market, capitalizing on both seasonal and strategic opportunities to expand its lending portfolio.

Technology Platform Segment:

During the third Q3 2023, SOFI's Technology Platform segment showed decent financial health with net revenues reaching $89.9M, marking a 6% increase over the previous year and a slight 3% increase from the preceding quarter. The segment's profitability also jumped significantly, with contribution profit rising to $32.2M, a 65% surge YoY, attributed to a sharp 12% cut in expenses. This financial period was pivotal for SOFI's product expansion and customer diversification. The company successfully introduced innovative offerings such as Konecta, an AI-powered digital assistant, and the Payments Risk Platform, which aims to curtail transaction fraud. These developments reflect SOFI's strategic growth and its adaptability to emerging market demands.

Financial Services Segment:

SOFI's Financial Services segment had a solid Q3 2023, with net revenues climbing to a record $118.2M, a remarkable 142% leap from the previous year's $49M. This growth was fueled by a 43% increase in interchange revenue and a substantial 231% rise in net interest income. A standout achievement was surpassing $1.2B in point of sale debit transaction volume for the quarter, signaling an impressive $5B annualized run-rate.

The sector experienced a financial turnaround, posting a contribution profit of $3.3M for the first time, a substantial recovery from the $52.6M loss in the same quarter of the previous year. This turnaround is credited to enhanced monetization and increased operating leverage, highlighting SOFI's efficiency in scaling its business. Remarkably, revenue per product has escalated to an annualized $53, up 61% YoY.

SOFI's product offerings have been a significant draw for customers. The Financial Services segment grew its products by 2.9M, a 50% increase over the year, reaching 8.9M products by the end of the quarter. Highlights include substantial growth in SoFi Money, Relay, and SoFi Invest products.

The Checking and Savings options are particularly appealing, offering an APY of up to 4.60% with no minimum balance or balance limits, alongside FDIC insurance covering up to $2M. With a suite of free features and a unique rewards program, the company saw a 23% quarterly increase in total deposits to $15.7B. Notably, the vast majority of SoFi Money deposits come from direct deposit members, and over half of the new SoFi Money accounts initiated direct deposit within 30 days in the third quarter of 2023. This points to a robust growth trajectory for SOFI's Financial Services, driven by both innovative products and strategic scaling.

Financial Outlook:

Management anticipates adjusted net revenue for the full year 2023 to be between $2.045B and $2.065b, an increase from the previously projected range of $1.974 to $2.034B.

Expected full-year adjusted EBITDA is now projected to be between $386m and $396M, revised upwards from the earlier forecast of $333 to $343m.

This revised guidance suggests an incremental adjusted EBITDA margin of 48%, with an adjusted EBITDA margin range of 18.9% to 19.2%.

With GAAP net income profitability expected in the fourth quarter, the company anticipates an increase in depreciation and amortization, and share-based compensation expenses, estimated to rise by a mid-to-high single-digit percentage in the fourth quarter compared to the third quarter.

My Take

The recent quarterly performance has been excellent, delivering beyond expectations. Growth has been swift and robust, and there's a clear sense of there being ample market opportunities still ripe for the taking. The team has demonstrated remarkable consistency in capturing a significant portion of these opportunities. Based on their proven track record, I am optimistic about the company's continued strong performance and effective execution in the upcoming years.

Financially, the company is solid, with impressive health and operational excellence across the board. The stock market's response, regardless of its nature, does not diminish the excellence of this quarter's results. The company's achievements stand on their own merit and make a compelling case for its potential. In an unbiased view, the facts speak loudly of success, and the anticipation for future outcomes remains positive. For me personally, I’m very comfortable with my position sizing, so I don’t plan on adding right now. My conviction remains unchanged at high.

4. Lemonade (LMND)

Navigating through the myriad of opinions on social platforms and MSM about this company requires discernment, as there is often excessive noise that lacks substance. The company has indeed been the subject of intense discussion, partly due to the substantial short interest in its shares, a factor that contributed to a recent minor short squeeze. It's understandable to encounter a mix of bearish and bullish sentiments, reflecting the uncertainty about the company's trajectory over the next few years and beyond. Speaking as someone who actually has skin in the game, I remain bullish about their future. While concerns about the volatility in underwriting profitability are valid and merit a cautious stance, I believe that declaring the company's downfall at this stage is premature. This view is based on the observation that critical business fundamentals are showing an upward trend—excluding the Gross Loss Ratio (GLR)—and the company is well-capitalized, with sufficient cash reserves to achieve its profitability targets by early 2025.

So, to put this to rest for now until later, it's a complex landscape, but the company's solid performance on key business metrics gives reason for a positive outlook. Keeping a balanced view, acknowledging both the challenges and the potential, is essential in forming a reasoned perspective on the company's future (for more ranting about irrational perma bears, check out my archived article with this business).

Key Financial Highlights:

In-force Premium (IFP) Growth: Our IFP soared to $719M, marking a robust 18% increase. This growth reflects our expanding customer base and strong policy renewals.

Efficient Operations: We successfully streamlined operations, reducing operating expenses by 11% to $98M. This efficiency demonstrates our commitment to optimizing costs.

Improved Loss Metrics: Our Gross Loss Ratio saw significant improvement, dropping 11 percentage points to 83%. This improvement signals our advancing risk management and underwriting processes.

Surging Gross Profit: A testament to our improved loss ratio and operational efficiency, Gross Profit surged by 170% to $22M.

Strengthened Bottom Line: The Adjusted EBITDA loss narrowed by 39% to $40M, showcasing the path to profitability. Additionally, they have cut the net loss by 33% to $62M, underscoring a stronger financial position.

Customer Growth: 12% increase in customer count to 1,984,154 compared to Q3 2022.

Premium per Customer: Premium per customer rose by 6% to $362 at the end of Q3.

Annual Dollar Retention (ADR): ADR was 85% at the end of Q3, a 1 percentage point increase from Q3 2022.

Cash & Investments: Cash, cash equivalents, and investments totaled approximately $945M. Net cash used in operations since December 31, 2022, was $103M. Insurance subsidiaries held approximately $109M as surplus for the benefit of policyholders.

Expected Profitability: Management highlighted on a revised early 2025.

These results are pretty good, especially given the company's current market position and the industry headwinds they faced in the last quarter. The key focus now is on improving the Gross Loss Ratio (GLR), which I believe will be addressed effectively over time.

That Awful GLR Bears Love:

The Gross Loss Ratio (GLR), when viewed in isolation, may indeed raise concerns. However, a thorough examination of the company's quarterly reports and shareholder letters reveals that this volatility can be attributed to catastrophic events, aptly termed CAT events. It's worth noting that last quarter, an industry-wide surge led to a GLR spike to 94%. Critics may argue this points to weak underwriting, but this irrational conclusion ignores the broader picture. With CAT events looming industry wide, and in the past, along with acquisitions, it’s not fully representative.

There are two critical factors to consider for the company's future. The first is bringing the GLR below 75%, a benchmark for underwriting profitability. The second is maintaining decent growth in customer numbers and in-force premium (IFP). As a shareholder, my trust in management has been validated by their words and actions; their actions have consistently aligned with their forecasts. For me, trust is paramount when investing, if a company's actions diverge from their commitments, I do not hesitate to sell, as was the case with my past dealings with DLR and MPW.

Financial Outlook:

Q4 2023 outlook:

They anticipate the in-force premium (IFP) by December 31, 2023, to be between $726M and $729M.

The gross earned premium is projected to be in the range of $174M to $176M.

Revenue is expected to land between $107M and $109M.

We're estimating an Adjusted EBITDA loss in the range of $44M to $42M.

Stock-based compensation expenses are expected to be around $16M.

Planned capital expenditures are set at approximately $3M.

The weighted average count of common shares outstanding should be near 70 million shares.

For the full year of 2023, the outlook is as follows:

The in-force premium (IFP) at year-end is expected to be between $726M and $729M.

Gross earned premium for the year is anticipated to be between $665M and $667M.

Revenue is forecasted to be in the vicinity of $421M to $423M.

We predict an Adjusted EBITDA loss of $188M to $186M.

Stock-based compensation expense is likely to total about $62M for the year.

Capital expenditures are projected to be roughly $10M.

The weighted average for total common shares outstanding is expected to remain consistent at around 70 million shares.

My Take

This was supposed to be an earnings breakdown, not a company specific thesis defense. In assessing LMND’s future, an optimistic viewpoint would focus on several key indicators of potential success. The growth in in-force premium (IFP) suggests an expanding customer base and increasing trust in Lemonade's products. Their commitment to controlling operating expenses, as seen by the reported decline, hints at improving operational efficiency. Moreover, the improvement in their GLR indicates that the company is making strides in managing claims and underwriting risks more effectively. The GLR is #1 metric investors should have concerns with… is it truly these CAT events, acquisitions, industry tailwinds? Or, is it a result of poor underwriting? It seems to be leaning more towards bulls after this quarter.

LMND's progressive use of technology and data science could be a significant driver for future growth as well. As they refine their predictive algorithms and enhance customer experience, they may gain a competitive edge in the insurance market. Their targets are the younger tech savvy generations. The increase in customer count and premium per customer reflects a growing brand loyalty and market penetration, which bodes well for future revenue streams. The company's investment in product development and strategic initiatives, like their move into new insurance categories and markets, could pave the way for diversified income streams. Additionally, management’s guidance on the trajectory toward profitability and their confidence, as inferred from shareholder communications, can often be a reassuring signal to investors.

For me personally, I thought this was an excellent quarter. I really believe in what this business is trying to accomplish long-term. I’m currently standing at 300 shares just below $15/share, so I’m comfortable with my sizing. My conviction remains very high, unchanged from previous.

Weekly Activity (Oct 30th-Nov 3rd)

10 shares of Coherus BioSciences

5 shares of Realty Income